Cryptocurrency

Michael Burry Warns of “Death Spiral” as Silver Liquidations Overtake Bitcoin

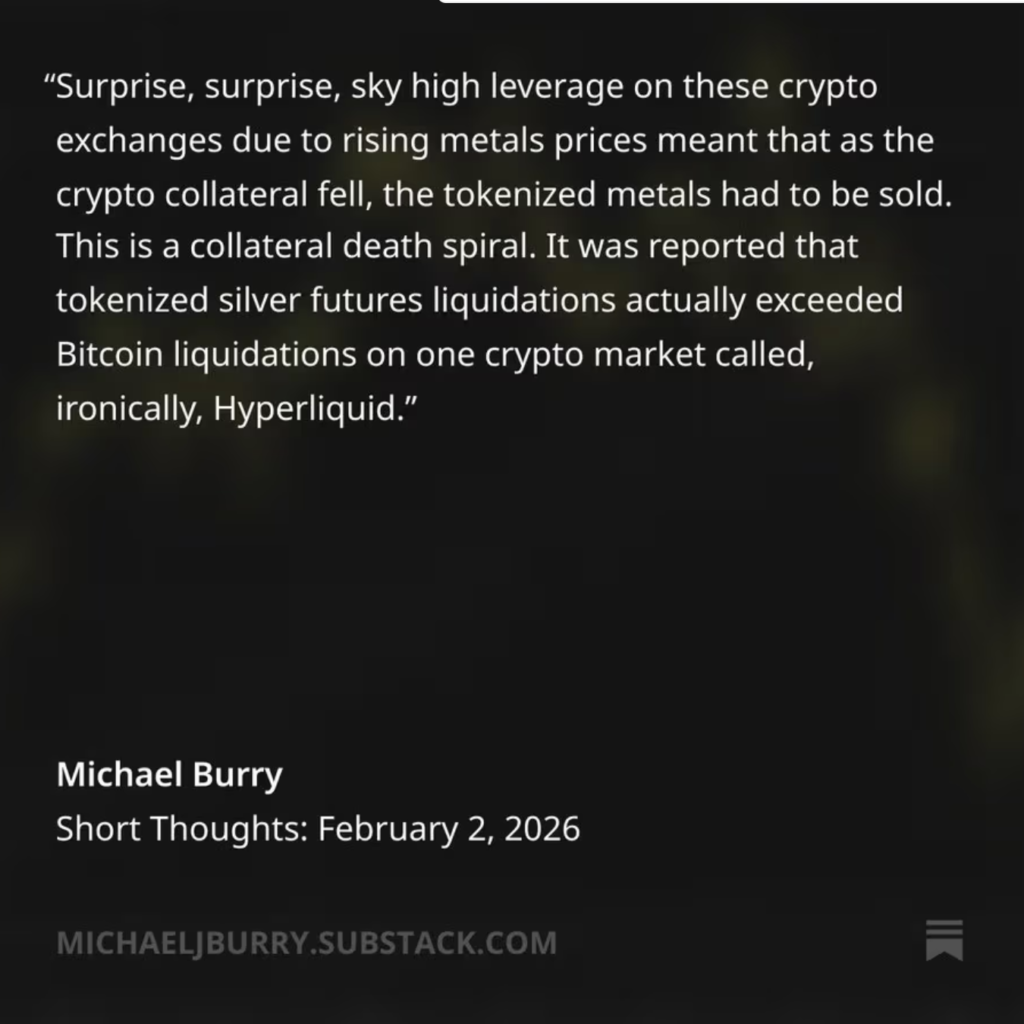

Hedge fund manager Michael Burry, best known for predicting the 2008 financial crisis and chronicled in The Big Short, has issued a stark warning about mounting instability in crypto markets. Burry says a wave of liquidations in tokenized silver futures has triggered what he calls a “collateral death spiral,” briefly eclipsing bitcoin as the largest source of forced selling on at least one major crypto venue.

According to Michael Burry, falling prices combined with heavy leverage created a vicious feedback loop in which declining collateral values forced traders to liquidate positions, pushing prices even lower. In a recent note, he highlighted that liquidations tied to tokenized silver contracts exceeded those of bitcoin during the peak of the unwind — a rare and eye-catching reversal in crypto market dynamics.

How Tokenized Silver Triggered a Sell-Off

Tokenized metals allow traders to speculate on assets like silver, gold, and copper using crypto-native platforms instead of traditional futures exchanges. These products trade around the clock and typically require less upfront capital, making them appealing during volatile periods.

However, that accessibility comes with risks. When silver prices pulled back sharply, leveraged traders were forced to unwind positions. Margin calls mounted, and automated liquidations kicked in as collateral values fell. On Hyperliquid, one of the most active platforms for tokenized commodities, silver-linked liquidations briefly surpassed bitcoin — an unusual moment where a macro-linked asset dominated crypto market stress.

Michael Burry described the situation bluntly: as crypto collateral declined, tokenized metals had to be sold to meet margin requirements, accelerating losses across the board. “This is a collateral death spiral,” he warned.

Michael Burry on Substack

Leverage, Liquidity, and Cascading Risk

The episode underscores how leverage and thin liquidity can amplify volatility. Tokenized metals often attract crowded trades, and when prices move quickly in the opposite direction, forced selling can overwhelm order books.

Compounding the issue, traditional markets also tightened risk controls. CME Group raised margin requirements for gold and silver futures, increasing collateral demands for leveraged traders. While those changes apply to regulated futures markets, traders say shifts in risk appetite can spill over rapidly into tokenized markets that track the same underlying assets.

The result: a synchronized unwind across traditional and crypto-linked instruments.

Bitcoin No Longer the Only Driver

While bitcoin remains the largest crypto asset, Michael Burry’s warning highlights a broader shift. Crypto venues are increasingly being used for macro trading, not just digital assets. In times of stress, that means liquidation pressure can come from unexpected corners — including tokenized commodities rather than BTC or ether.

Burry has also cautioned that sharp declines in bitcoin itself could trigger cascading effects, particularly for companies and funds that have built balance sheets around the cryptocurrency. Combined with the turmoil in tokenized metals, his message is clear: leverage-driven markets can unravel quickly.

The silver liquidation shock may mark a turning point in how traders view crypto markets. As tokenization expands beyond coins into real-world assets, the risks of forced selling, collateral feedback loops, and cross-market contagion are growing harder to ignore.

For investors, Burry’s warning serves as a reminder that innovation does not eliminate risk — it often reshapes it.

Pingback: Bitcoin Crashes Below $70K as Trump-Era Crypto Boom Unravels

Pingback: Michael Burry Warns Google of Repeating Motorola’s Mistake?