Business

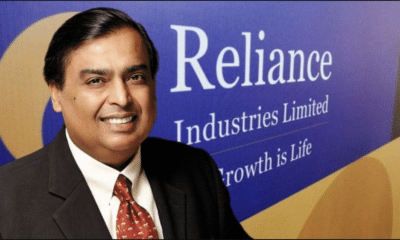

Reliance Industries buys iconic British Country Club Stoke Park for 57 mn Pounds

Mukesh Ambani-led Reliance Industries Ltd has acquired U.K.-based Stoke Park for $79 million (Rs 592.615 crore). In an exchange filing dated April 22, RIL said a wholly-owned unit of Reliance Industries will buy Stoke Park, which owns and manages a hotel, sports and leisure facilities in Buckinghamshire and one of the highest-rated golf courses in Europe, for 57 million pounds ($79 million). The latest acquisition will add to Reliance’s consumer and hospitality assets, it added.

The Indian conglomerate will look to enhance the sports and leisure facilities at this heritage site, while fully complying with the planning guidelines and local regulations, it added. The iconic locale has been the setting for two famous James Bond films i.e. Goldfinger (1964) and Tomorrow Never Dies (1997). The epic duel between James Bond (Sean Connery) and Goldfinger (Gert Frobe) is still considered to be the most famous game of golf in cinematic history, The property’s rolling golf course garnered fame after British Movie spy James Bond played a game with Auric Goldfinger there in the 1964 blockbuster. The property with Georgian-era mansion has also been a backdrop in productions like “Bridget Jones’s Diary” and Netflix’s British Royal Family drama “The Crown”.

The property comprises 49 luxury bedrooms and suites, 27-hole championshop golf course, 13 tennis courts and 14 acres of private gardens attracts wealthy tourists — including the Ambani family themselves — from across the world, Bloomberg News reported. Notably, this is a second major acquisition by Indian behemoth. Last year, Reliance Industries purchased British’s iconic toy chain to consolidate its retail footprint to marks its pivot toward consumer offerings.

Also Read:

India toughens up on Big Tech with new rules

RIL has invested in more than 100 companies over the past nearly five years and has continued its buying spree in 2021 as well. The firm is scouting for established firms across sectors and looking to increase its stakes in technology firms such as Artificial Intelligence (AI), Blockchain, Cloud, Augmented Reality (AR), gaming and banking software among others. The company would look to invest in logistics, supply chain, retail, chemicals and energy among others.