Auto

Tata Motors with JLR and Tesla’s Indian Suppliers Hit Hard by U.S. Auto Tariff Plans

The tariffs aren’t just a concern for Tata Motors; they also affect Tesla’s Indian supply chain. Key suppliers, including Sona Comstar and Bharat Forge, saw their stocks decline by over 4% and 0.4%, respectively. Samvardhana Motherson, India’s largest auto parts supplier, also fell by more than 2%, reflecting broader market jitters.

The Indian auto sector faced significant turbulence on Thursday after U.S. President Donald Trump announced a 25% tariff on imported cars and auto parts, a move that sent shockwaves through global markets. The announcement of the Trump auto tariff led to a sharp drop in the stock prices of Tata Motors, Tesla’s Indian suppliers, and other key players in the Indian automotive industry.

Tata Motors Jaguar Land Rover (JLR) Faces a Major Setback

Tata Motors, the parent company of Jaguar Land Rover (JLR), saw its stock plummet by 5%, adding to an overall 10% decline since the start of the year. The U.S. is a critical market for JLR, accounting for 23% of its total sales in FY24 and over 30% of its Q3 FY25 sales. With the new tariffs set to take effect from April 2 for cars and May 3 for auto parts, JLR’s financial outlook is now under pressure. Morgan Stanley has warned that JLR’s operating margins could take a 200-basis point hit, impacting Tata Motors’ overall earnings. The tariffs could significantly affect the company’s bottom line since the U.S. contributes 15% of Tata Motors’ consolidated revenue.

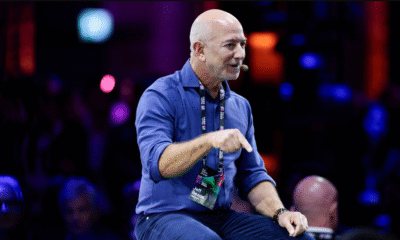

President Trump is bringing back MADE IN AMERICA:

🇺🇸 25% tariff on automobiles made outside of the U.S.

🇺🇸 $100B projected in new revenue thanks to auto tariffs

🇺🇸 Strengthen America’s manufacturing industry pic.twitter.com/ArU44jdTn3— The White House (@WhiteHouse) March 26, 2025

Ms.Mrunmayee Jogalekar, Auto and FMCG Research Analyst at Asit C Mehta Investment Intermediates Ltd., said, “The US is not a significant export destination for India’s vehicle exports. However, Tata Motors could face an impact due to its subsidiary, Jaguar Land Rover (JLR), which derives over 30% of its sales volume from the US market in 9MFY25. With no manufacturing facility in the US, all JLR vehicles will be subject to tariffs, which could impact pricing and profitability.”

“For the Indian auto components industry, the US remains a key export market, contributing 27% to total exports in FY24. Tariffs are expected on key components such as engine, transmission, powertrain, and electrical parts. This could have a greater impact on companies like Sona Comstar (~43% revenue from North America) and Samvardhana Motherson (~18% revenue contribution). However, most other component manufacturers have a well-diversified export presence, which could mitigate the overall impact.”

Jaguar’s Type 00 Electrifies Paris Fashion Week as Barry Keoghan Steps Out

Tesla’s Indian Suppliers Also Take a Hit

The tariffs aren’t just a concern for Tata Motors; they also affect Tesla’s Indian supply chain. Key suppliers, including Sona Comstar and Bharat Forge, saw their stocks decline by over 4% and 0.4%, respectively. Samvardhana Motherson, India’s largest auto parts supplier, also fell by more than 2%, reflecting broader market jitters.

Tesla CEO Elon Musk acknowledged the severity of the situation, stating that the impact of the tariffs on Tesla is “significant.” The U.S. market forms a major chunk of revenue for Indian auto parts makers, with Sona Comstar generating 40% of its earnings from North America, primarily led by the U.S.

A Global Ripple Effect on the Auto Industry

The market downturn in India mirrored losses in global auto stocks, as major international manufacturers such as Toyota, Hyundai, Stellantis, and Ford also saw declines following Donald Trump’s tariff announcement. The new trade barriers threaten to disrupt supply chains, increase production costs, and force automakers to either absorb the cost hikes or pass them on to consumers.

The uncertainty surrounding the tariffs is further heightened by questions over their scope—whether they will apply to all non-U.S. automakers or specifically target certain countries. As a result, investors are bracing for a volatile period in the auto industry.

What’s Next for Tata Motors and Indian Auto Suppliers?

As global automakers assess their options, Tata Motors may need to explore alternative strategies to mitigate the impact of these tariffs. Potential measures could include shifting some production to the U.S., negotiating exemptions, or adjusting pricing strategies to offset losses.

For Tesla’s Indian suppliers, diversifying their customer base beyond the U.S. and strengthening partnerships with European and Asian automakers could be key to minimizing the fallout. With the tariffs set to go into effect in just a few days, the Indian auto sector is in for a turbulent ride. The industry now awaits further clarifications from the U.S. government on whether any exemptions or policy adjustments will be made in response to the growing global backlash.