Funding News

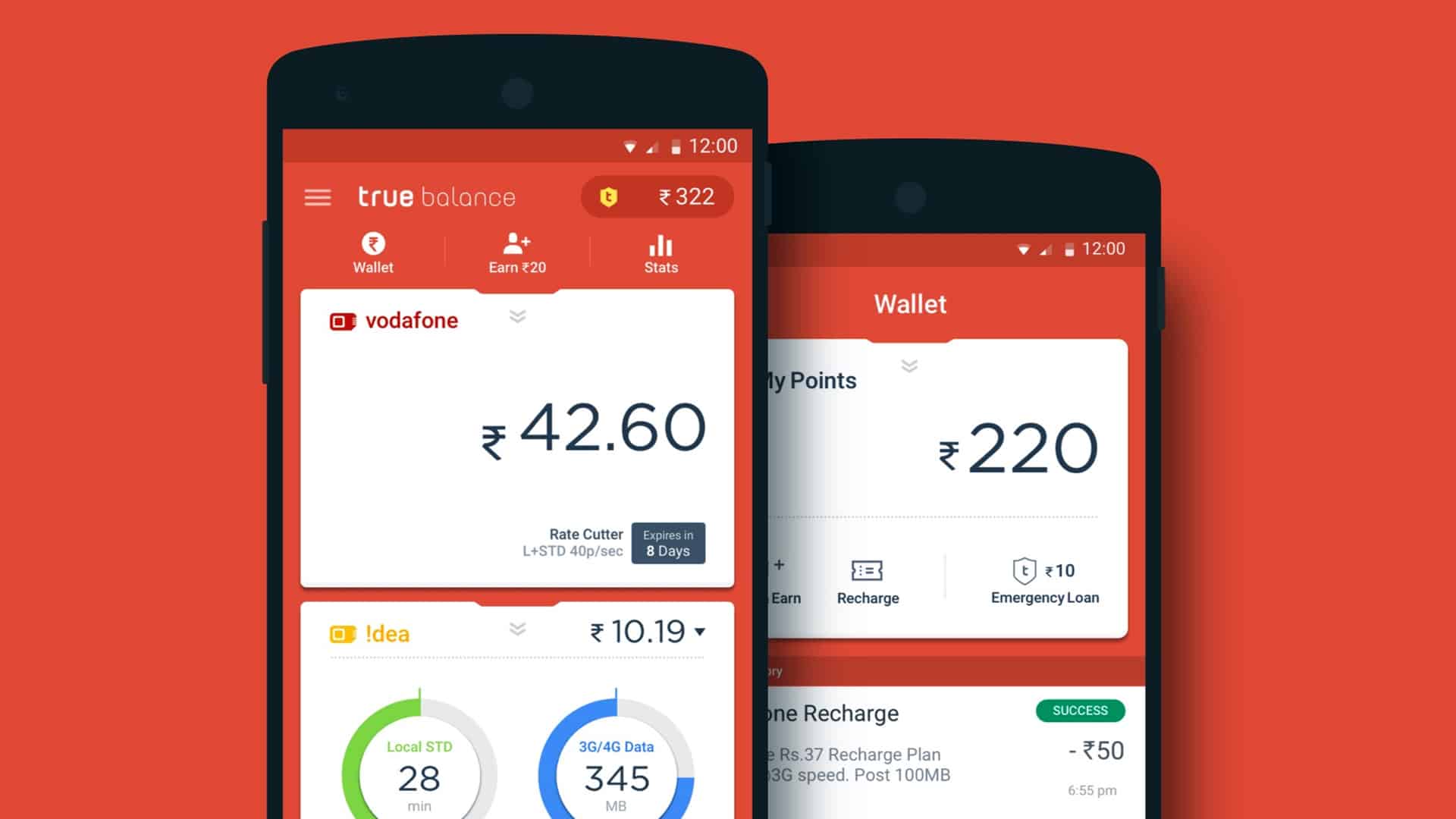

True Balance’s NBFC arm raises USD 15 mn in debt funding

True Credits, a Reserve Bank-licensed NBFC of True Balance, on Wednesday said it has raised USD 15 million (about Rs 111.4 crore) in debt funding from investors across India and Korea. With this, the total debt fund raised by the company stood at USD 25 million, a statement said. The second round of investment has come from Pace and E-clear, as well as other investors in Korea, to support the company’s expansion in India, it added.

True Balance app was launched in 2016 in India to help users to efficiently manage their phone recharge, bill payments and balance check. In 2019, True Credits received their licence from RBI, post which True Balance started the lending business. True Credits has disbursed loans worth over Rs 300 crore in this calendar year. “The company’s loan book has grown at 2000 per cent in CY2021 for small ticket size products – the key product focused towards new-to-credit users, Level Up Loan. The company intends to cater to customers within the monthly income bracket of Rs 5,000 to Rs 30,000 with loans between Rs 1,000 to Rs 50,000,” the statement said.

Also read: Japan’s imports, exports grow on overseas economic rebound

True Balance aims to break even within CY2021 on the back of its 30-50 per cent month-on-month growth, it added. Every round of funding we raise only cements our commitment to ensuring access to finance for the underbanked, and those who lack access to credit. We have seen exponential growth this year and are confident of achieving break even within the year, True Balance Chief Financial Officer Vishal Bhatia said. He added that the goal with this round of funding is to expand to newer markets and making finance available for all.

Pingback: Go First inks sales partnership with WorldTicket, DTW