Defence

India vs Pakistan Drone War Sparks Billion-Dollar Tech Boom—Here’s Who’s Cashing In

The May 2025 skirmish between India and Pakistan, featuring hundreds of drones lighting up the night sky, wasn’t just a historic military event—it was a sales pitch for the drone industry. For the first time, New Delhi and Islamabad deployed unmanned aerial vehicles (UAVs) at scale in active conflict, signalling a transformative moment in Asian warfare. This dramatic shift has triggered an unprecedented demand for combat and surveillance drones, pushing both countries—and their suppliers—into a new arms race powered by low-cost, high-impact technology.

India, already the world’s fourth-largest military spender, is reportedly tripling its UAV procurement budget. Smit Shah of the Drone Federation of India forecasts a staggering $470 million in drone investments over the next 24 months. That’s a massive jump, and the biggest beneficiaries are Indian drone manufacturers like ideaForge, NewSpace, and other emerging players with battlefield-ready UAV solutions.

IdeaForge, a frontrunner in India’s UAV ecosystem, has supplied over 2,000 drones to Indian forces. Its executives in an interview to Reuters, confirm a dramatic uptick in government trials and demonstrations. “Defence procurement, which used to take years, is now happening in months,” said Vishal Saxena, a VP at the firm, in an interview with Reuters. The surge in demand has transformed these companies into highly sought-after investments for both domestic and international investors.

Pakistan, while grappling with budget constraints, is aggressively fast-tracking drone production through partnerships with China and Turkey. Turkish-made Baykar drones and the locally assembled Shahpar-II UAVs are now central to Islamabad’s asymmetric warfare strategy. With support from Beijing and Ankara, Pakistan’s drone industry is evolving from tactical to strategic within months.

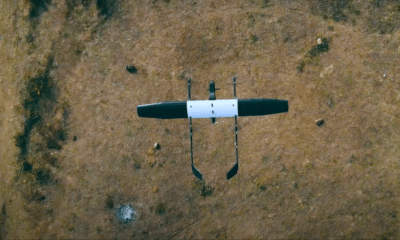

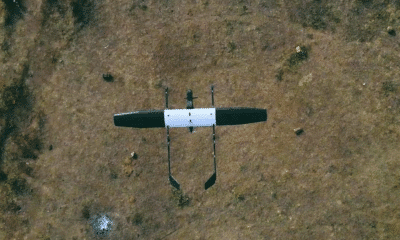

India’s NETRA 5 Drone by ideaForge Shocks the World—AI-Powered, Jam-Proof, and Battle-Ready

This arms race is also exposing the Achilles’ heel of Indian drone makers: their dependence on Chinese components, especially lithium batteries and rare earth magnets. With China’s potential to disrupt supplies during geopolitical tensions, industry experts are calling for rapid diversification of the supply chain. Still, Indian firms are pressing ahead with R&D on loitering munitions and anti-jamming technologies.

The military demand has caught the attention of tech investors worldwide. Defence-tech startups are rapidly pivoting toward drone development, while governments are encouraging domestic manufacturing through incentives and emergency procurement funds, like the $4.6 billion recently approved by India.

Even as both countries claim battlefield success, one thing is clear: drones are now the future of South Asian warfare. They offer a low-cost, low-risk option for political signalling, precision strikes, and intelligence gathering—all without risking pilot lives or escalating into full-blown war.

For drone companies, this isn’t just a moment—it’s a market moment. With combat-proven models like Israel’s HAROP, Poland’s WARMATE, and India’s indigenous loitering UAVs in active rotation, Asia’s drone war is now the world’s most valuable tech battleground.

War may be hell, but for drone makers, it’s big business.