US-based EMVC, Kunal Shah of CRED, Better Capital and existing investor, Das Capital co-invest in this round

Fintech Startup slice (Formally known as SlicePay) announced a pre-series B funding of Rs. 46cr from a Japan-based investor Gunsoy.

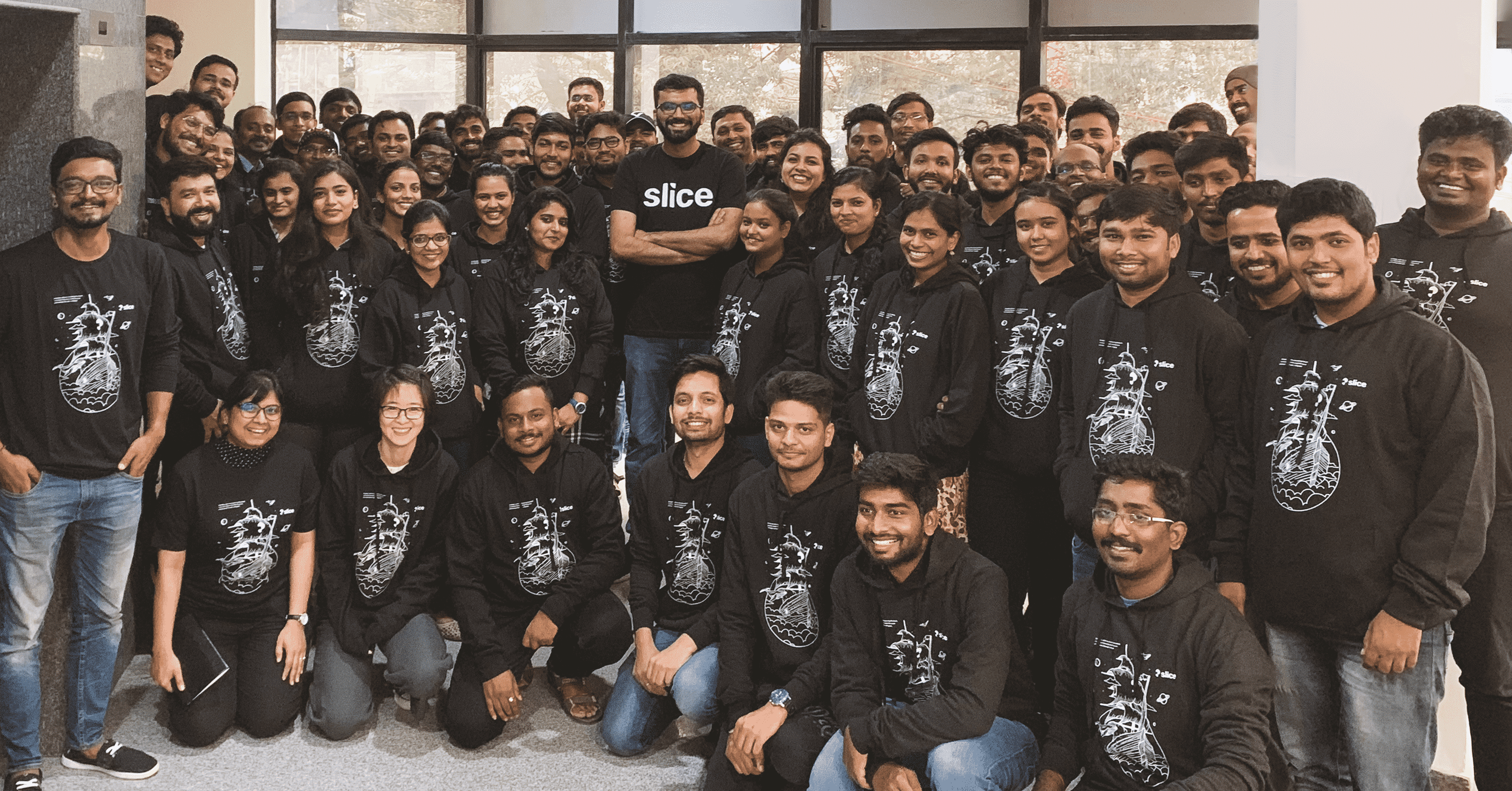

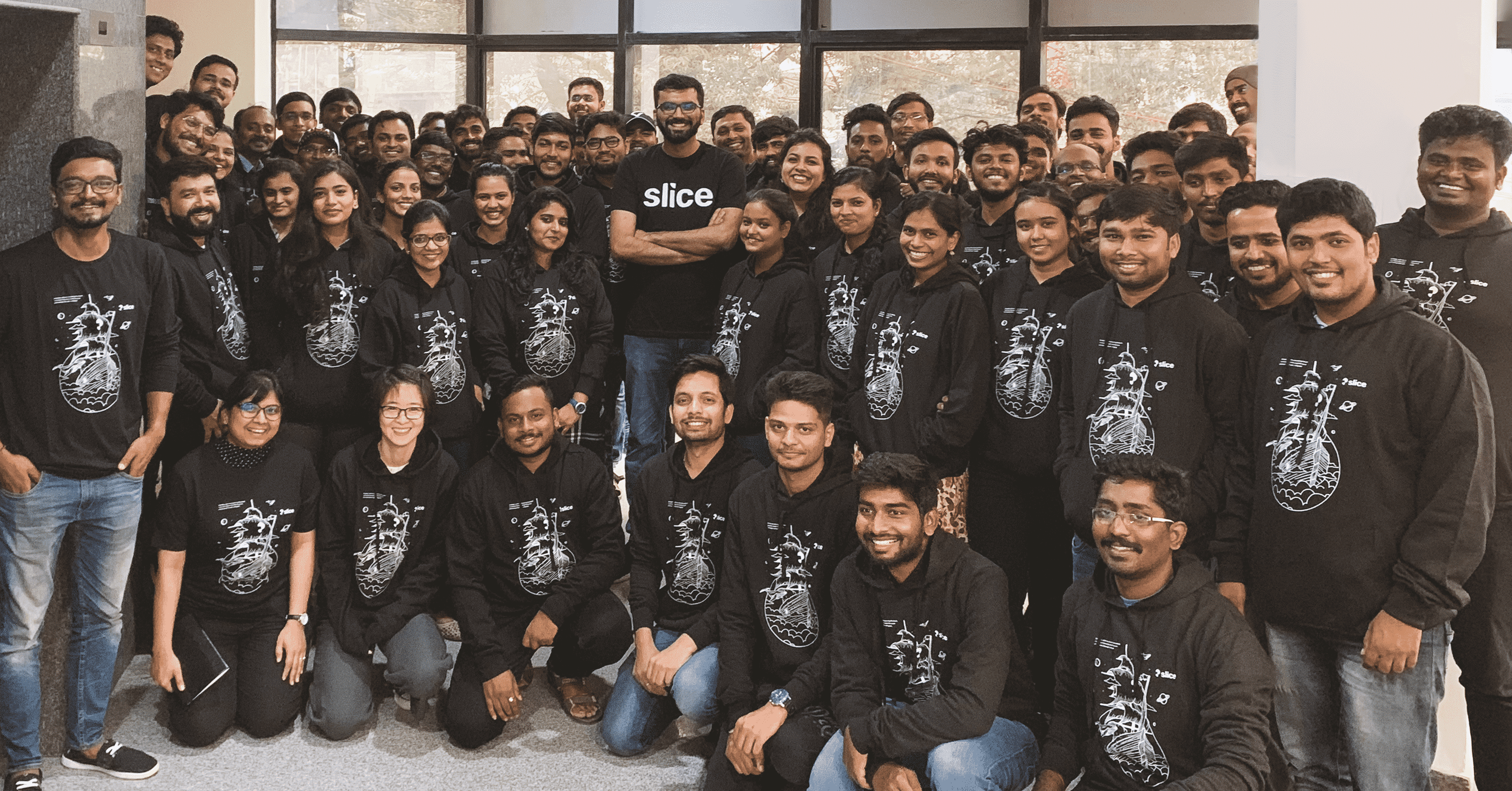

“We are inventing the future of finance for young Indians, who want to understand and relate to financial products just like they would with Snapchat and Instagram. As a young team, we understand this consumer very well and in the last four years, our primary focus has been making youngsters’ financial experience fun and seamless.”, Said, Rajan Bajaj, Founder and CEO of slice.

Indian card market has multiplied for the last five years, with around 30million unique users and 5million active new credit card users. As per the SBI report, the proportion of credit card origination among millennial (persons below 30 years of age) has increased from 19.0% to 35.0% over the last four years.

“We believe slice has a sustainable advantage as it has decoded young credit users’ demands and has built a deep understanding of credit risk and low-cost distribution using technology. We are happy to work closely with slice as they continue to transform the credit landscape in India”, said, Yuki Maniwa, Director of Gunosy.

Founded in 2016 by Rajan Bajaj, the Bangalore based startup, slice has built a data-driven financial product – the slice card, a physical and a virtual card, designed exclusively for young customers in India that includes freelancers, college students, and salaried professionals.

slice is today present across 18 cities in India including Bangalore, Mumbai, Chennai and Delhi. It is funded by Blume Ventures, Better Capital, Traxcn Labs, China’s Finup, Singapore’s Das Capital and Japan’s Gunosy, Russia’s Simile Ventures, USA’s EMVC and entrepreneurs like Kunal Shah of Freecharge & CRED.

This round also saw participation from US-based EMVC, Kunal Shah of CRED, Better Capital and existing investor Das Capital