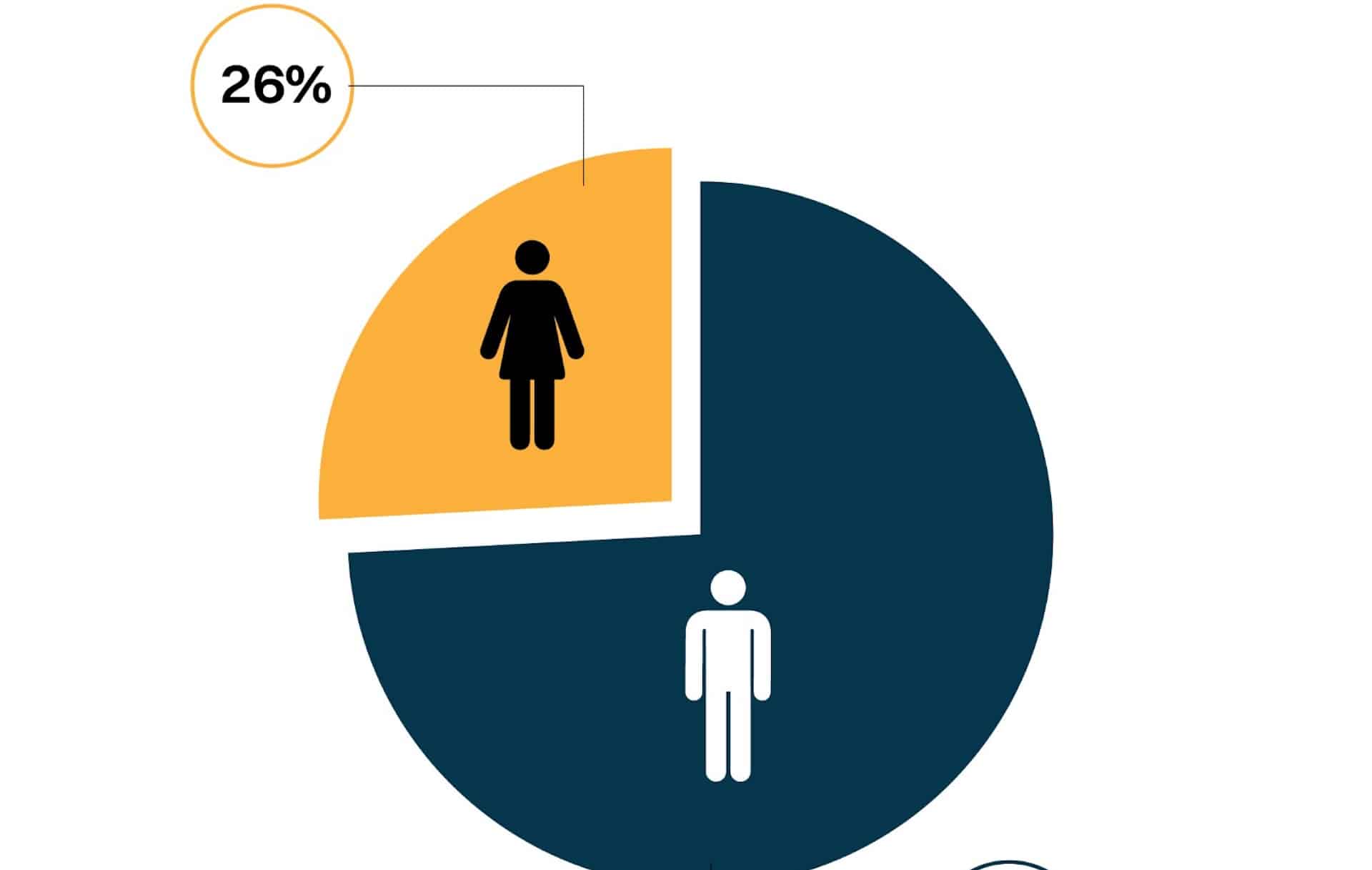

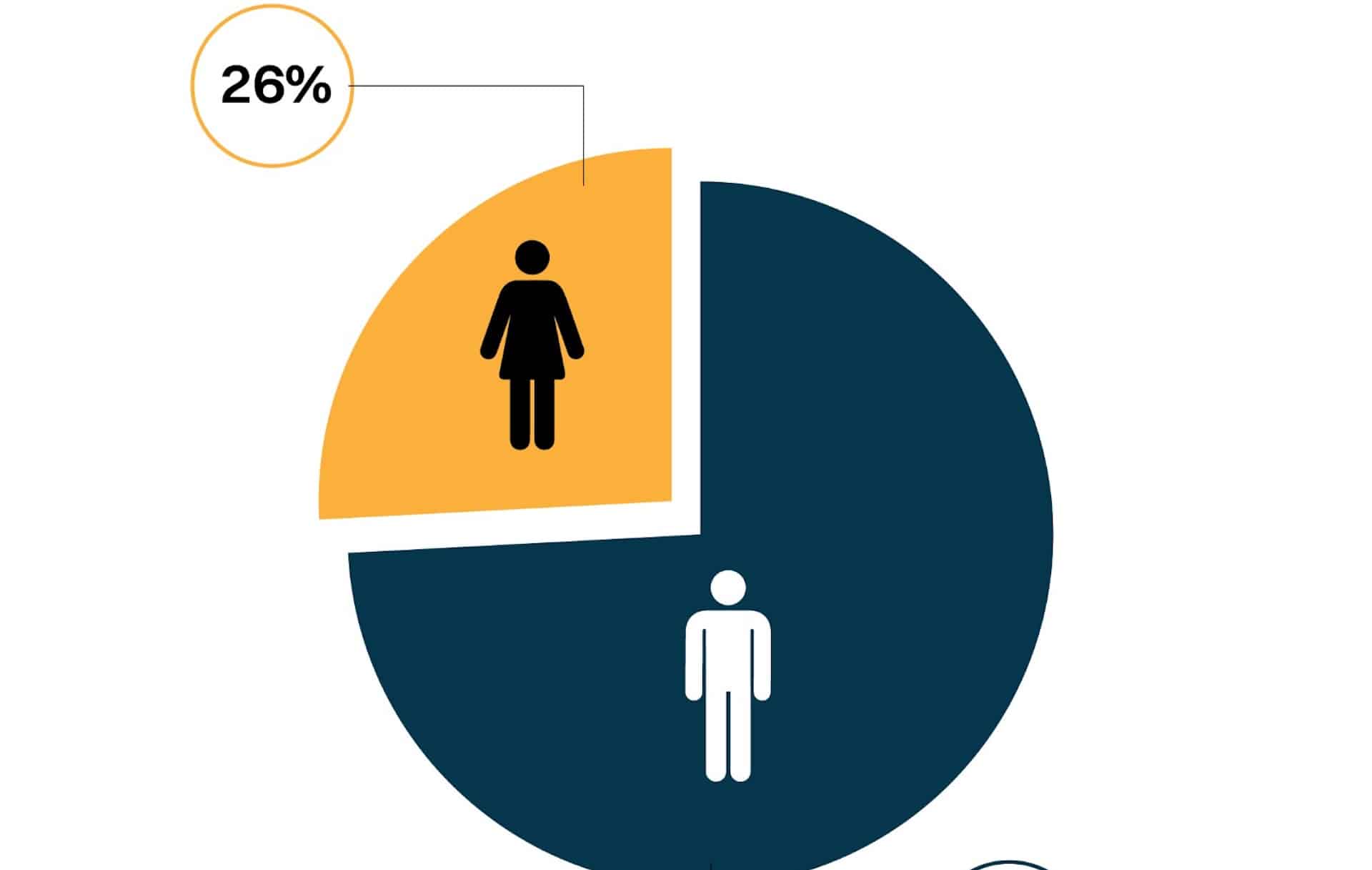

Of the 16 lakh Kuvera investors, 26% were women. This is a significant improvement over 19% in March’22, indicating various financial literacy activities undertaken by industry participants are showing results.

“We have seen a marginal improvement from last year (~19% in 2022). While this demonstrates a growing awareness of financial planning among women, we clearly have a long way to go to achieve investing equality,” said Gaurav Rastogi, Founder and chief executive officer of Kuvera.

Kuvera analysed its investor data to understand the investing behaviour of Indian women. Retirement, buying a home and educating a child were the top financial goals of women.

Women investors from the National Capital Region, Bengaluru and Mumbai made up 30% of all women investors in the country, indicating better financial literacy among women in metro cities.

However, around six in 10 women investors were from tier 1 and 2 cities, indicating that financial literacy among women is not limited just to the top tier towns.

The analysis also found that the men and women investors got a little younger this year than the last year The median age of women investors is now 33 (vs 34 in 2022), an indication of more younger women taking control of their finances.

However, the higher median age of women investors shows that they are likely to begin investing later in life than men.

Insights from gender-wise portfolio analysis revealed that on average, women had a 20% smaller portfolio than their male counterparts.

“The higher median age among women, coupled with 20% smaller avg. portfolio size makes it clear that gender wage difference is real, and it takes longer for women to reach an age when they start feeling in charge of their finances,” Rastogi added.

Tax-saving funds continue to be a favourite among women as the share of women investing in these funds has shown a consistent and significant rise over the years – from 23% in FY20 to 29% in FY23. Incidentally, the average woman investor invests more in ELSS than the average male investor – 29% of women account for 32% of the investments.

India, which is currently the fifth-largest economy, is set to become the third-largest by 2035. However, the share of people investing in the markets is just about 3%, compared to over 55% in the US, 33% in UK and 13% in China.

“Greater market participation from citizens will make our financial markets stronger, drive businesses and the GDP. And women will play a massive role in driving this shift to propel India’s economic transformation,” Rastogi added.