Reliance Industries Ltd. (RIL) reported a 5% year-on-year decline in consolidated net profit for the second quarter of FY25, reflecting the impact of challenges in its oil-to-chemicals (O2C) business. However, market analysts remain bullish on the company’s long-term prospects, with several brokerages predicting significant upside potential for the stock.

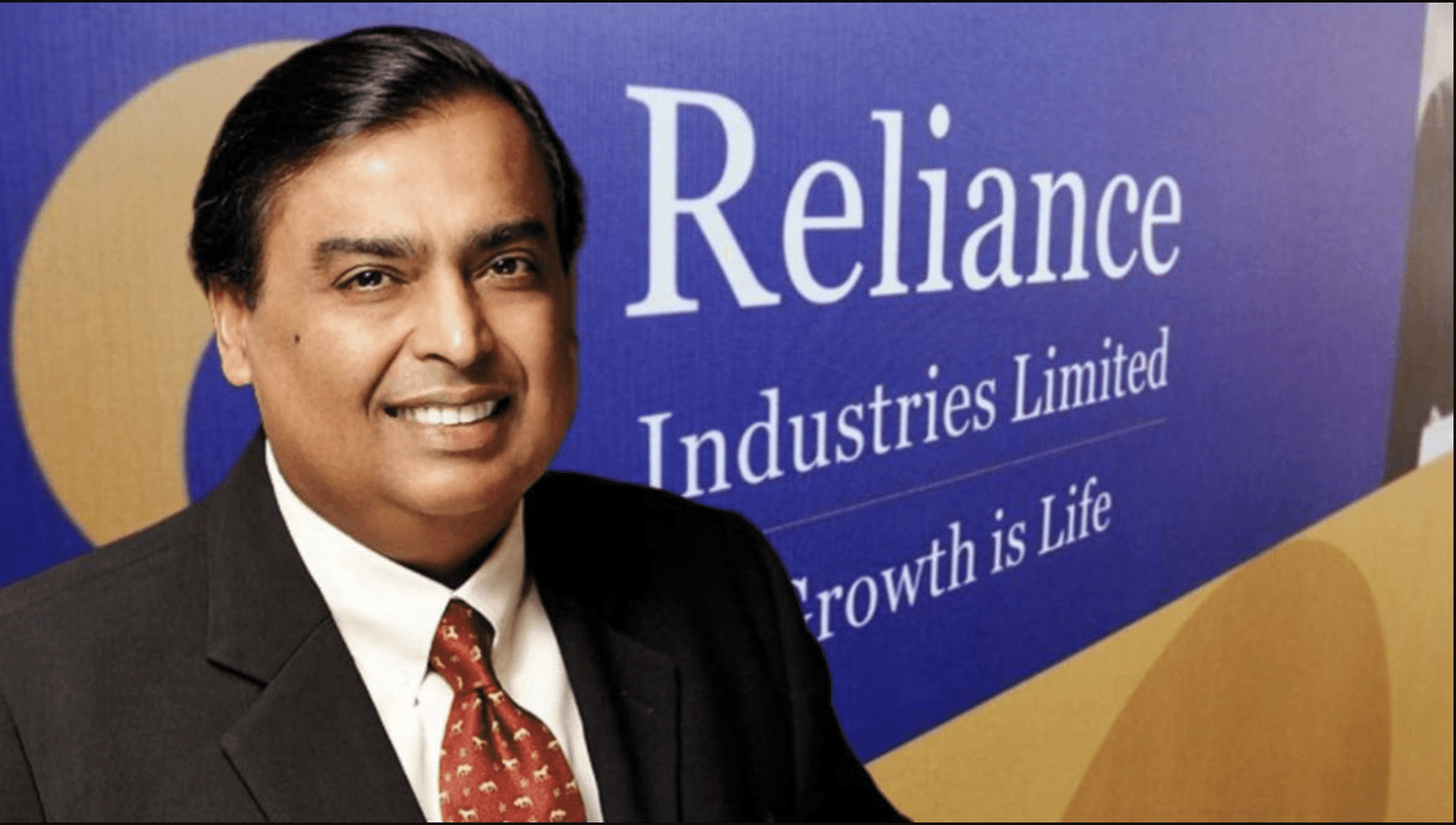

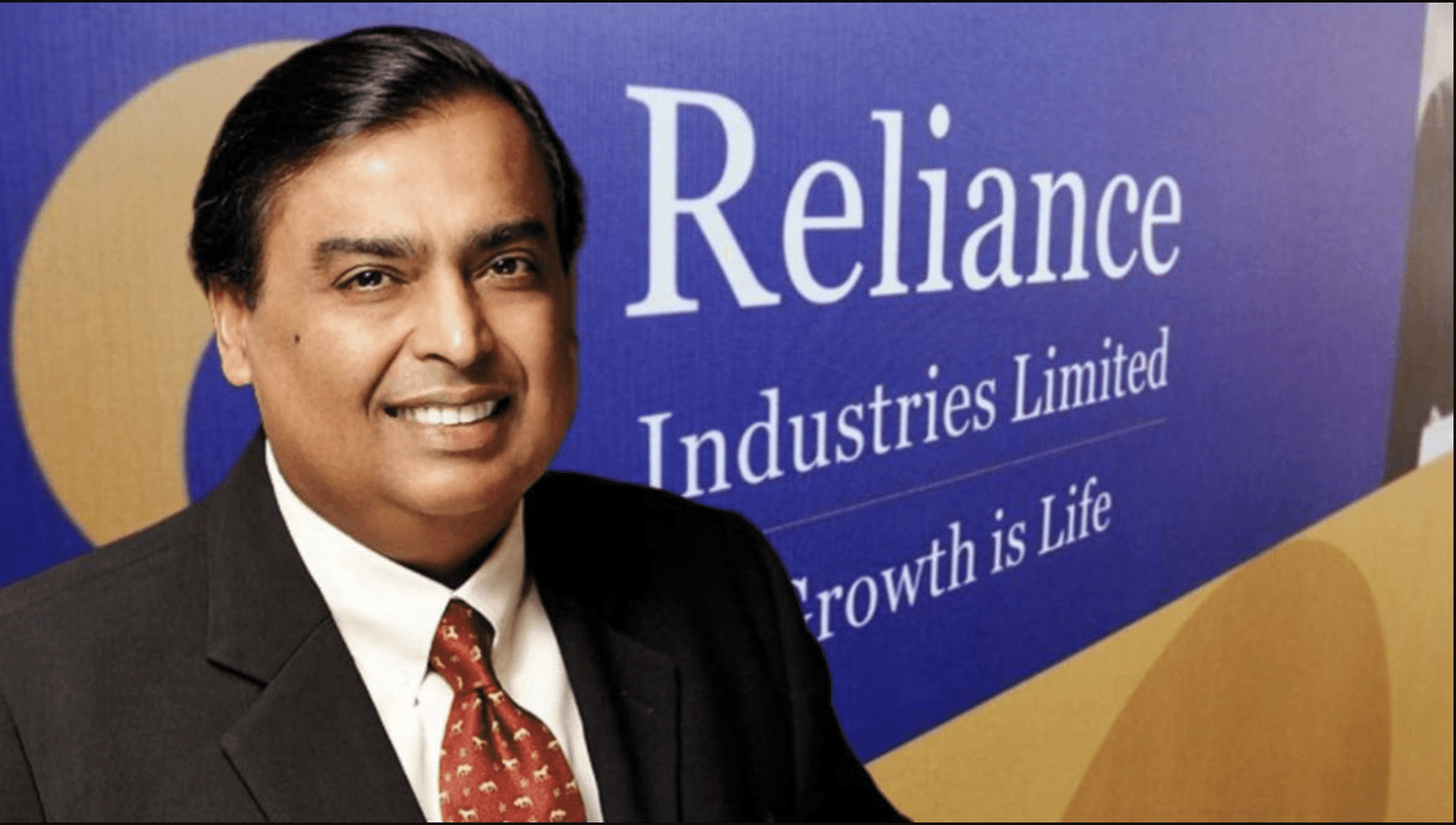

In Q2FY25, Mukesh Ambani Reliance’s net profit stood at ₹16,563 crore, down from ₹17,394 crore in the same period last year. This marks the third consecutive quarter of declining profits on a year-on-year basis. Nevertheless, on a sequential basis, the company’s net profit rose by 9.4% compared to the previous quarter. The company’s total income increased marginally to ₹2,40,357 crore, compared to ₹2,38,797 crore in the same period last year.

The company’s EBITDA for the quarter was ₹43,934 crore, down 2% year-on-year, with the EBITDA margin dipping to 17% from 17.5% in the previous year. Despite these figures, Reliance’s diversified business model helped offset the weak performance of its O2C segment. Its digital services and upstream businesses, driven by growth in telecom tariffs and an expanding customer base, contributed positively to the company’s overall results.

Mukesh Ambani, Chairman of Reliance Industries, noted the company’s resilience despite global challenges affecting the O2C segment. Ambani highlighted the robust performance of the digital services sector, which benefited from higher average revenue per user (ARPU) and continued growth in Jio’s subscriber base. The O2C segment, though affected by global supply-demand dynamics, showed improvements in domestic product placement.

Brokerages remain optimistic about Reliance’s future. HDFC Securities reaffirmed its “ADD” rating with a price target of ₹3,350, citing recovery in the O2C segment, growth in digital services, and potential value unlocking in the retail sector. Nomura maintained a “buy” rating with a target of ₹3,450, noting short-term challenges but emphasizing future growth drivers like Jio tariff hikes and the commencement of new energy operations. UBS and JPMorgan also retained positive outlooks, with price targets of ₹3,250 and ₹3,125, respectively, focusing on digital services and new energy initiatives.

Despite short-term headwinds, analysts agree that Reliance’s diverse portfolio positions it well for long-term growth, with the digital and energy sectors expected to drive future performance.