Business

India Set to Become 3rd Largest Economy by 2027, Market Cap to Hit $10 Trillion by 2030

India is on a trajectory to become the world’s third-largest economy by 2027, with its market capitalization projected to reach $10 trillion by 2030, according to the latest report ‘Recap 2024. Crystal Gaze 2025‘ by Pantomath Group. The report highlights India’s robust economic growth, supported by a series of positive indicators and government initiatives.

Positive Economic Indicators

India’s economy has demonstrated remarkable resilience, surpassing even China with an impressive GDP growth rate of 7.3% in recent years. The country’s equity market has witnessed exceptional performance, with benchmark indices reaching unprecedented all-time highs. The Nifty and Sensex have scaled milestones of 22,526.60 and 74,245.17, respectively, in FY2024.

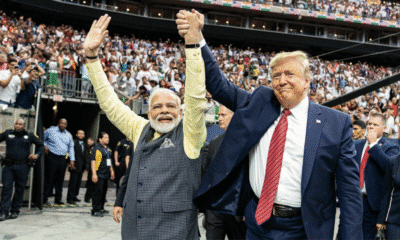

Political Stability and Economic Growth

The recent victory of the BJP in the assembly state elections is seen as a positive indicator that the ruling government is likely to retain power in the upcoming Lok Sabha election in 2024. This outcome is expected to benefit the economy’s objective of achieving a $5 trillion GDP.

Capital Market Enabler

The report emphasizes that equity raise through IPOs in FY25 could exceed ₹1 lakh crores, indicating a robust appetite for investments in the Indian market. India would require ₹ 2.5 lac crores of equity capitalization each year, with capital markets playing a crucial role in achieving such large investment targets.

Continued Growth Momentum

The growth momentum of FY2024 is expected to continue in FY2025, with the RBI projecting a GDP growth rate of 7%. The Reserve Bank of India (RBI) might consider rate cuts in the second half of FY2025, contingent on overall inflation and global monetary policy stances.

Industry Insights

Commenting on the report, Mr. Devang Shah, Head Retail Research at Asit C Mehta Investment Intermediates Limited, highlighted India’s outperformance in the third quarter of FY2024, with growth rates surpassing both RBI and market predictions. He expressed confidence in sectors like Auto and Auto Ancillary, Cements, Defence, Railways, and others, which are expected to be outperformers in the coming years.

Outlook for FY2025

Looking ahead, the focus will be on the Lok Sabha elections and the continuation of economic reforms and policies. The anticipated continuity of policies and reforms under the ruling government is expected to instill confidence in both domestic and global investors, encouraging long-term investments in the Indian equity markets.

India’s economic resurgence, coupled with political stability and favorable market conditions, positions the country as a key player in the global economy. With a strategic focus on sustainable growth and inclusive development, India is poised to become a major driver of economic growth in the next decade.