Fintech

Slice is giving free Visa card with its pay-later app

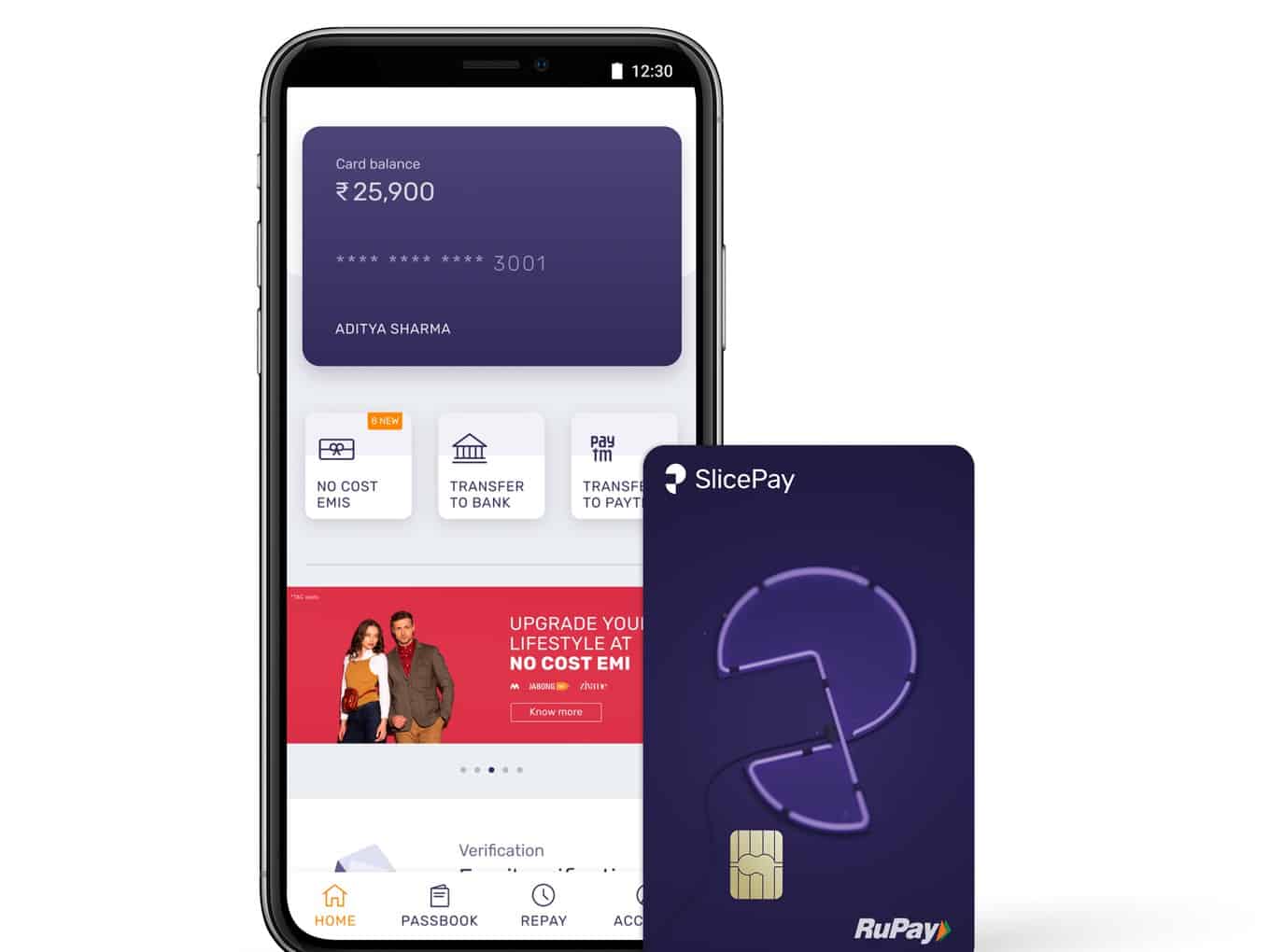

Slice has introduced a Visa card, which comes for free with its pay-later app, to meet the evolving financial needs of Gen Zs and millennials across India. The card is available in a physical and virtual form. It enables Slice users to make payments at over 4.8 million merchants across the country where Visa is accepted.

Expressing excitement with the launch, Rajan Bajaj the Founder & CEO said it will introduce the youth of India to a world of financial freedom in a simple, transparent and responsible way. “As a young team, we understand this consumer very well and in last four years, our primary focus has been on making their financial experience fun and seamless,” he said. “The offers, partnerships and experience in our new product is customized keeping in mind their expectations and priorities.” Slice believes a cutting-edge new solutions like these will help the company become the go-to fintech destination for Young India. Arvind Ronta, Head Products India and South Asia Visa, described Slice as an exciting young proposition that is well suited to the millennial consumer’s credit and payment needs. “We are happy to partner with them to enhance the offering with a Visa card and provide access to pay later options. With the power to access it all through an app, this gives the cardholders a great way to pay while tracking their expenses and spending patterns,” he said.

The new offering is targeted at young professionals, startup employees, gig workers, freelancers and graduates. The fintech startup aims at introducing the next generation to a world of financial freedom through a customized, transparent and intuitive payments product. The Slice card can immediately be issued to customers through digital on-boarding on the app. Cardholders will receive several benefits across both online and offline purchases, including all Visa Platinum offers. All card users will enjoy cashback features and discounts on some of the most sought after online shopping, entertainment, grocery and food delivery platforms. The users will also have access to their transactions, EMIs, vouchers and credit history on their slice app to plan their budgets and finances seamlessly.