Business

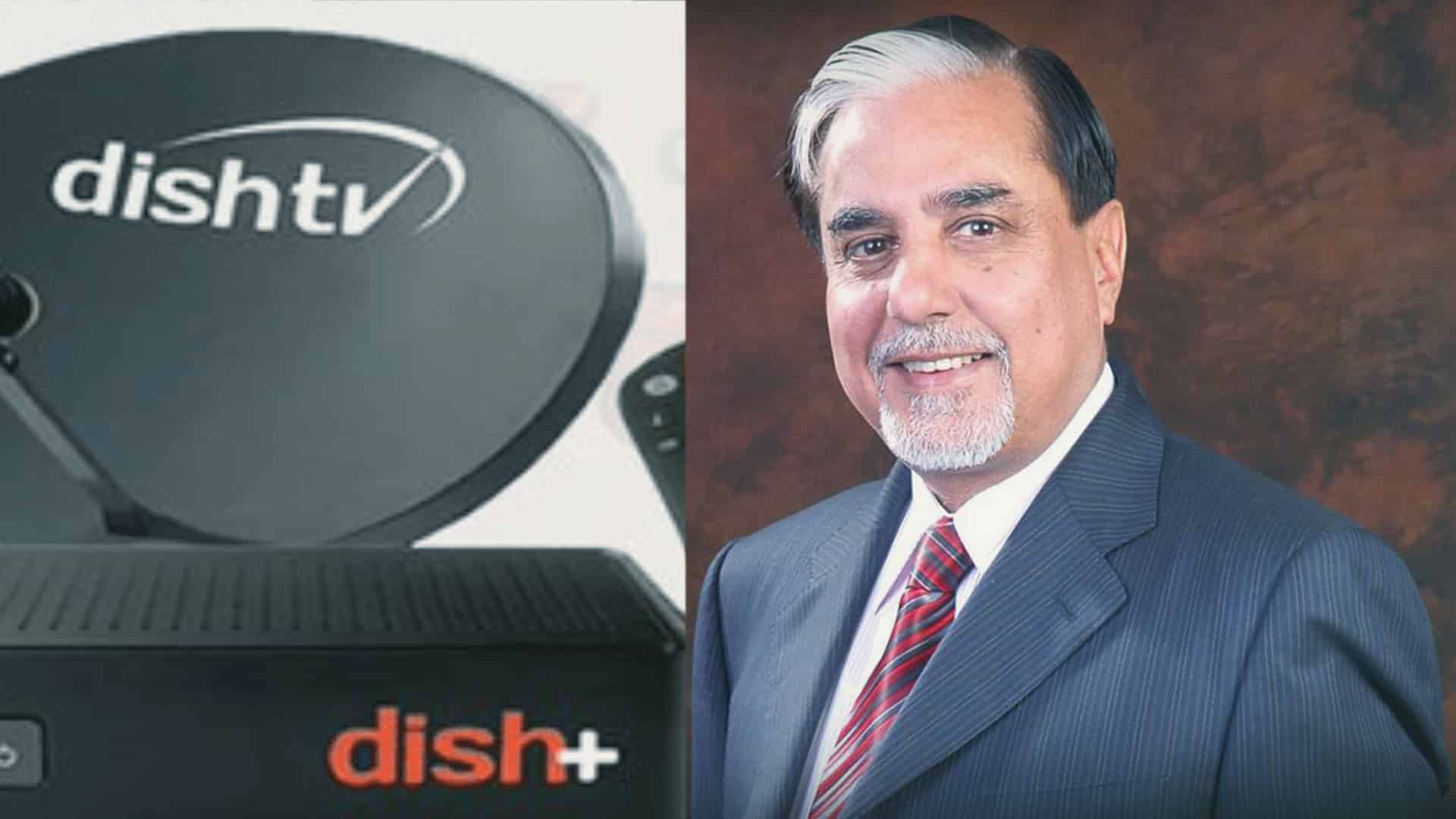

Chandra says will soon return pledged Dish TV shares to brother Goel

Subhash Chandra, whose Zee Group was rescued by Dish TV owner Jawahar Goel in 2018 when he extended his personal holdings in the direct-to-home firm to be pledged by Zee to raise bank loans, on Thursday said he would soon be returning the shares released by the lenders to his younger brother. The statement, which did not offer a time frame, comes amid market rumours that the former media baron would not be able to return the shares. Currently, Chandra does not manage the largest private broadcaster Zee Group as he owns only under 5 per cent in the group since November 2019 when due to financial crisis he was forced to sell out to external investors.

The market was buzzing with rumours that Chandra, who is now the chairman of the Essel Group and chairman emeritus of the Zee Group, will not be able to return the shares of his younger brother’s Dish TV, a leading direct-to-home player and that if at all he did, it would be at a substantial discount to the then price. Dish TV shares closed at Rs 9.39 on the BSE on Thursday, up 6.34 per cent. On April 23, 2018, the share had closed at Rs 77.59. It has not been disclosed when the share pledge happened and what was the Dish TV price when it took place. “The Essel Group wishes to deny all the rumours and market speculations pertaining to Dish TV India The group is confident and fully committed to return the mentioned security cover back to Goel and his family.

Also read: Oxygen Express leaves for Maharashtra from RINL plant

“The group also wishes to iterate that Goel, as the rightful owner of the equity stake in Dish TV India, had only stepped forward to offer support, and has no financial stress whatsoever in his personal capacity,” Chandra said in a statement without disclosing how many shares of Dish TV were pledged by him. Goel now owns 30.37 per cent in Dish TV. He had reportedly pledged close to 8 per cent of the holdings when the Zee Group was facing financial difficulties that began in 2018. Chandra further said his group has consistently focused on its commitment towards its lenders. With the undeterred faith and support of the lenders, the group has successfully resolved majority of the issues and is on a steady path to iron out the limited pending issues.

He also thanked Goel, promoter and managing director of Dish TV, for extending support in the form of a substantial portion of his equity in the mentioned listed entity as security for the credit facilities availed by the Subhash Chandra Group. The statement further said Chandra is not the promoter of Dish TV and neither does he hold any management control in it. “We also wish to deny all the speculations and rumours, pertaining to the shares being released from the lenders at a lower price and sold to third-party investors at higher price. These speculations are absolutely baseless and incorrect,” Chandra said. The Chandra-Goel rescue act had a parallel among the Ambani brothers in March 2019, when Mukesh Ambani extended over Rs 480 crore to his younger brother Anil to help him avoid default of the Supreme Court ordered payment to Ericsson and a jail term.

In March 2020, Yes Bank had acquired 24.19 per cent stake in Dish TV following invocation of pledged shares after default by Dish TV and other Essel Group firms such as Essel Business Excellence Services, Essel Corporate Resources, Living Entertainment Enterprises, Last Mile Online, Pan India Network Infravest, RPW Projects, Mumbai WTR and Pan India Infraprojects. Chandra has been selling assets to pare down debt. As fund raising plans did not fructify, in November 2019, Chandra was forced to sell most of his stake in crown jewel Zee Entertainment to a clutch of foreign funds such as GIC of Singapore, BlackRock, HSBC Global, Fidelity India and local investors such as SBI Mutual Fund and Reliance Mutual Fund which collectively picked up almost 15 per cent of pledged shares. In September 2019, he had sold 11 per cent in ZEEL to Invesco-Oppenheimer fund for over Rs 4,224 crore. After retiring a lot of debt, the Essel Group still has a substantial amount of borrowings.