Gupshup, the global leader in conversational engagement announced its association with SBI General Insurance, one of the leading private general insurance companies to enhance its insurance buying journey on WhatsApp. With Gupshup’s conversational chatbot, customers can not just purchase a new insurance policy from SBI General but renew an existing one, intimate claims and more, all within WhatsApp.

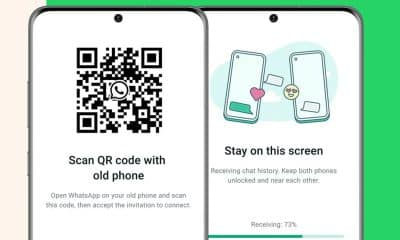

Customers across the country can buy insurance from SBI General by sending a ‘Hi’ to http://wa.me/919136233331/ on WhatsApp. The bot will guide users through a simple and secure buying process, and help them complete the purchase within the WhatsApp chat thread. The hassle-free buying experience ensures that end-to-end policy purchase happens on the platform itself, right from exploring product features to accessing their policy documents.

“Customers are increasingly looking for ease and convenience in their policy buying experience. With the consumer trend towards interactivity and personalization, messaging is at the forefront of every brand’s user engagement. We believe that our WhatsApp solution will further enhance accessibility and user-friendliness of SBI General’s products”, said Ravi Sundararajan, COO, Gupshup.

Apart from facilitating purchases, the WhatsApp chatbot allows for deeper insights into customer journeys and possibilities of advanced personalisation across crucial customer touchpoints. Gupshup has been instrumental as a conversational engagement platform in helping brands build engagement through seamless discovery and purchase experiences.

“Besides, insurance is not a “one-size fits all” product. It has to be customized based on a person’s requirement. Through a two way conversation, our chatbots enable easier product discovery, even for customers who are buying it for the first time”, he further added.

Post Covid, Gupshup has seen immense traction in the insurance market, wherein customers are increasingly seeking conversational engagement to take the next step. The company works with a number of BFSI brands both in India and abroad, to streamline product discovery, customer onboarding, KYC, payments and support.

“With increased access to the internet across demographics, customers are willing to explore simpler and more convenient options for financial solutions. The current generation looks for simplified buying experience for complex financial products. We aim to further enhance this journey and make a wider range of simple products available in the near future. This will enable the much-required deeper insurance penetration and financial inclusion in the country”, said Anand Pejawar, Deputy Managing Director, SBI General Insurance.

For a rapidly digitising insurance sector, chatbots could be the catalysts for ushering a new era of growth for insurance companies.

“The banking and insurance industry has been at the forefront of building innovative customer engagement journeys on the WhatsApp Business Platform. These solutions are making financial products and services more accessible to people across the country thus contributing to the overall financial inclusion vision. We are delighted to further strengthen our collaboration with SBI General Insurance to make insurance products more easily available for their new and existing customers”, said Abhijit Bose, Head of WhatsApp India.

Gupshup enables better customer engagement through conversational messaging. Gupshup is the leading conversational engagement platform, powering over 9 billion messages monthly. Tens of thousands of large and small businesses across industry verticals use Gupshup to build conversational experiences across marketing, sales, and support.