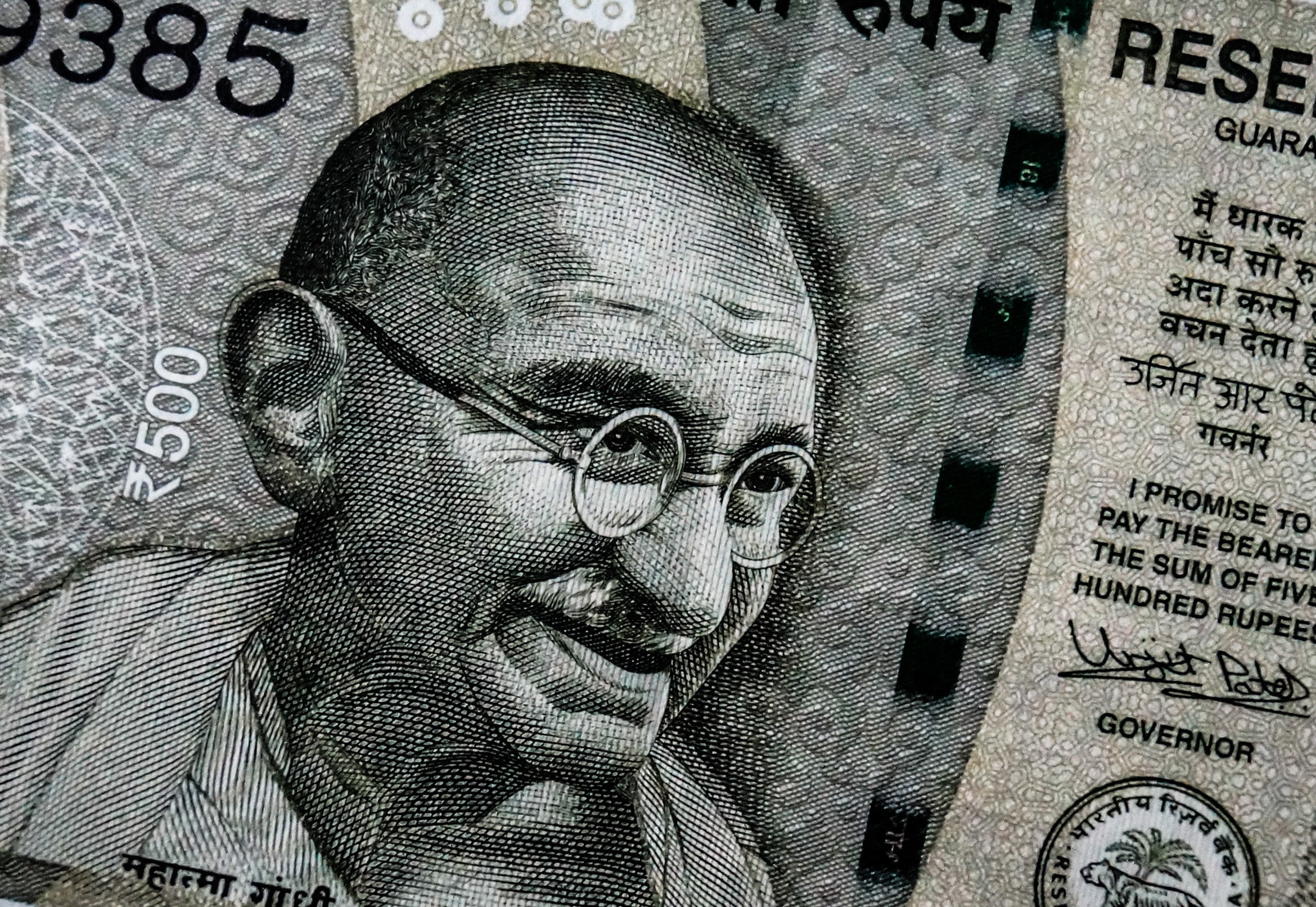

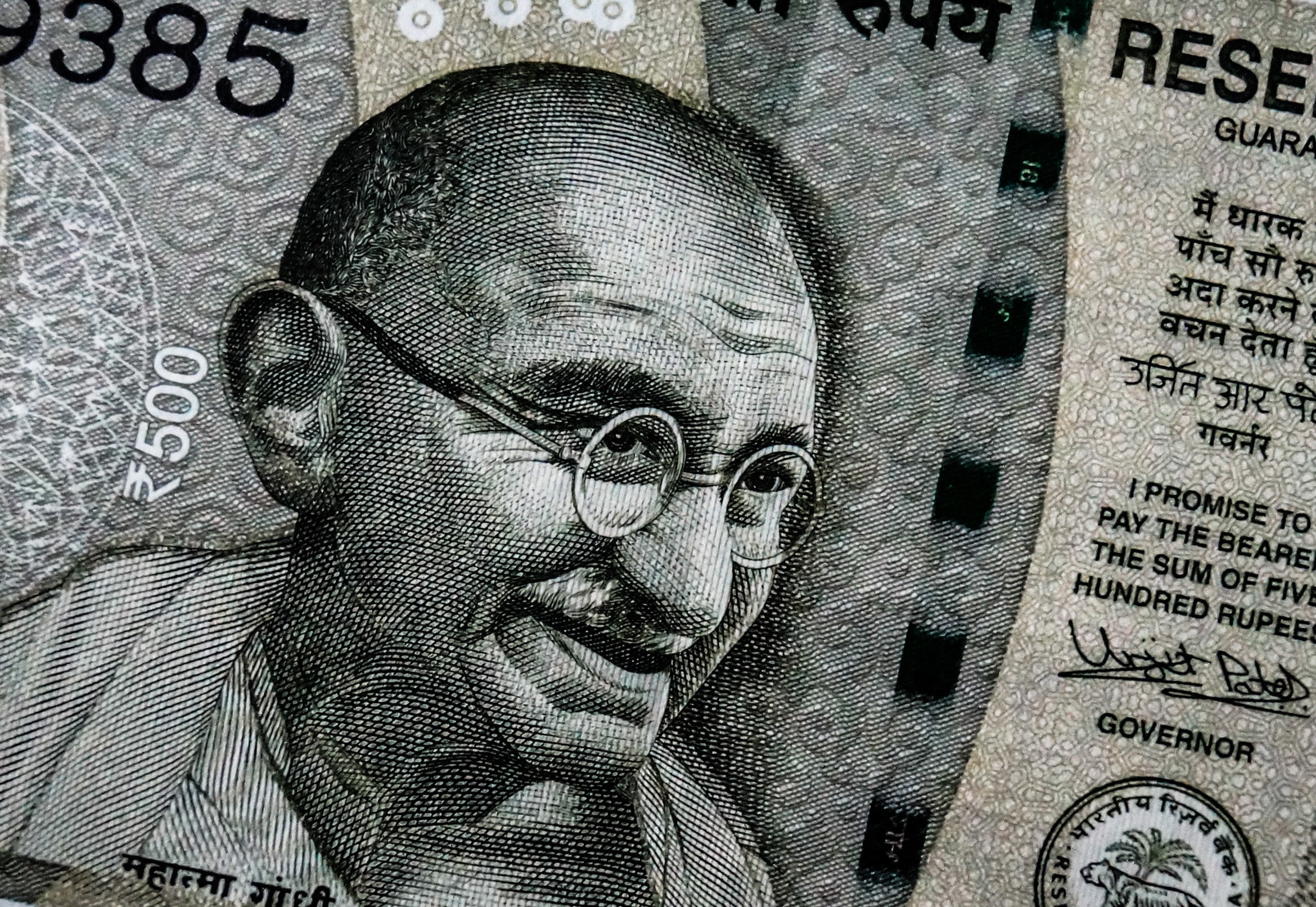

In an effort to revive and sustain economic growth, the Reserve Bank of India (RBI) has kept key interest rates unchanged. The Monetary Policy Committee (MPC) decided to keep the policy repo rate at which the RBI lends money to commercial banks unchanged at 4%.

It also retained the GDP forecast for 2021-22 at 9.5%, while raising the inflation forecast to 5.7%. The committee expects the pressure to ease on the prices front with the arrival of kharif crop and the impact of the supply side measures.

RBI Governor Shaktikanta Das, in his policy statement, said the outlook for aggregate demand is improving but the underlying conditions are still weak. “Aggregate supply is also lagging below pre-pandemic levels. While several steps have been taken to ease supply constraints, more needs to be done. The recent inflation pressures are evoking concerns, but the current assessment is that these pressures are transitory and largely driven by adverse supply side factors.”

Das said the conduct of monetary during the pandemic has been geared to maintain congenial financial conditions that nurture and rejuvenate growth. “At this stage, therefore, continued policy support from all sides – fiscal, monetary and sectoral is required to nurture the nascent and hesitant recovery.

As such, the implication for borrowers is that there is not much scope for interest rates to come down, barring some pass-through of earlier cuts by lenders. The RBI has cut the repo rate by 250 basis points (1%=100 bps) since February 2019 and banks have responded with a 217 bps cumulative decline in their weighed average lending rate.

Also Read: CII believes PM Modi’s USD 400 billion target in exports is attainable

The central bank government said India was in a much better position than it was in June 2021 but advised caution. “The need of the hour is to not drop our guard and to remain vigilant against any possibility of a third wave, especially in the background of rising infections in certain parts of the country.” In regards to the MPC decision, Das pointed out that the members were unanimous on retaining the repo rate at 4%, however, one member voted against the proposal to continue with the accommodative stance.

Pingback: M&M is looking at scaling down production due to chip shortage