Fintech

WinZO Rolls Out ZO Gold: Digital Gold Investments Start at Just ₹2

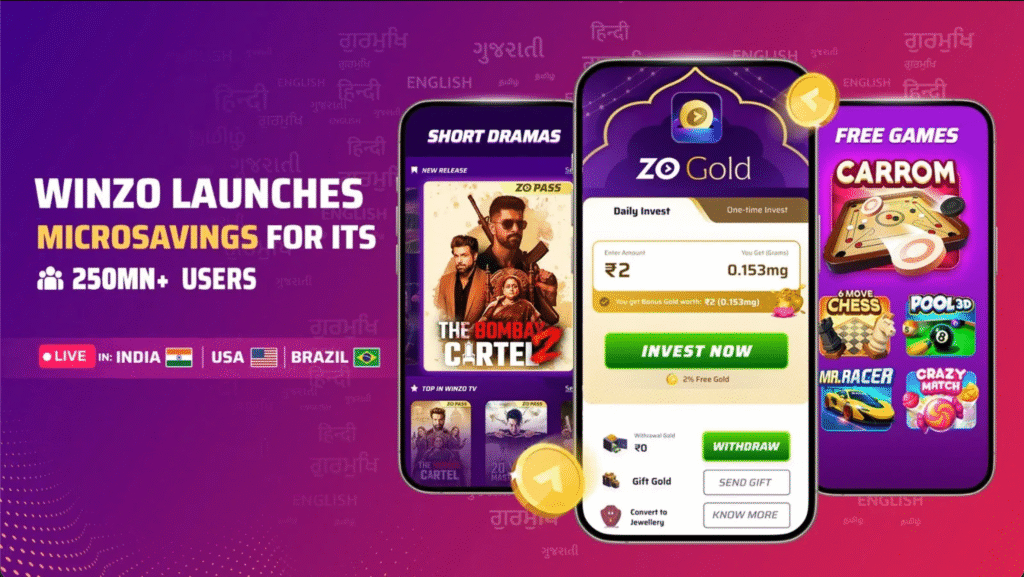

WinZO, one of India’s digital entertainment platforms, has taken a bold leap into financial services. The company has officially launched ZO Gold, a first-of-its-kind micro-investment offering that allows users to buy and grow gold savings digitally from as little as ₹2. The service is powered through a strategic partnership with SafeGold, a leading digital gold provider.

The introduction of ZO Gold reflects WinZO’s ambition to become far more than a gaming app. It aims to position itself as a unified digital economy platform that not only entertains users but also empowers them to build long-term financial stability.

Democratizing Gold for Bharat’s Digital Youth

Gold has always held deep cultural and economic value in India, yet traditional investment routes have remained expensive or inaccessible to many first-time investors. WinZO sees that changing fast. According to the company, its audience is already deeply integrated into the digital economy, especially across Tier-II and Tier-III regions where smartphone usage and UPI payments have surged. WinZO claims its user base once represented 1 in every 200 UPI transactions in India, highlighting the platform’s penetration into everyday financial behaviour.

With ZO Gold, users can:

– Buy gold in micro-amounts starting at ₹2

– Track holdings in real-time via the app

– Set up recurring contributions similar to SIPs

– Save without pressure or high minimum thresholds

“The goal is to make wealth creation simple, intuitive, and accessible,” WinZO said in its launch announcement, emphasizing its focus on young professionals and new investors learning to manage money digitally.

All gold purchased through ZO Gold is backed by physical assets stored securely and can be redeemed at any time.

WinZO Rolls Out ZO Gold

A Unified Digital Ecosystem Takes Shape

ZO Gold follows the launch of ZO TV, WinZO’s fast-growing microdrama vertical, introduced in August 2025. In addition to its well-known two-minute gaming experiences, the platform is now bundling gaming, content, and financial growth into one seamless app journey.

This evolution taps into a decisive shift: India’s young users want daily digital experiences that mix fun with productivity. Micro-investing aligns perfectly with that habit.

Analysts view the move as a clever gateway into fintech, leveraging WinZO’s existing trust equity while boosting financial inclusion goals nationwide.

View this post on Instagram

Micro Investments, Major Future

ZO Gold underscores an emerging belief within India’s digital ecosystem: small steps can lead to transformative outcomes. By removing cost and accessibility barriers, WinZO hopes to introduce millions to their first-ever investment product.

For India’s next generation of wealth builders, ₹2 might just be the start of something golden.