Business

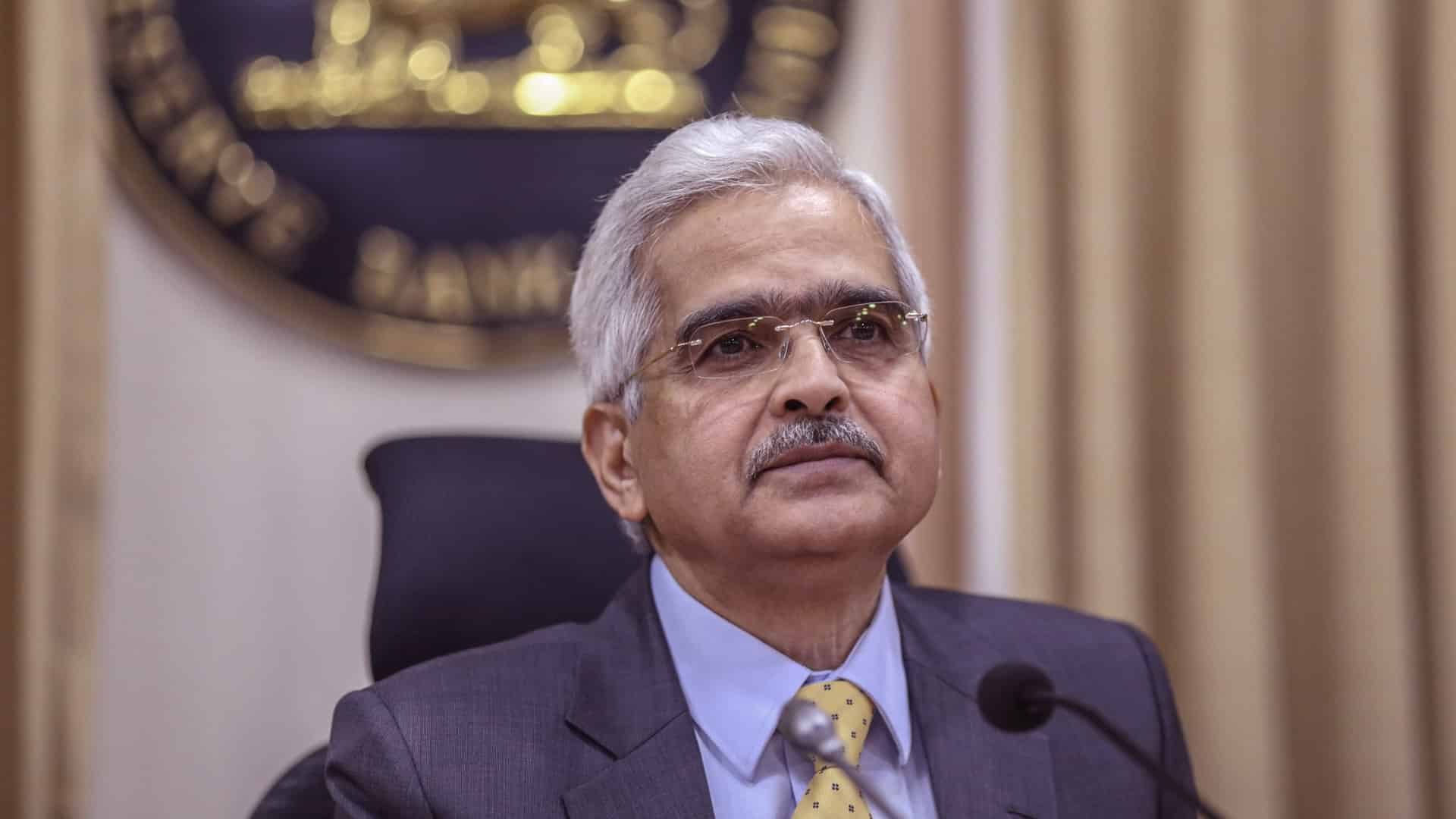

Governor Das against pause in rate hikes: MPC minutes

In a tightening cycle, a premature pause in monetary policy action would be a costly policy error, Reserve Bank Governor Shaktikanta Das opined while voting along with five other members of the MPC for raising the key lending rate by 35 basis points earlier this month, according to the minutes of the meeting released on Wednesday.

Prior to the December hike in repo rate, the RBI had raised the key short-term lending rate by 190 bps in four tranche.

“I am…of the view that a premature pause in monetary policy action would be a costly policy error at this juncture. Given the uncertain outlook, it may engender a situation where we may find ourselves striving to do a catch-up through stronger policy actions in the subsequent meetings to ward-off accentuated inflationary pressures,” said the minutes of Monetary Policy Committee (MPC).

Also read: Govt keeping eye on inflation: Sitharaman in Rajya Sabha

The meeting was held during December 5-7. The Governor also said that in a tightening cycle, especially in a world of high uncertainty, giving out explicit forward guidance on the future path of monetary policy would be counterproductive. This may result in the market and its participants overshooting the actual play out of real conditions, he opined.

Pingback: New Covid outbreak in China: India Inc says no need to panic yet