News

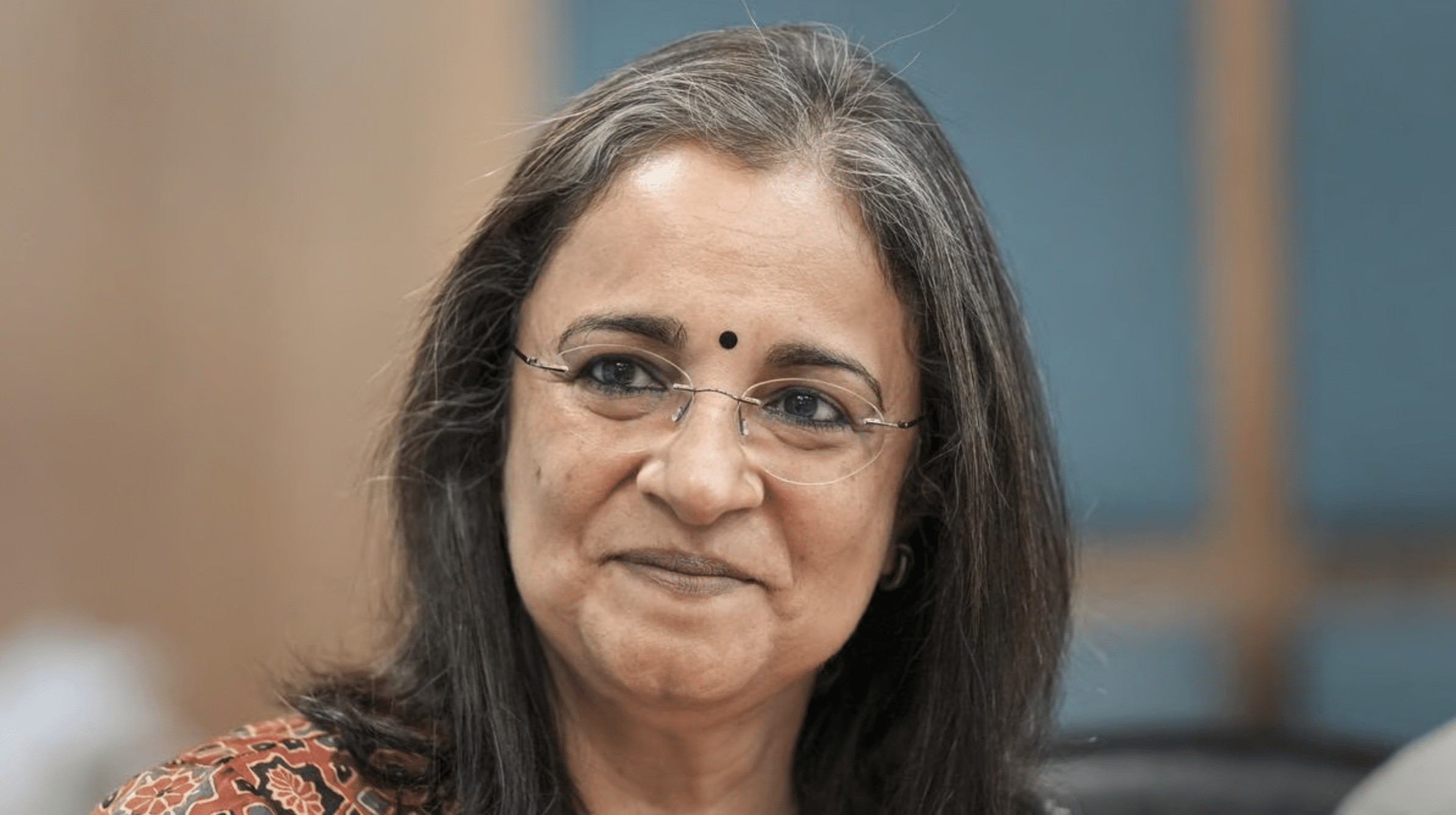

SEBI Chairperson Madhabi Puri Buch Alleged to Have Stake in Offshore Entities Tied to Adani Scandal, Says Hindenburg Research

In a significant new development in the ongoing controversy surrounding the Adani Group, U.S.-based short-seller Hindenburg Research has released fresh allegations implicating Securities and Exchange Board of India (SEBI) Chairperson Madhabi Puri Buch in a potential conflict of interest. According to Hindenburg, Buch had a financial stake in offshore entities that were reportedly used in the alleged money siphoning and stock manipulation activities associated with the Adani Group.

New Whistleblower Documents Released

On Saturday, Hindenburg released what it claims are whistleblower documents that suggest SEBI’s reluctance to take meaningful action against suspicious offshore shareholders in the Adani Group might be due to Chairperson Madhabi Puri Buch’s involvement in similar offshore structures. The firm alleges that the same offshore funds used by Vinod Adani, brother of Adani Group Chairman Gautam Adani, were also utilized by Buch and her husband.

Hindenburg’s report highlights the potential conflict of interest, stating that SEBI’s inaction in the Adani case could be attributed to Buch’s own ties to the funds under scrutiny. When approached, SEBI declined to comment on these allegations.

Allegations Against Buch and Offshore Funds

Hindenburg Research has raised concerns about Buch’s involvement with specific offshore entities, particularly the Global Dynamic Opportunities Fund (GDOF), which Vinod Adani reportedly used. According to the documents shared by Hindenburg, on March 22, 2017, just weeks before Buch’s appointment as a SEBI Wholetime Member, her husband, Dhaval Buch, allegedly wrote to the fund’s administrator, Trident Trust in Mauritius, seeking to transfer control of their investments to himself.

The report further alleges that by February 2018, the full details of this offshore investment structure, including its links to Mauritius-registered cells used by the Adani Group, were revealed in communications addressed to Madhabi Buch’s private email. At the time, the value of Buch’s stake in the GDOF was reportedly worth $872,762.25.

Previous Involvement with Offshore Consulting Firm

Hindenburg also alleged that from April 2017 to March 2022, during her tenure as a Wholetime Member and later Chairperson of SEBI, Buch held a 100% interest in a Singaporean consulting firm named Agora Partners. The firm claims that Buch transferred her shares in Agora Partners to her husband just two weeks after her appointment as SEBI Chairperson in March 2022.

SEBI’s Response and Alleged Inaction

The allegations against Buch add a new dimension to the Adani-Hindenburg saga, which first came to light in January 2023 when Hindenburg accused the Adani Group of stock manipulation and accounting fraud. Despite these serious accusations, SEBI has yet to take action against suspect Adani shareholders, particularly those operated by India Infoline, such as EM Resurgent Fund and Emerging India Focus Funds, both of which were identified in Hindenburg’s initial report.

Hindenburg’s latest claims suggest that SEBI’s investigation into the Adani matter has stalled. The regulatory body is reportedly struggling to uncover the true holders of offshore funds linked to the conglomerate. The Indian Supreme Court has also expressed frustration over SEBI’s inability to provide conclusive findings.

Implications and Future Developments

The new allegations against SEBI Chairperson Madhabi Puri Buch could have far-reaching implications for both the regulatory body and the ongoing investigation into the Adani Group. If substantiated, these claims could raise serious questions about the integrity and independence of SEBI’s leadership.

As the story continues to unfold, all eyes will be on SEBI’s next steps, as well as any potential legal or regulatory actions that may arise from these explosive new allegations.

Pingback: SEBI X Profile Locked? Regulator Dark over Hindenburg Adani report?

Pingback: SEBI Madhabi Puri Buch 16.8 crore Salary from ICICI Bank : Congress