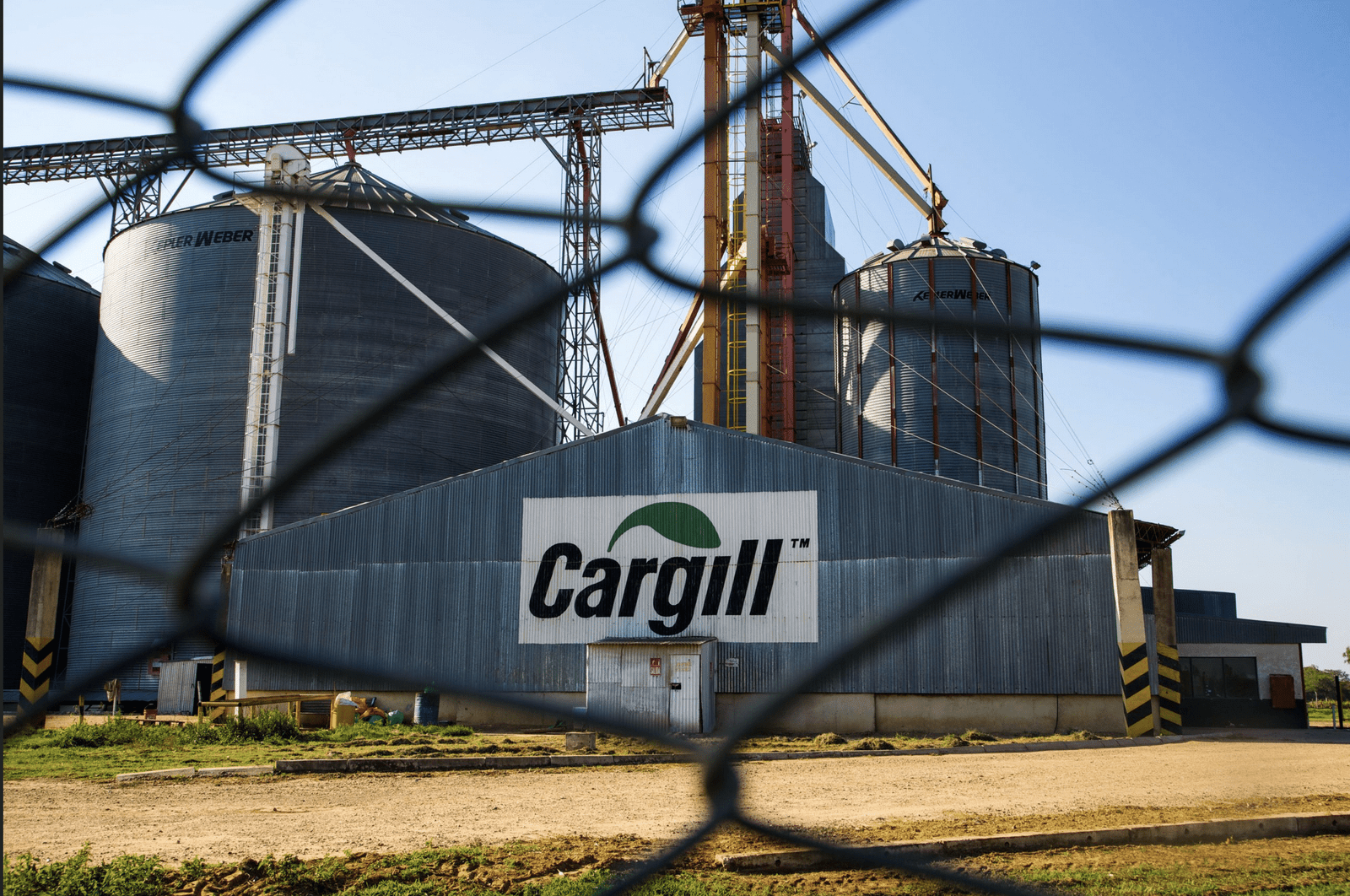

Agriculture

Cargill Cuts 8,000 Jobs as Profits Hit Decade-Low

Cargill, Inc., the largest privately held company in the United States and a cornerstone of the global agricultural industry, has announced significant workforce reductions. The company plans to cut 5% of its global workforce, impacting approximately 8,000 positions out of its 164,000-employee base. Cargill’s job cut decision follows a sharp decline in profitability, driven by market shifts, operational challenges, and a reassessment of long-term strategy.

Economic Pressures and Industry Challenges

Headquartered in Minneapolis, Cargill has long been recognized as the world’s largest agricultural commodities trader. The company thrived during the pandemic due to supply chain disruptions and geopolitical tensions that drove up food prices. However, as global conditions stabilized, the agricultural sector experienced a downturn. Declining commodity prices, oversupply of crops, and decreased grocery prices have led to a challenging financial landscape.

Adding to these pressures, the U.S. cattle herd has reached its smallest size in nearly seven decades, straining Cargill’s beef processing margins. These factors have culminated in a sharp decline in the company’s profitability. For the fiscal year ending May 2024, Cargill reported a net profit of $2.48 billion, a significant drop from its record $6.7 billion in 2021-2022 and its lowest performance since 2015-2016.

Happy to meet Mr Brian Sikes, Chairman, President & CEO @Cargill Inc in Davos. He expressed excitement in India’s quest towards sustainable fuel under the visionary leadership of PM @narendramodi Ji & India’s focus on production of Biofuels.

Invited Cargill to join the Global… pic.twitter.com/yOYGUG4NxC

— Hardeep Singh Puri (@HardeepSPuri) January 16, 2024

Strategic Workforce Reductions

Cargill’s CEO, Brian Sikes, has emphasised the necessity of these workforce reductions as part of a broader effort to streamline operations and increase efficiency. Brian Sikes, who took over as CEO last year, aims to simplify the company’s organizational structure by consolidating five business units into three and reducing layers of management. Cargill’s job cut and layoffs-based restructuring seeks to eliminate redundancies, enhance decision-making, and focus managerial roles to align with the company’s strategic objectives.

The layoffs will primarily target middle management and senior leadership positions, leaving the executive team unaffected. This move follows earlier restructuring steps, including eliminating 200 tech jobs in June 2024, and reflects the company’s commitment to staying agile in a volatile market.

Sector-Wide Implications

Cargill’s challenges are not unique; the agricultural industry has faced similar difficulties. Competitors like Bunge Global SA and Archer-Daniels-Midland Co. have also reported narrowing margins due to declining corn and soybean prices. These trends underscore the broader pressures facing the sector, where firms must navigate fluctuating market conditions, geopolitical uncertainties, and the impact of climate change on agricultural yields.

Looking Ahead

Despite these challenges, Cargill remains focused on its long-term vision of becoming the world’s most consequential food and agriculture company by 2030. The company invests in new digital technologies, including artificial intelligence and data analytics, to enhance operational efficiency and meet evolving consumer demands.

While the immediate impact of these Cargill layoffs will resonate across affected communities and industries, analysts are closely monitoring how Cargill executes its restructuring plan. The company’s ability to adapt and innovate in the face of market challenges will be crucial to its recovery and sustained growth.

Cargill’s transformation period reminds us of the dynamic nature of global agricultural markets and the importance of strategic adaptability in navigating economic pressures. As the company implements these changes, stakeholders will watch closely to assess their long-term implications for the industry and beyond.

Pingback: 139 Years Old Del Monte Declares Bankruptcy, Canned Food End?