Banking

RBI announces liquidity window of Rs 50,000 crore for COVID-related healthcare infrastructure

The Reserve Bank of India has announced a targeted on-tap liquidity window of Rs 50,000 crore for setting up COVID-related healthcare infrastructure as the country has been engulfed in the second wave of coronavirus infections.

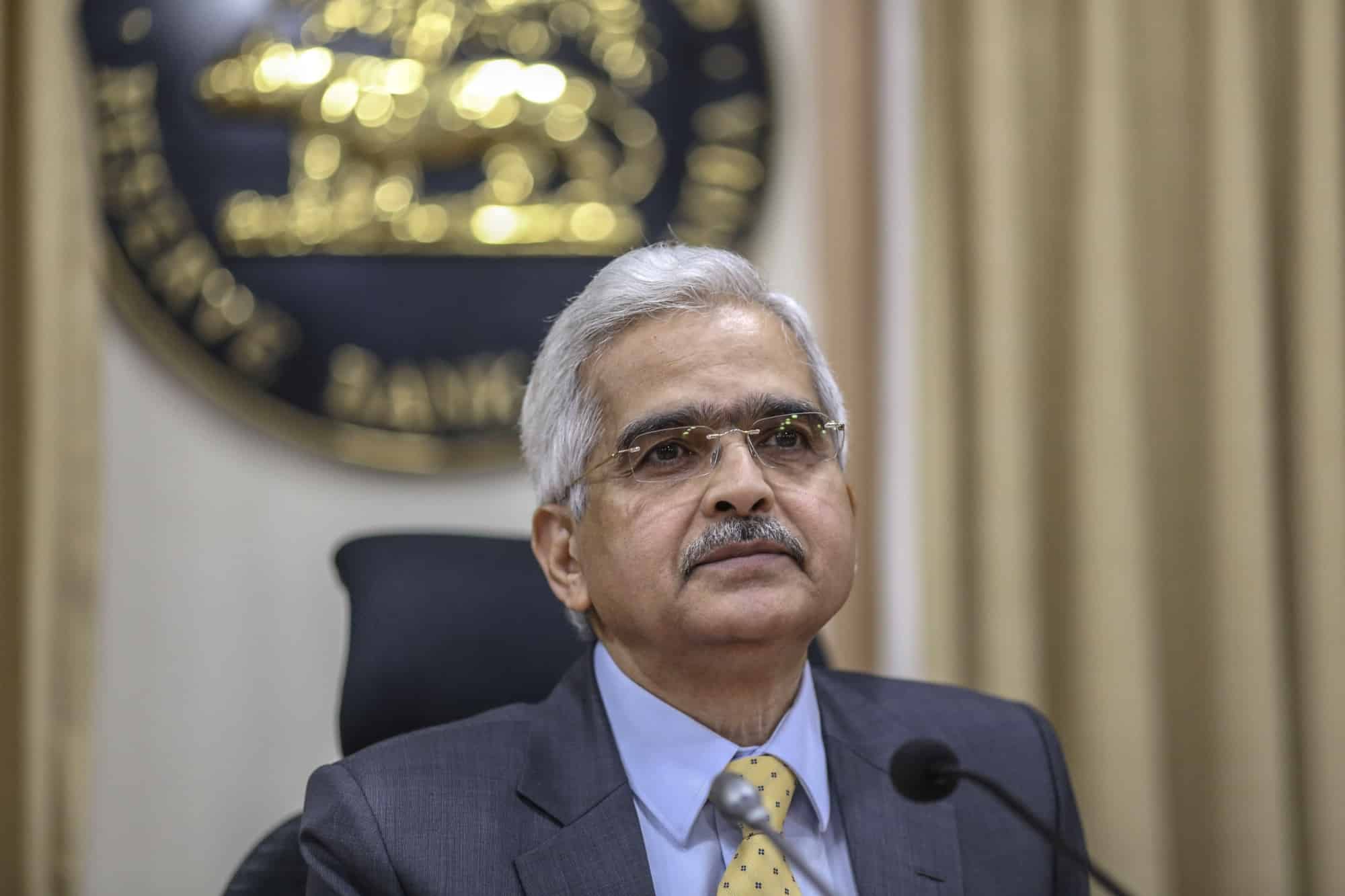

Shaktikanta Das, the RBI Governor, in a virtual briefing said banks can provide fresh lending support to a wide range of entities including vaccine manufacturers; importers/suppliers of vaccines and priority medical devices; hospitals/dispensaries; pathology labs; manufacturers and suppliers of oxygen and ventilators; importers of vaccines and COVID-related drugs; logistics firms and also patients for treatment.

He said cheap loans would be available until March 31 of 2022.

“The devastating speed with which the virus affects different regions of the country has to be matched by swift and wide-ranging actions,” the governor said. “With hospitals complaining of critical shortages of oxygen, beds and vaccines, the new measures aim to improve access to emergency health care during the pandemic. It will be easier for banks to give cheap loans to hospitals, oxygen manufacturers and even patients.”

Das highlighted that the immediate objective is to preserve human life and restore livelihoods through all means possible.

The RBI also asked banks to let certain borrowers have more time to repay loans, among other support measures, amid a major second wave of COVID-19 infections in the country that has led to strict lockdowns in several states. The moratorium will be available to individuals and small and medium enterprises that have not restructured their loans in 2020 and were classified as standard accounts till March 2021.

Also Read: NEAR launches its first India Accelerator to strengthen blockchain start-up ecosystem in India

Das said the second purchase of government securities worth Rs 35,000 crore under the G-sec Acquisition Programme (G-SAP 1.0) will be done on May 20 for an orderly evolution of the yield curve as a fresh COVID-19 wave threatens to hit the economy. He pointed out that the first purchase of Rs 25,000 crore, last month, received enthusiastic response from the market. “RBI will do second purchase of government securities (G-secs) aggregating Rs 35,000 crore in two weeks,” he said.

Pingback: SC says West Bengal Housing Industry Regulation Act 2017 is “unconstitutional” | The Plunge Daily

Pingback: RBI relaxes KYC norms, tells banks not to impose any restriction till Dec-end | The Plunge Daily

Pingback: RBI tries to cushion impact of second COVID-19 wave on MSMEs and small businesses | The Plunge Daily

Pingback: The Walt Disney Company, Star India pledge Rs 50 cr towards COVID-19 relief efforts | The Plunge Daily