Economy

GST Council reduces levy on life-saving medicines, fuel price not under tax regime

The GST Council has reduced the levy on several life-saving medicines, with the concessional GST rates for four COVID drugs extended by three months up to December 31. The council agreed to look into the tax structure for a number of products, ranging from textiles and footwear to pens.

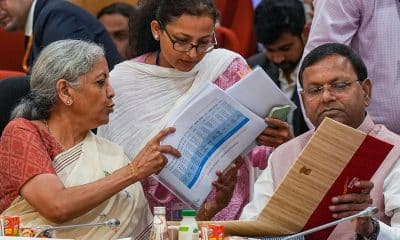

However, it unanimously concluded that there was no need to include petrol and diesel under the tax regime. The Finance Minister Nirmala Sitharaman said issue of GST on fuel being on the council’s agenda was the result of a high court directive which wanted the GST Council to look into the issue.

“In terms of the recent directions of the High Court of Kerala, the issue of whether specified petroleum products should be brought within the ambit of GST was placed for consideration before the Council,” she said. “After discussion, the Council was unanimously of the view that it is not appropriate to do so at this stage.”

The council reduced the tax rates on most of the COVID-19 medicines and equipment and announced that no tax will be levied on the medicines for treating Black Fungus. The tax cut was based on recommendations by a Group of Ministers amid the pandemic, whose crippling effects on the economy has also hurt household finance. The Council had decided that no tax will be levied on medicines like the monoclonal antibody Tocilizumab and Amphotericin B, used for treating Black Fungus. Earlier, the GST rates on these medicines stood at 5%.

Moreover, the GST rates on ambulances were reduced from 28% to 12%. The tax rates on hand sanitizer was lowered from 18% to 5%, while rates on temperature check equipment was reduced from 18% to 5%.

In regards to compensation cess, the council extended it to March 2026 for repaying loans. “Detailed financial statements have been worked out, based on which we learn that cess will have to be collected till March 2026, purely to pay back loans taken between 2020-21 and 2021-22,” the finance minister said. “It was decided at 43rd GST Council meeting that cess has to be collected beyond July 2022 for the specific purpose of repayment of loans taken. This cess collection has to go on till March 2026, based on the financial statements worked out now.”

Furthermore, the council decided to set up a Group of Ministers to examine the issue of correction of inverted duty structure for major sectors; rationalize the rates and review exemptions from the point of view of revenue augmentation, from GST.

Pingback: IMF chief denies pressuring World Bank staff to favor China Business

Pingback: The govt’s aim in J&K is to take industrial revolution to the next level.