Business

Niti Aayog to empanel transaction advisor for PSU assets monetisation, disinvestment

Niti Aayog has decided to empanel transaction advisor for monetisation of assets and carry forward the process of disinvesment of public sector enterprises. In this connection, the government think-tank Niti Aayog has floated request for proposals (RFP) from eligible entities. The Aayog is hand-holding the respective asset owners — the statutory bodies, public sector enterprises and other such undertakings within the purview of the government of India and state governments — in undertaking the detailed assessment of potential assets for monetisation and subsequently the transaction process for monetisation of various identified assets. “The objective of the proposed monetisation is to raise long-term private investment in lieu of the right to operate, maintain and earn revenue from such core assets over a pre-specified tenure,” said the RFP document.

Niti Aayog also envisages provision of support to state governments for identification of potential state public sector entities for disinvestment and in undertaking the end-to-end disinvestment process for identified entities. As per the RFP document, the Aayog has decided to carry out the process of empanelment of consultants for providing financial consultancy services for the monetisation pipeline and/or disinvestment pipeline projects and for providing transaction advisory services. The RFP seeks to select three panels of consultants, one each — ‘Pipeline Consultant(s)’; ‘Monetisation Consultant(s)’ and ‘Disinvestment Consultant(s)’. The Aayog “invites proposals from interested firms for empanelment under either one or more than one categories of empanelment i.e. Pipeline Consultant, Monetisation Consultant and Disinvestment Consultant…and who shall deliver end to end Consultancy services or a combination of identified deliverables under such Consultancy, for various Projects”, the RFP said.

Also read: SME-focused startup Flobiz raises $10 mn from Elevation, others

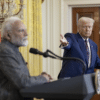

Prime Minister Narendra Modi had last month said that 100 under-utilised or unutilised assets with public sector units (PSUs), such as those in the oil and gas and power sectors, will be monetised, creating Rs 2.5 lakh crore of investment opportunities. Finance Minister Nirmala Sitharaman in the 2021-22 Budget speech had said monetising operating public infrastructure assets is a very important financing option for new infrastructure construction. “A National Monetisation Pipeline of potential brownfield infrastructure assets will be launched. An asset monetisation dashboard will also be created for tracking the progress and to provide visibility to investors,” she had said. The government has budgeted Rs 1.75 lakh crore from stake sale in public sector companies and financial institutions, including 2 PSU banks and one general insurance company, in the next fiscal year beginning April 1.

Pingback: Revenue analytics firm Voiro raises $1.8 million in investment round led by Mela Ventures