Business

Future Retail moves SC against high court order on deal with Reliance Retail

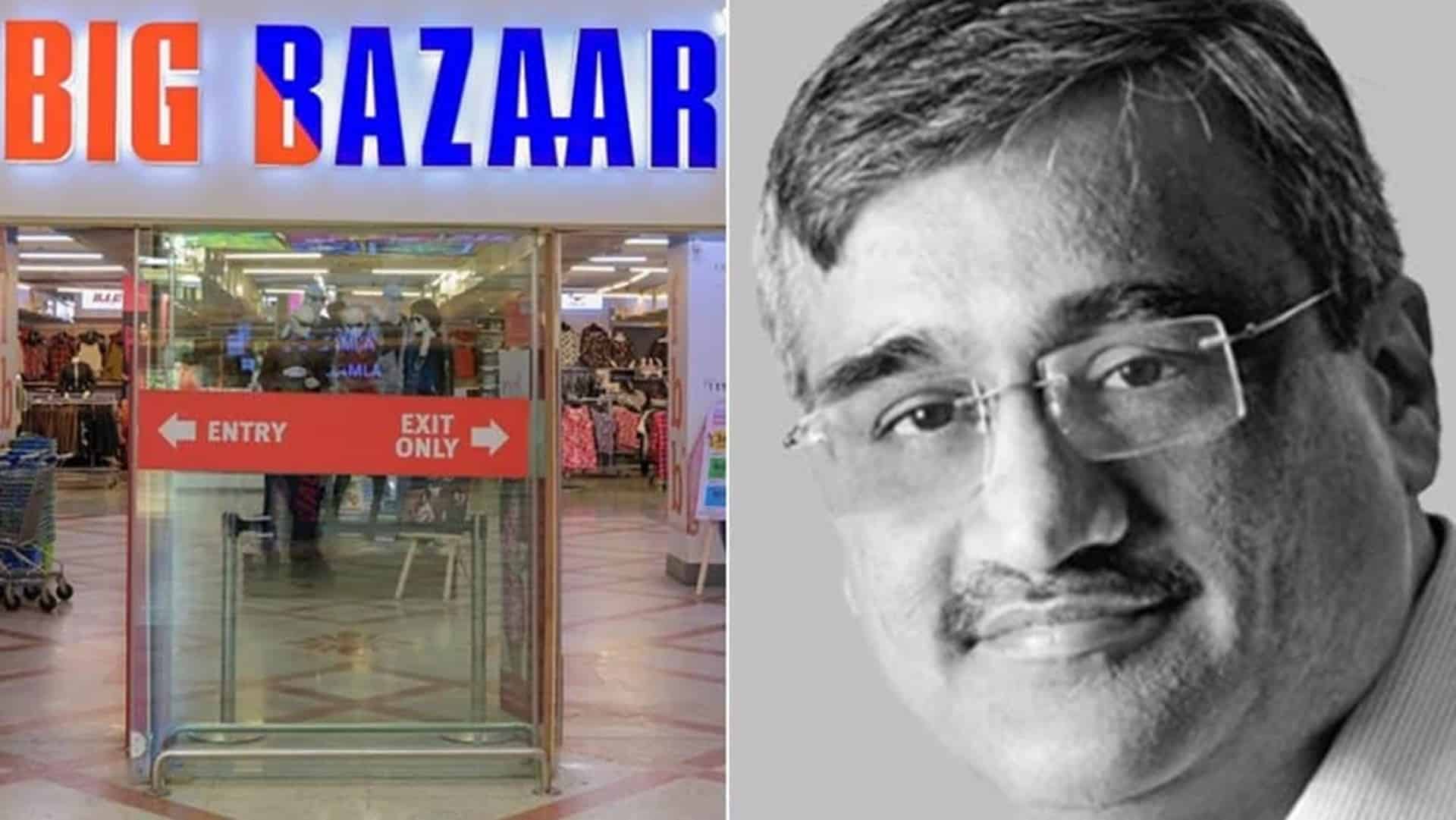

Kishore Biyani-led Future Retail Ltd on Saturday said it has approached the Supreme Court against an order passed by the Delhi High Court to maintain status quo in relation to its Rs 24,713 crore deal with Reliance Retail and directing it to enforce the order of the Singapore-based Emergency Arbitrator.

In a regulatory filing, Future Retail said, “Please be informed that the company has filed a special leave petition before Hon’ble Supreme Court of India against the impugned orders dated 2nd February 2021 and 18th March, 2021 passed by ‘Ld. Single Judge’…The SLP will be listed for hearing in due course.”

On February 2, a single bench of the Delhi High Court had directed Future Retail Ltd (FRL) to maintain status quo in relation to its Rs 24,713 crore deal with Reliance Retail, which was objected to by US-based e-commerce giant Amazon.

Justice J R Midha said the court was satisfied that an immediate interim order was required to be passed to protect the rights of Amazon.

Later, on March 18, the court upheld the Singapore Emergency Arbitrator’s (EA) order restraining Future Retail Ltd (FRL) from going ahead with the Rs 24,713 crore deal with Reliance Retail to sell its business, which was objected to by US-based e-commerce giant Amazon.

Justice J R Midha directed Kishore Biyani-led FRL not to take further action on the deal with Reliance and held that the group willfully violated the EA’s order. The high court rejected all the objections raised by Future Group and imposed a cost of Rs 20 lakh on it as well as its directors.

Earlier this month, Future group promoters, including Kishore Biyani and several group holding companies, had approached the Supreme Court against an order passed by the Delhi High Court directing to enforce the order of the Singapore-based Emergency Arbitrator.

In a regulatory filing by Future Retail Ltd on August 12, the company had stated that Kishore Biyani, Rakesh Biyani and other family members of the Biyani family along with the holding companies Future Coupons, Future Corporate Resources, Akar Estate and Finance had filed SLP against Amazon.com NV Investment Holdings LLC before the Supreme Court.

Passing an interim order, the EA of Singapore International Arbitration Centre (SIAC) had on October 25 last year restrained the Future group from going ahead with its Rs 24,731 crore deal with Reliance Industries to sell its retail and wholesale business, and the logistics and warehousing business.

Amazon, which has 49 per cent stake in one of Future’s unlisted firms, Future Coupons Ltd had approached SIAC.

In August last year, Reliance Retail Ventures Ltd (RRVL) had said it would acquire the retail and wholesale business, and the logistics and warehousing business of Future Group for Rs 24,713 crore.

The scheme of arrangement entailed consolidation of Future Group’s retail and wholesale assets into one entity Future Enterprises Ltd and then transferring it to Reliance Retail.

The deal has been contested by Amazon, an investor in Future Coupons that in turn is a shareholder in Future Retail Ltd.

The apex court had on August 6 upheld Amazon’s plea. It had ruled in favour of Amazon and held that an award of an EA of a foreign country is enforceable under the Indian Arbitration and Conciliation Act.