Energy

After Shares Worth Rs 357 Crore Exchange Hands in Block Deal, Reliance Power Gains

Shares of Reliance Power rose on September 25 after a block deal worth Rs 357 crore took place on the stock exchanges. Around 8.6 crore shares, representing a 2.1% stake in the company, were exchanged at a floor price of Rs 42 per share, reflecting an upside from the previous closing price. Although the identity of the buyers and sellers involved in the deal remains unclear, the transaction spurred significant market activity, reported Moneycontrol.

The block deal triggered a sharp spike in trading volumes, with 22 crore shares changing hands by mid-session. This marked a significant increase from the one-month daily trading average of just five crore shares. Following the deal, Reliance Power’s stock gained over 1%, reaching Rs 40.46 per share on the National Stock Exchange (NSE).

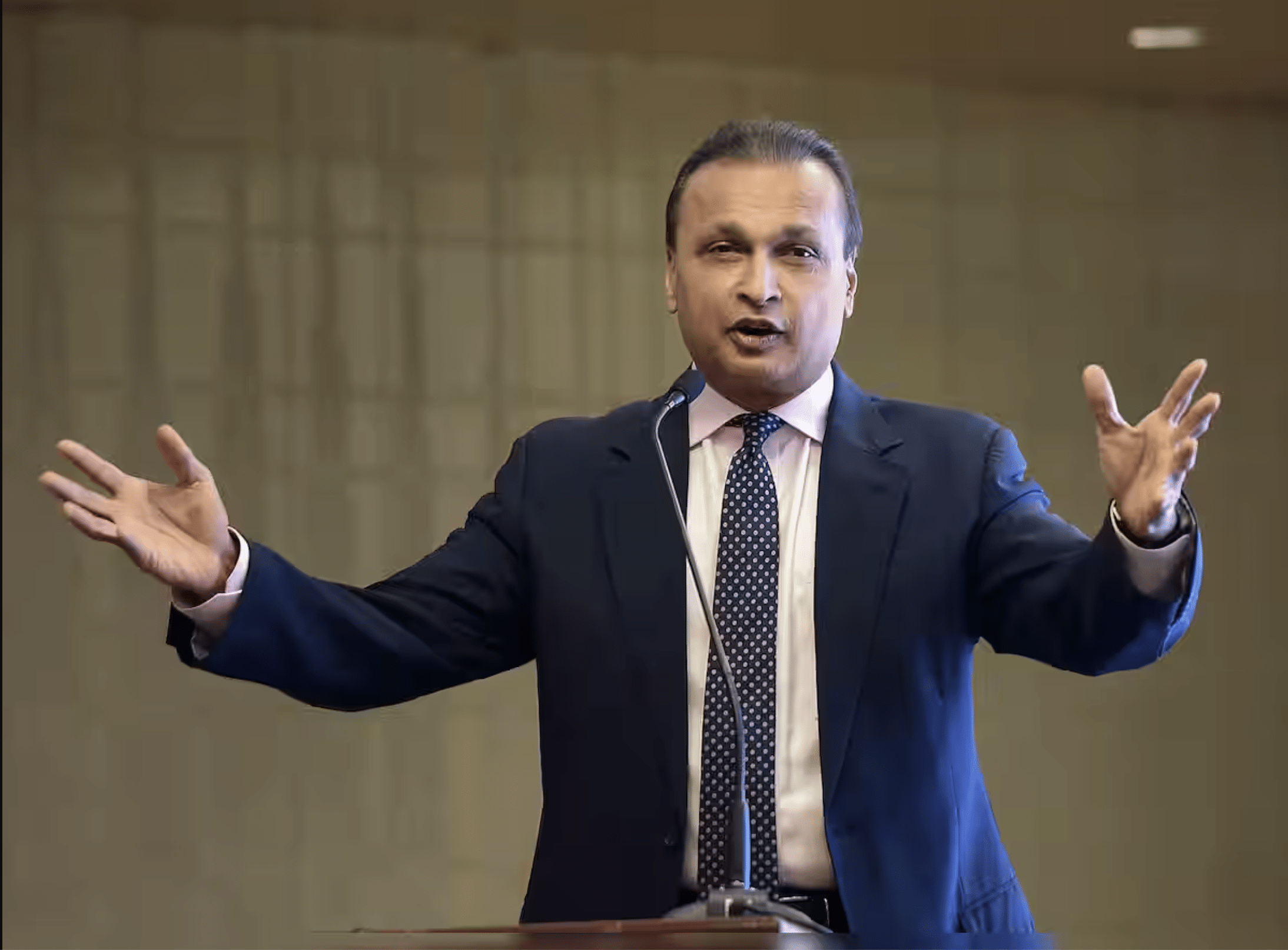

This surge in activity follows a previous session where Reliance Power shares hit the 5% upper circuit after the company, led by Anil Ambani, announced a preferential issue of 46.2 crore equity shares. The issue, valued at Rs 1,524.60 crore at Rs 33 per share, was priced at a 14% discount to the closing price on September 23. The company stated that the capital raised through the preferential issue would augment long-term resources, reduce existing debt, and support its expansion, especially in renewable energy.

Reliance Power, reportedly zero-debt on a standalone basis, is looking to venture into the renewable energy sector, signalling a strategic shift towards sustainable growth. The company plans to use Rs 803.60 crore of the proceeds from the preferential issue to strengthen its renewable energy initiatives and support its subsidiaries and special purpose vehicles.

The focus on renewable energy aligns with the broader market trend as companies look to diversify their energy portfolios. Reliance Power’s strategy also involves addressing long-term working capital needs, ensuring financial stability, and enhancing shareholder value through new investments and capital infusion.

The rise in stock price and trading volume following the block deal reflects growing investor interest in Reliance Power as it embarks on new growth trajectories in the clean energy space.