Business

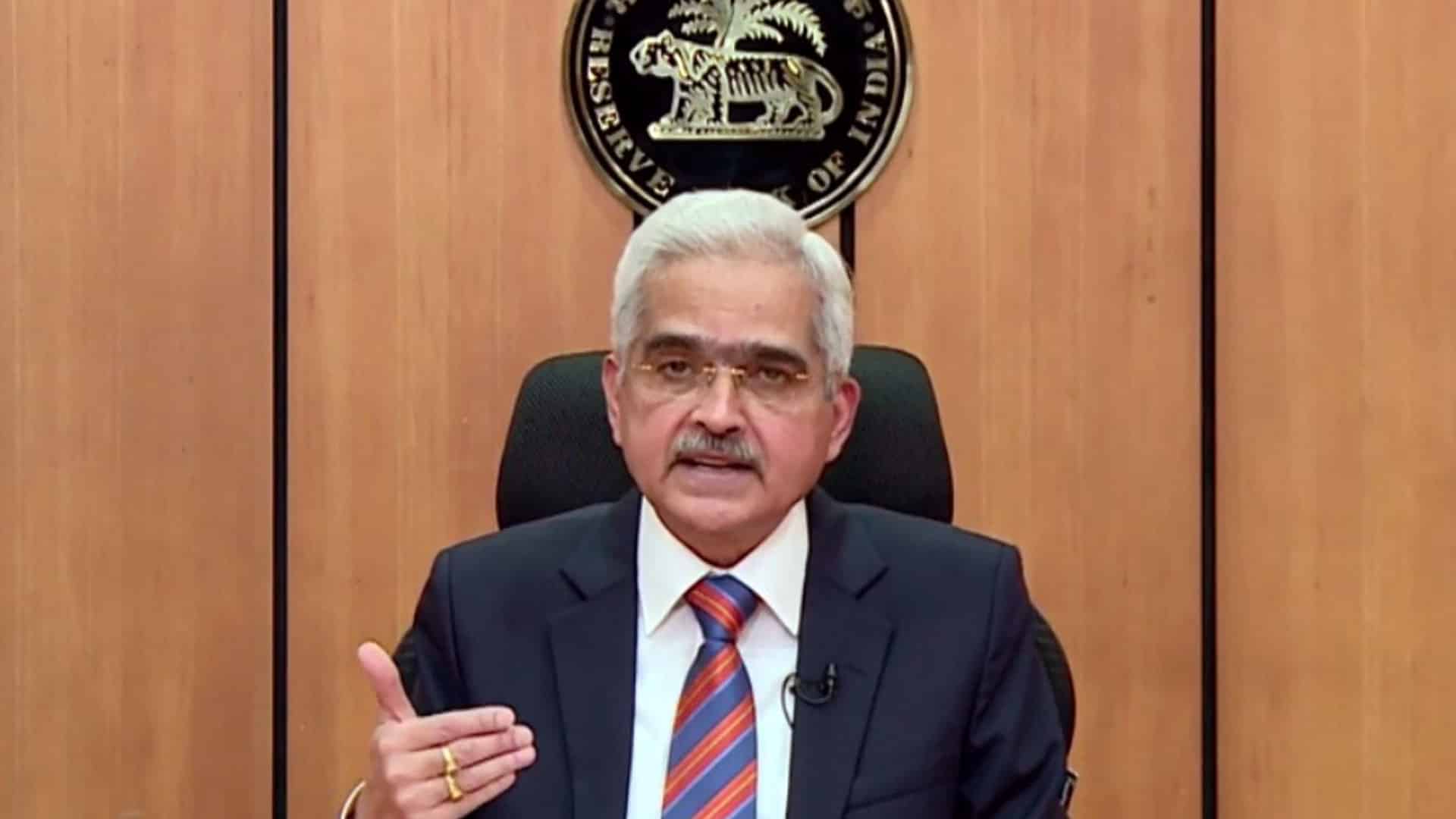

RBI Governor exhorts banks to continue process of capital argumentation

Reserve Bank Governor Shaktikanta Das on Thursday urged banks and NBFCs to continue the process of augmentation of capital and building up of appropriate buffers to meet future uncertainties.

Unveiling the bi-monthly policy, Das said RBI has been watchful of the impact of the pandemic on the banking and NBFC sectors when the effects of regulatory reliefs and resolutions fully work their way through. The Reserve Bank has accorded the highest priority to preserving financial stability by taking quick and decisive steps to ease liquidity constraints, restore market confidence and prevent contagion to other segments of the financial market, he said.

Also read: Xuppi.com: Changing the Face of e-commerce In India

Thus, he said, despite the pandemic-induced bouts of volatility, the Indian financial system has remained resilient and is now in a better position to meet the credit demands as recovery takes hold and investment activity picks up. The balance sheets of Scheduled Commercial Banks (SCBs) are relatively stronger with higher capital adequacy, reduced NPA, higher provisioning cover and improved profitability than in the previous years, he said.

“Banks and other financial entities would be well advised to further strengthen their corporate governance and risk management strategies to build resilience in an increasingly dynamic and uncertain economic environment. They also need to continue the process of capital augmentation and building up of appropriate buffers,” he said. With regard to RBI, he said, the regulator has been also strengthening the regulatory and supervisory framework for both banking and non-bank financial sectors to proactively identify, assess and deal with vulnerabilities.

In a global environment rendered highly volatile and uncertain by diverging monetary policy stances, geo-political tensions, elevated crude oil prices and persistent supply bottlenecks, emerging economies are vulnerable to destabilising global spillovers on an ongoing basis, he said. Thus, he said, policymakers face daunting challenges even as recovery from the pandemic remains incomplete.

On its part, Das said, the Reserve Bank has been and will continue to insulate the domestic economy and financial markets from these spillovers. Further, he said, while the RBI will continue to focus on smooth completion of the government borrowing programme, market participants also have a stake in the orderly evolution of financial conditions and the yield curve. It is expected that market participants will engage responsibly and contribute to cooperative outcomes that benefit all, he added.

In the forex market, Das said, the Indian rupee has shown resilience in the face of global spillovers, even relative to EME (emerging market economy) peers. “India’s external sector sustainability is anchored by high foreign exchange reserve buffers and a modest level of the current account deficit (CAD). In H1:2021-22, the CAD was 0.2 per cent of GDP, underpinned by robust exports of goods and services. The merchandise trade deficit has widened in recent months partly due to elevated crude oil prices and rise in non-oil imports in line with the domestic economic recovery,” he said.

Buoyant services exports led by IT services with strong prospects going forward are, however, likely to keep the CAD contained well below 2.0 per cent of GDP during 2021-22. Moreover, he said, foreign direct investment inflows remain strong, which along with other forms of capital inflows, are expected to comfortably finance this modest level of the CAD.

Pingback: Ola eyes NBFC acquisition to expand financial services business