Business

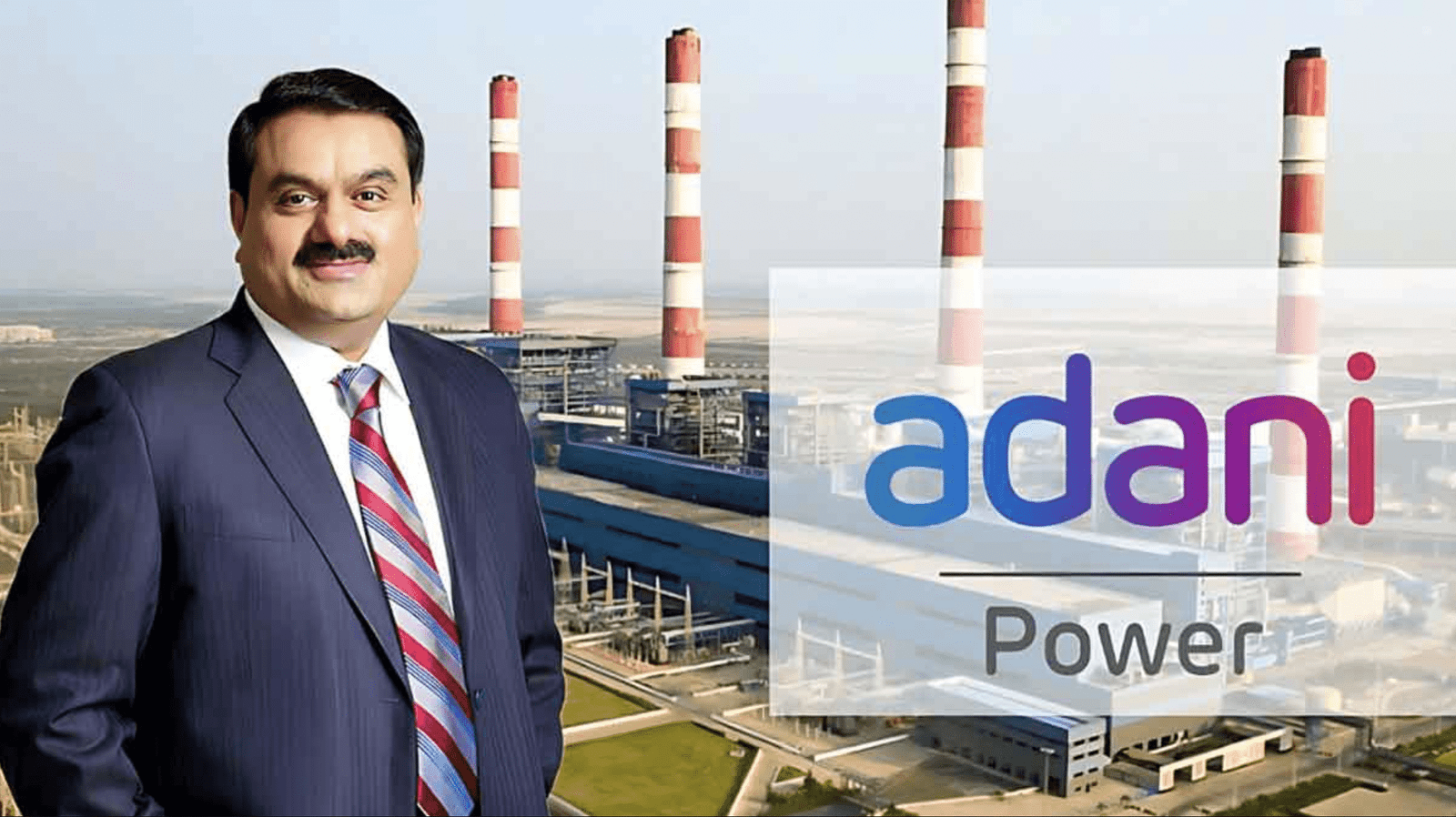

Bangladesh Struggles to Resolve Power Crisis as Adani Cuts Supply Over $800 Million Debt

Bangladesh is grappling with a severe power shortage after Adani Power, an Indian energy conglomerate, cut its electricity supply to the nation by 50%, citing an outstanding $800 million bill. This reduction threatens to further strain Bangladesh’s energy infrastructure, which is already dealing with intermittent shortages. In response to Adani Power, Bangladesh has intensified its repayment efforts to avoid a complete supply suspension. According to the Bangladesh Power Development Board (BPDB), a $170 million letter of credit has been issued to Adani Power to address the delayed payments. Additionally, payments to Adani have been progressively increasing, from $35 million in July to $97 million in October, as the government works to avert a more profound energy crisis.

A senior BPDB official expressed confidence that ongoing payments would satisfy Adani and prevent a full supply suspension. However, officials remain concerned that Adani’s actions could set a precedent for other suppliers, and a comprehensive payment strategy has been put in place to stabilize the situation.

The power supplied by Adani, which constitutes around 10% of Bangladesh’s energy needs, is generated at its 1600-megawatt coal-fired plant in Jharkhand, India. This supply arrangement was part of a 2015 deal brokered under the administration of former Prime Minister Sheikh Hasina. Now, under the interim government, the transparency and cost-effectiveness of this agreement are being re-evaluated along with ten other similar energy contracts.

The energy crisis has added to Bangladesh’s economic woes. Bangladesh has seen its foreign exchange reserves dwindle due to political unrest and high import costs for essential resources, including coal, oil, and electricity. Amid these financial challenges, the interim government has requested an additional $3 billion loan from the International Monetary Fund (IMF) on top of an existing $4.7 billion bailout package. The foreign currency crunch has made it increasingly difficult for Bangladesh to maintain timely payments for imported energy.

SEBI Backs Madhabi Puri Buch over Investigating Hindenburg Adani allegations

In addition to payments to Adani Power, Bangladesh has started making partial payments to other Indian energy suppliers, such as NTPC Ltd. and PTC India Ltd., to maintain their support during this challenging period. The government also plans to restart several of its gas- and oil-fired plants to offset the shortfall, though these options come at a high cost.

Bangladesh’s energy strategy includes diversifying its power sources, and the nation aims to commission its first nuclear power plant by December. Constructed with Russian assistance, the nuclear facility is expected to add substantial capacity to the grid, providing a longer-term solution to energy needs. However, experts warn that the nuclear plant alone may not be sufficient to address immediate shortfalls, particularly if the debt with Adani remains unresolved.

With winter around the corner, the BPDB expects that cooling-related power demand will decrease, temporarily easing pressure on the grid. Nonetheless, the situation underscores Bangladesh’s vulnerabilities in its energy sector and the urgency of finding sustainable solutions amid complex economic and diplomatic challenges.

Pingback: Unrest in Bangladesh reflects people’s struggle to find decent work