Startup & Entrepreneurship

Union Budget 2021: A budget for MSMEs to adopt e-commerce

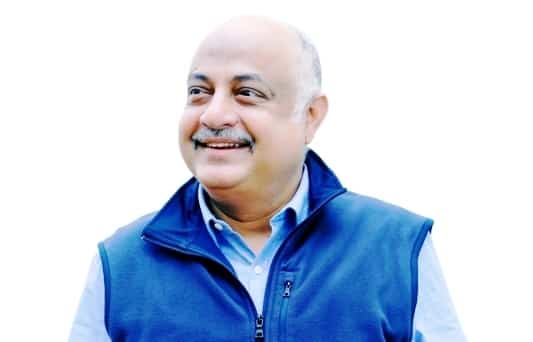

Having weathered the storm of 2020, the Indian MSMEs ecosystem was one amongst other critical sectors that looked up to the budget as a major revival stimulus, says Deepak Shetty, Director of Zed-Axis Technologies. He believes the budget indeed did well across several counts for the sector as it allocated Rs 15,700 cr amongst other offerings, for the FY 2021-22, which is double the outlay for the sector as compared to the previous year.

“Additionally, the government proposed to allocate Rs 300 cr to ensure the establishment of new technology centres for MSMEs, exposure to entrepreneurial and skill development programmes, rationalization of Customs Duties structure and a speedy dispute redressal system,” Shetty said. “The budget signals a healthy set of progressive measures taken for the MSME sector to be Atmanirbhar and be able to see a profitable and prosperous 2021.”

During the early days of the lockdowns in 2020, industry surveys indicated that more than a quarter of India’s 69 million micro, small and medium enterprises may shut shop if the lockdown policies are continued in their aggressive form. As bad a disruptor the pandemic was however, it also fuelled adaptability and forced people to think of newer ways to do business by adapting to digital ecosystems. As physical interaction between consumers and markets was disrupted, online marketplaces and digital services saw a rise.

Shetty said the budget underlines the government’s thrust towards building a self-reliant India through technological adoption for enhanced efficiency and competitiveness. “To realize this vision on ground, the government would need to enhance its focus on enabling digitalization and transition to e-marketplaces to help MSMEs streamline their supply chain gaps, enhance market access and create employment.”

He pointed out that the MSME ecosystem in India has already realized the potential of e-commerce for reviving their businesses, a significant share of them have started selling online. The transition came as a logical choice of survival in light of the market data reflecting strong consumer demand on online marketplaces, which subdued interest in retail markets. Furthermore, the transition to online marketplaces played a key factor in helping MSMEs stay afloat by reaching their customers online as the market visits reduced.

The government through provisions under the budget, Shetty said has tried creating a strong foundation for MSMEs by enabling restructuring measures like enhanced credit flow and a rationalized duty structure. “It would further require tax policy reform to ensure parity for MSMEs selling online, versus those selling offline.”

Moreover, for a country like India which is pushing for digitalization across the board, the tax policies for online sellers seem like a conflicting reality. Shetty acknowledged that online sellers in India bear the brunt of complex, burdensome and un-equal tax policies. He pointed out that Goods and Service Tax Act and the Composite GST scheme seem to deliver a disproportionate tax burden on businesses selling online, and prove to be counterproductive to the vision of Atmanirbhar Bharat and Digital India.

Also Read: Cryptocurrency volatility undermines its ability to store value: Powell

“Another compliance and cost-heavy norm which the government may consider revising, could be Additional Place of Business (APoB) requirements, which mandate MSMEs to register warehouse where their products are stored as an Additional Place of Business; and TCS levy on supplies made through e-commerce platforms,” he said.

Pingback: Skymet launches skAlgeo to pave way for fintech revolution | The Plunge Daily