Funding News

Blacksoil Capital invests Rs 20 cr to Banyan Tree backed Mahaveer Finance

Mahaveer Finance, Chennai-based Asset Financing NBFC, has raised Rs 20 crore bridge equity through structured funding from Backsoil Capital (NBFC) before its Series C funding of 100 crore in the current year. The funds will be utilized to achieve its target AUM of Rs 500 crore for the year.

Praveen Dugar, Mahaveer Finance Promoter, said they heartly appreciate the quick turn-around time, prompt decision making and well supportive team from Blacksoil which helped them close this within committed timelines. “The fund infusion would strengthen the firm’s balance sheet and will enable us to tap growth opportunities that continue to emerge in the current market towards our larger goal of Rs 2,000 crore in the next three years,” he said. “This transaction will be a stepping stone for the upcoming Series-C 100 cr fundraise. After our first round by Banyan Tree in 2018, we have grown the book from Rs 50 crores to Rs 300 crores and the current round from Blacksoil will help us achieve Rs 500 crores.”

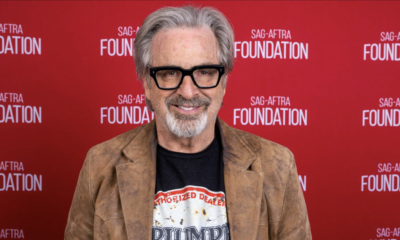

Ankur Bansal, Co-founder of Blacksoil Capital, said the company has established rigorous credit controls, portfolio monitoring systems and loan recovery systems, which reflects in its Gross NPA levels, which is at par with industry benchmarks. “The company has also shown strong resilience during COVID times while dealing with the customer segment which was among the most impacted due to the lockdown restrictions,” he said. “Based on this, we strongly believe in their business model and scalability. We look forward to supporting them in growing their portfolio and expanding their presence.”

Mahaveer Finance, established in 1981, finances used commercial and passenger vehicles through a network of 42 branches which is spread across three southern states and one Union Territory with dominance in First time Buyer/New to credit vehicle segment. The company has built a strong network of over 35,000 small road transport operators, dealers, agents and individuals. Low OPEX structure enables them to offer low ticket loans (Rs 3 to 4 lakhs) and effectively service them through their branch network. The company has raised over Rs 350 crore of debt from over 26 relationships which are well-diversified with PSU Bank, Private Banks, AIFs & NBFCs.

Also Read: LG Electronics to stop making smartphones

The company recently raised Rs 50 crore of TLTRO funding from its PSU Bankers. It aims to serve the gaps in the used commercial vehicle market retail segment and first-time buyers/new to credit buyers, where most of the large players in used commercial vehicle finance cater to large fleet operators. All loans are secured, livelihood financing enabling self-employment/micro-entrepreneurship.

Pingback: PayPal, FlexiLoans.com join hands to offer collateral-free loans to MSMEs | The Plunge Daily

Pingback: Human hair, worth crores, smuggled out of India into China | The Plunge Daily