X Offices Raided in France as UK Opens New Investigation Into Grok

By Tech PlungeFebruary 3, 2026

X Offices Raided in France as UK Opens New Investigation Into Grok

By Tech PlungeFebruary 3, 2026

Google Gemini Prepares Tool to Make Switching From ChatGPT Easier

By Tech PlungeFebruary 3, 2026

Bethesda Sparks Fallout Remaster Speculation With New Promo

By Tech PlungeFebruary 3, 2026

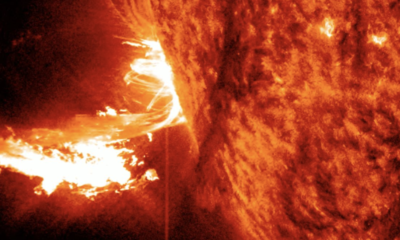

The Sun Unleashes One of Its Most Powerful Solar Flares in Years

By Tech PlungeFebruary 3, 2026

Meta Blocks ICE List Links Across Facebook, Instagram, and Threads

By Tech PlungeJanuary 28, 2026

TikTok Outage Fuels Censorship Fears as New US Owners Take Control

By Tech PlungeJanuary 27, 2026

Pahadi Beach Goa: Where Every Meal Feels Like a Homely Affair

By Prashant SinghSeptember 21, 2023

Soul Chef – Feasts From The North East

By Prashant SinghAugust 17, 2023

Pingback: Budget announcements, PLI are efforts in making country self-sufficient: Goyal