Business

Gautam Adani Indicted in US Bribery Case Involving $250 Million Scheme

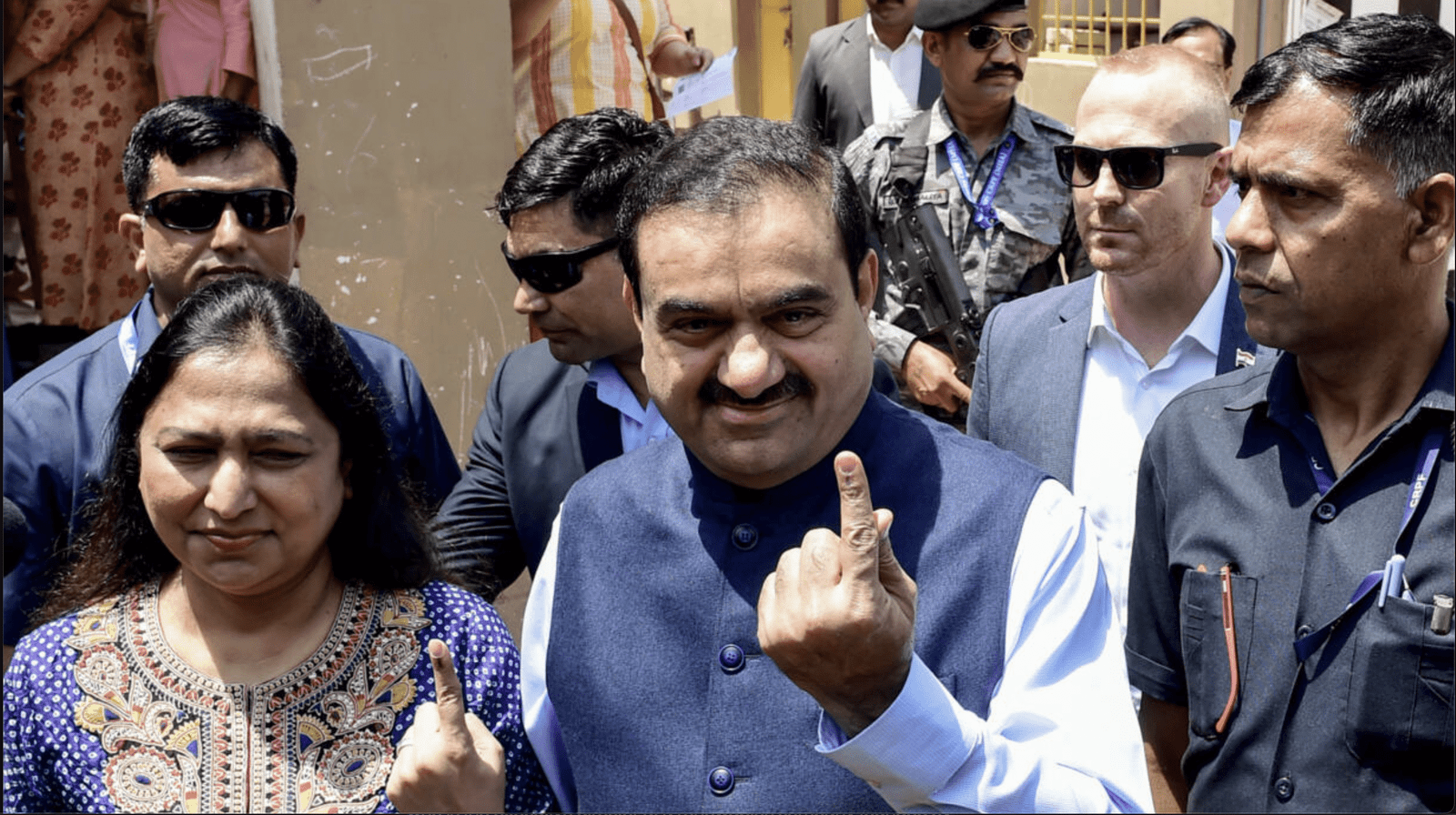

Indian billionaire Gautam Adani, often referred to by the opposition as an Indian Oligarch and a personal friend of PM Narendra Modi by many, has been indicted by US federal prosecutors in New York over an alleged bribery scheme tied to renewable energy contracts in India. The charges mark a significant development in a case involving bribery exceeding $250 million, a network of high-profile collaborators, and accusations of defrauding US investors.

The Allegations

Gautam Adani, who was indicted at 62, chairman of the Adani Group and a prominent supporter of Indian Prime Minister Narendra Modi, faces charges alongside seven others, including executives from his conglomerate and former employees of a Canadian pension fund. The alleged scheme spanned four years, from 2020 to 2024, and involved securing favourable terms on solar power contracts projected to generate over $2 billion in profit.

Prosecutors allege that bribes were paid to Indian government officials to secure these contracts, with Gautam Adani himself purportedly meeting an Indian official to advance the scheme. These payments were allegedly concealed from US banks and investors, who provided billions of dollars in funding for Adani’s ventures.

Involvement of Sagar Adani and Canadian Pension Fund Executives

Among the accused is Sagar Adani, Gautam Adani’s nephew and executive director of an Adani renewables company. US regulators allege that Sagar Adani coordinated with executives from Azure Power, a renewable energy firm, to propose “incentives” — code for bribes — to Indian officials to secure lucrative government energy contracts.

Additionally, three former employees of the Canadian pension fund CDPQ have been charged with obstructing an investigation into the scheme. They are accused of deleting incriminating emails and providing false information to US authorities. CDPQ, a key investor in Adani’s infrastructure projects, has yet to comment on the allegations.

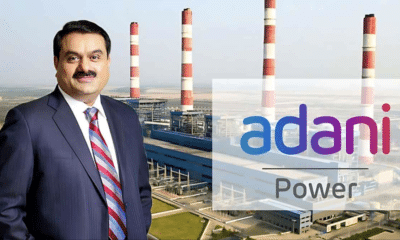

The Impact on Adani Group

The indictment reignites scrutiny on the Adani Group, which faced significant reputational damage in 2023 following accusations of stock market manipulation and accounting fraud by US short-seller Hindenburg Research. This latest development could lead to further legal challenges and reputational harm, especially as Adani Green, a subsidiary implicated in the scheme, had raised over $175 million from US investors through a corporate bond offering.

BREAKING: Gautam Adani and 7 other executives criminally indicted in the U.S. over $250 million in alleged bribes.

The SEC has filed parallel charges in the “massive bribery scheme”.https://t.co/uWULHHI7Ab

— Hindenburg Research (@HindenburgRes) November 20, 2024

Statements from Authorities

Lisa Miller, US Deputy Assistant Attorney General, said, “This indictment alleges schemes to pay over $250 million in bribes to Indian government officials to obtain massive state energy supply contracts.” Sanjay Wadhwa, Acting Director of the SEC’s Enforcement Division, emphasized that Gautam Adani and his executives misled investors by falsely claiming adherence to robust anti-bribery measures.

Broader Implications

The charges come at a time when the Adani Group is heavily invested in renewable energy projects, a sector crucial to global climate goals. The allegations raise questions about the ethics of major players in this critical industry and highlight the risks of corruption undermining international investment. Hindenburg Research has been investigating the Gautam Adani Group and has presented some very compelling aspects that should ideally lead the Indian government to set up an inquiry.

Gautam Adani and his legal team have not yet issued a formal response. As the case unfolds, it will likely have far-reaching implications for Adani’s global business empire and investor confidence in Indian corporations on the world stage.