Indian Regulators

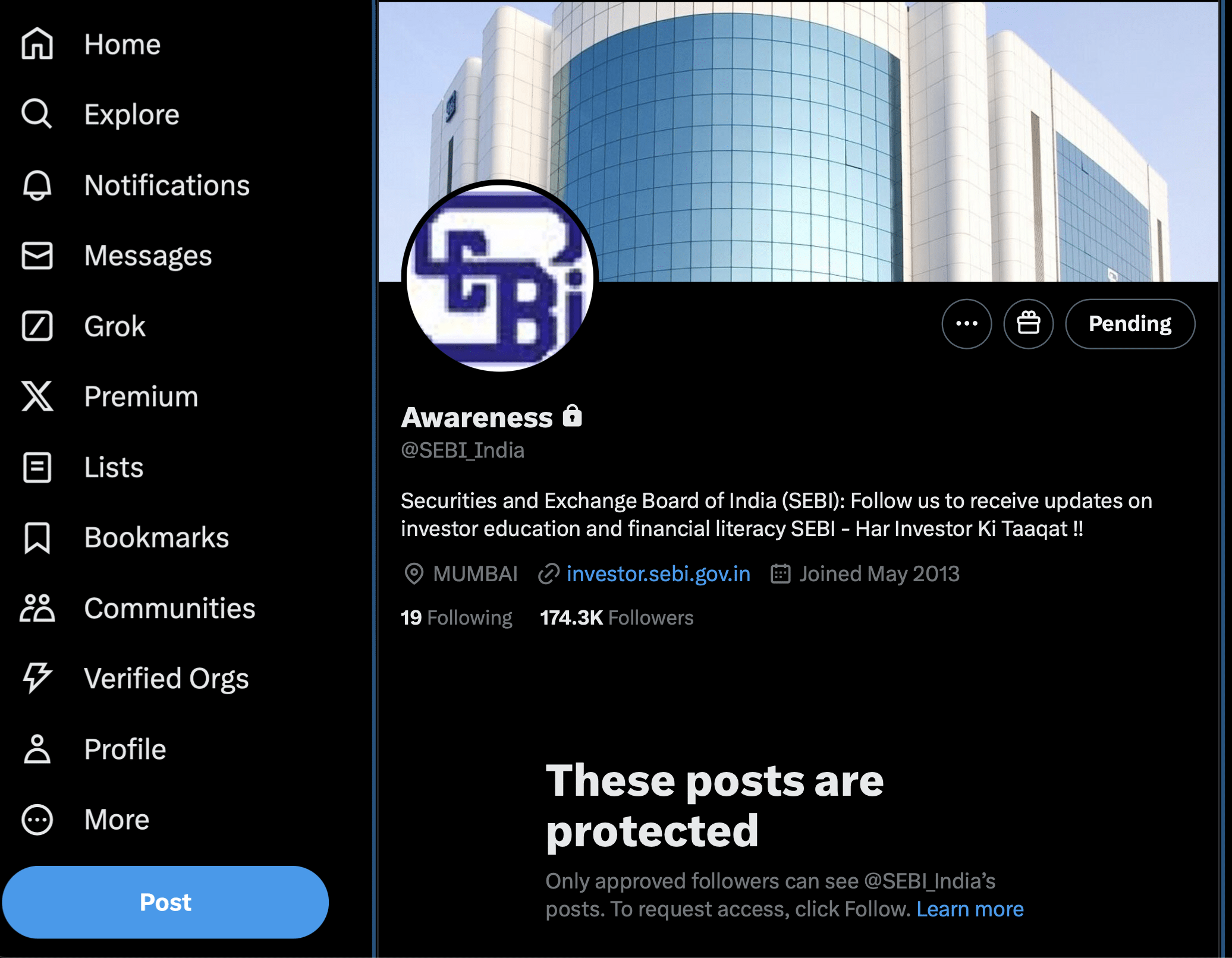

Why is SEBI’s X Profile Locked? Questions Arise as Public Regulator Goes Dark

In a move that should spark widespread speculation and concern, the Securities and Exchange Board of India (SEBI) has locked its X (formerly Twitter) profile, restricting access to its posts and updates. The decision is suspicious and should raise eyebrows across the financial and regulatory landscape, particularly given SEBI’s role as a public regulator that maintains transparency and accountability in India’s financial markets. They are not supposed to be an individual or an emotional human being hurt by Hindenburg Research claiming to have caught them in an act of conflict. An act where allegedly the SEBI Chairman Madhabi Puri Buch, who is heading a regulatory body in charge of investigating Adani Group, has been put in the corner of being hand in glove with Adani Group on alleged fraud and scam. This act calls for an investigation of SEBI, let alone the possible issue of where they seem to have lied to The Supreme Court earlier.

A Public Regulator with a Locked Profile

As a public institution, SEBI is more than just an ordinary entity with a social media presence. Unlike private individuals or corporations that might lock their profiles for personal reasons, SEBI’s mission is to protect investors’ interests and ensure the stock market’s orderly functioning. As such, its communications should be as open and accessible as possible, serving the public good.

SEBI X Profile with the Display name ‘Awareness’ – what an oxymoron?

However, the company’s sudden decision to lock its X profile has led to questions about its reasoning. Is this an attempt to control the narrative, or is there something more concerning at play? Is this what they call in a crime series – covering up their track or cleaning up the crime scene?

The Timing Raises Suspicions

The timing of SEBI’s decision to lock its profile is particularly intriguing. It comes on the heels of renewed allegations against the regulatory body and its leadership, Madhabi Puri Buch, particularly about the Adani Group scandal. Hindenburg Research has released a series of explosive claims suggesting that SEBI Chairperson Madhabi Puri Buch may have had a conflict of interest in the Adani case, with ties to offshore entities allegedly used for stock manipulation.

Given these recent developments, some observers are questioning whether SEBI’s move to lock its profile is an attempt to “clean up the crime scene” by controlling publicly available information and limiting scrutiny of its actions. The lack of transparency in this decision only adds fuel to the fire, as stakeholders and the public need to be made aware of the regulator’s motivations.

Lack of Accountability?

For an organisation like SEBI, which is supposed to embody transparency and accountability, the act of locking its X profile sends mixed messages. Social media has become a vital tool for public institutions to communicate with citizens, disseminate important information, and engage in dialogue. By restricting access to its posts, SEBI risks alienating the people it is supposed to serve.

What’s Next for SEBI?

The locked profile raises questions about SEBI’s transparency and commitment to public engagement. If the regulator is cleaning up its digital presence in response to the allegations, it suggests a more troubling trend of avoiding accountability and scrutiny. On the other hand, if this is part of a broader strategy to manage its communications, SEBI needs to communicate the reasons behind this decision to avoid further speculation and mistrust.

It remains to be seen how the situation develops. In any case, the public and the markets will be watching closely, as transparency remains a cornerstone of trust in any regulatory body.

Hindenburg Research has raised concerns about Buch’s involvement with specific offshore entities, particularly the Global Dynamic Opportunities Fund (GDOF), which Vinod Adani reportedly used. According to the documents shared by Hindenburg, on March 22, 2017, just weeks before Buch’s appointment as a SEBI Wholetime Member, her husband, Dhaval Buch, allegedly wrote to the fund’s administrator, Trident Trust in Mauritius, seeking to transfer control of their investments to himself.

Pingback: SEBI Backs Madhabi Puri Buch over Investigating Hindenburg allegations