Banking

RBI announces slew of measures to keep NBFCs resilient

The Reserve Bank of India (RBI) has announced a slew of measures to keep NBFCs resilient. It hopes to achieve rein them in by improving their governance standards and fool-proofing their risk management and internal controls.

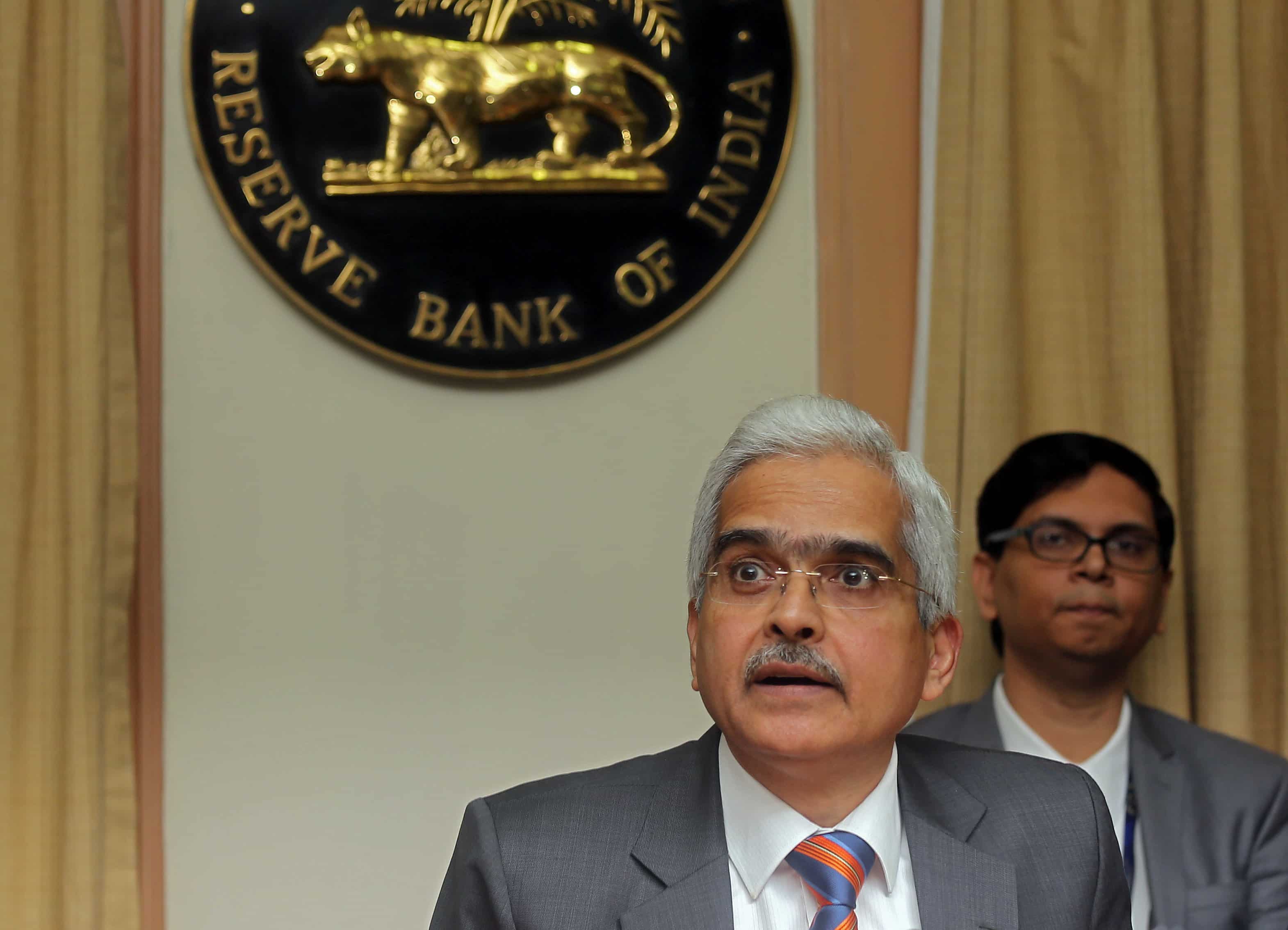

Governor Shaktikanta Das said the first tightening measure is on the regulatory regime for non-banking financial companies (NBFCs), which currently is built on the principle of proportionality. He said it warrants a review. “It is felt that a scale-based regulatory approach linked to the systemic risk contribution of NBFCs could be the way forward.” As part of the stakeholder consultation process, Das said a discussion paper on this will be issued before January 15, 2021 for public comments.

The central bank’s executive explained that a review is needed because of their growing significance and rising interlinkages with other segments in the financial system. “This has made it imperative to enhance the resilience of NBFCs by putting in place a transparent criteria according to a matrix of parameters for declaring dividends by different categories of NBFCs,” he said.

In regards to supervisory side measures, RBI said large NBFCs and urban cooperative banks (UCBs) will have to submit a risk-based internal audit and a harmonized guidelines for appointing statutory auditors for commercial banks, UCBs and NBFCs with a view to improve the quality of financial reporting. On the scale-based regulatory framework, Das pointed out that the contribution of NBFCs as a supplemental channel of credit intermediation alongside banks is well recognized. “The regulatory regime governoring NBFCs is built on the principle of proportionality such that adequate operational flexibility is available to the sector through calibrated regulatory measures,” he said. “But there are rapid developments in the past few years, which have led to significant increase in size and interconnectedness of NBFCs.”

Also Read: Indian economy going through V-shaped recovery

Therefore, the regulator said there is a need to review the regulatory framework in line with the changing risk profile of NBFCs. “It is felt that a scale-based regulatory approach linked to their systemic risk contribution can be the way forward.” It highlighed that in recent past, weakness in three lines of defence mechanism has often proved to be a major fault line affecting certain banks and large NBFCs.

With inputs from PTI

Pingback: RBI orders HDFC Bank to stop launch of new digital banking initatives and credit card issuance | The Plunge Daily

Pingback: India’s economic growth to reach pre-COVID levels by end of FY2022: NITI Aayog | The Plunge Daily