FDI

CCEA gives nod to FDI investment worth ₹15,000 cr in Anchorage Infra

The government on Wednesday cleared a Rs 15,000-crore foreign direct investment (FDI) proposal of Anchorage Infrastructure Investment Holding Ltd, a subsidiary of Canada-based pension fund, for the investment in the infrastructure sector.

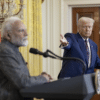

The Cabinet Committee of Economic Affairs (CCEA), chaired by Prime Minister Narendra Modi, approved the FDI proposal specifically for the purpose of investment in infrastructure and the construction-development sectors. These may include transport and logistics, along with downstream investment in the airport sector and aviation-related businesses and services.

Also read: Govt launches schemes to support 300 start-ups for creating 100 unicorns

The investment also includes transfer of share of Bangalore International Airport Limited to Anchorage, and investment of Rs 950 crore in Anchorage Infrastructure Investment Holding Ltd by the 2726247 Ontariao Inc, an official statement said. The 2726247 Ontariao Inc is a wholly-owned subsidiary of OAC, which is the administrator of OMERS, one of Canada’s largest defined benefit pension plans.

The investment will be a major boost to the infrastructure and construction sector and also to the airport sector. It will considerably substantiate the Government of India’s plan to develop world-class airport and transport-related infrastructure though private partnership, it said. The statement further said the investment will also be a significant boost to the recently announced National Monetisation Pipeline (NMP). It will help fund leasing out of state-owned infrastructure assets which involves handling assets like roads, railways, airports, sports stadiums, power transmission lines and gas pipelines to private operators.

Anchorage Infrastructure Investment Holding Ltd is proposing to make downstream investment in some of the sector covered under the NMP, it said. The statement added that the investment will also lead to direct employment generation, as the sector in which Anchorage Infrastructure Investment Holding Ltd is proposing to make downstream investments are capital- and employment-intensive sector. The investment will also generate indirect employment in construction and ancillary activities, it added.

Pingback: FinMin asks banks to push for one district, one product' agenda