Business

GST Council approves 28 pc tax on online gaming; clarifies on taxation of utility vehicle

The GST Council on Tuesday decided to levy the maximum 28 per cent tax on the full face value of bets in online gaming, casinos and horse racing, lowered tax on food and beverages sold in multiplexes, and tweaked the definition of utility vehicles for the levy.

The panel also exempted GST (Goods and Services Tax) on import of cancer drug Dinutuximab, and medicines used to treat rare diseases and food used in Food for Special Medical Purposes (FSMP), besides satellite launch services provided by private operators. Food and beverages consumed in cinema halls will attract a GST of 5 per cent, equivalent to the levy charged in hotels and restaurants, instead of 18 per cent which in many cases the cinema halls were charging.

Also read: Cyber crimes: Par panel to hear RBI, IT ministry

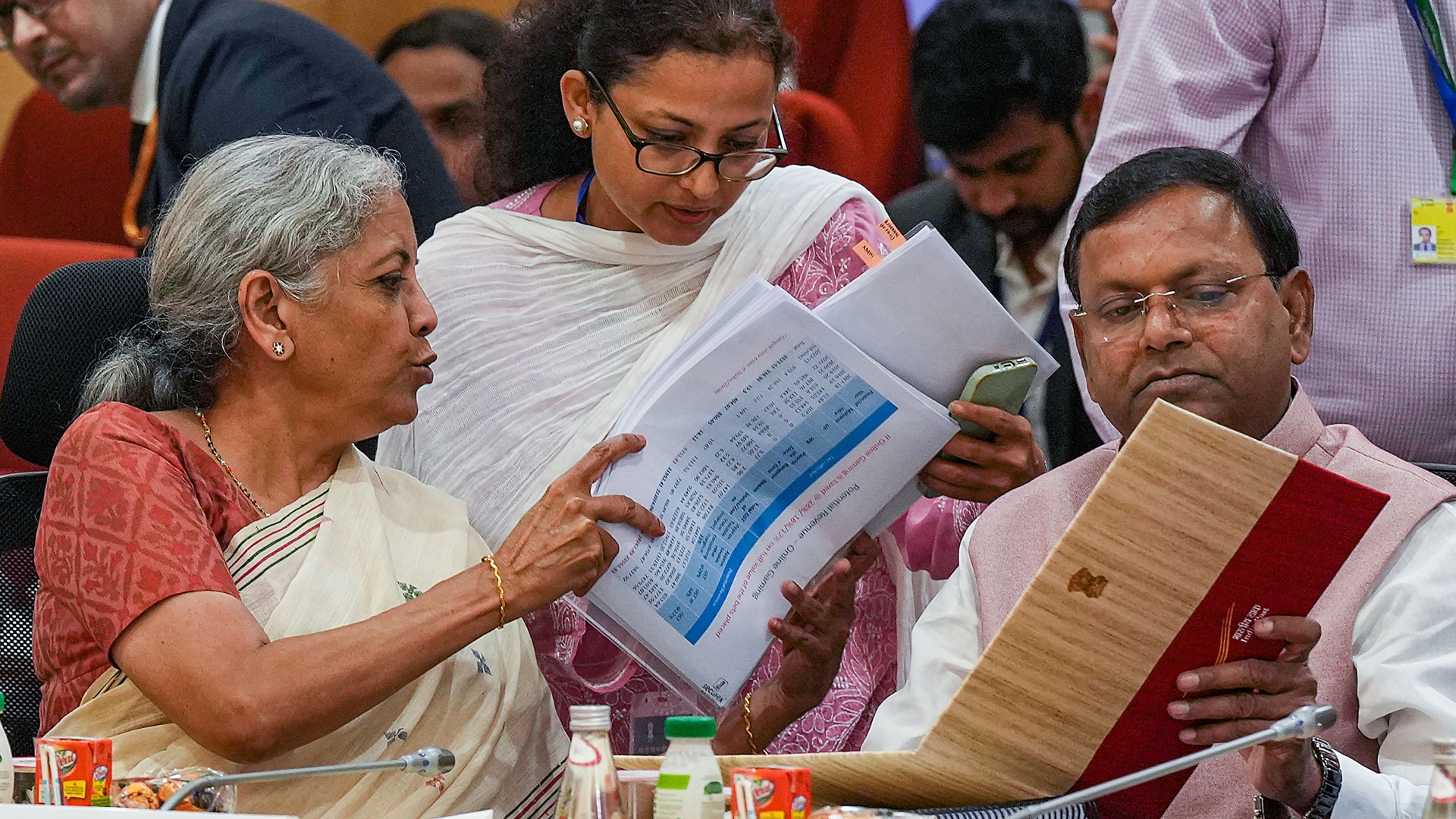

The definition of utility vehicles has been tweaked for the purpose of levy of a 22 per cent cess over and above the 28 per cent GST rate. The cess will be imposed on any utility vehicles of 1,500 cc and above engine capacity, length of 4 metres and above and un-laden ground clearance of 170 mm. This definition will, however, not cover sedans. Giving details of the decisions taken at the 50th Council meeting, Union finance minister Nirmala Sitharaman said the decision to levy maximum tax on online gaming and casinos was not intended to kill the industry but considering the “moral question” that it cannot be taxed at par with essential commodities.

“We are purely looking at that what is being taxed because it creates value, profit is being made… based on the wager people win. Today’s decision looks at what is to be taxed and what not,” Sitharaman said, adding that the IT ministry is looking at the regulatory aspect of online gaming, while the GST Council has taken decision solely for tax purpose. The tax on online gaming companies would be imposed without making any differentiation based on whether the games required skill or were based on chance. Officials said the decision was taken to discourage young people from getting addicted to online gaming. Some state ministers raised concerns over how this addiction had become a menace.

Explaining the rationale for 28 per cent tax on online gaming and casinos, Sitharaman said it was impractical to meet the industry demand for levy of tax on platform fees as it was impossible for tax authorities to go after every player and find where all the bets have been placed. “It is impossible to pierce the veil of opacity,” she said, adding that every state was in agreement that online gaming and betting should be taxed at the highest rate on full face value. On legal challenges mounted by some gaming companies against levy of 28 per cent tax on full value, Revenue Secretary Sanjay Malhotra said the government will continue to fight those cases in courts. “28 per cent tax was always the case in online gaming. Today’s decision is only to clarify it and put an end to these debate,” he said.

An amendment to the GST law to define online gaming, horse racing and casinos as ‘actionable claim’, like lottery and gambling, is likely in the ensuing monsoon session of Parliament. A group of ministers (GoM) on taxation of online gaming, casinos and horse racing on whether to impose a 28 per cent GST on the face value of bets, or gross gaming revenue (platform fees) had submitted its report to the government in December last year. To a question, Sitharaman said AAP-ruled Delhi and Punjab raised the issue of Enforcement Directorate sharing information with GST Network (GSTN).

“It was also clarified that this notification will empower our tax authorities with more information. The GSTN is recipient of information. There were doubts that GSTN will start sharing information about private businesses to other law enforcement agencies, like ED. It was clarified that Director FIU will provide information to tax authorities wherever they feel there is any chance of tax evasion or money laundering. This information can be used by tax authorities,” Malhotra said. The Council also approved the appointment and condition of services rules for setting up of dispute resolution appellate tribunals in all states. About 50 tribunals will be set up across the country and in next 4-6 months the tribunals will start working.

Commenting on the Council’s decision on online gaming, the All India Gaming Federation (AIGF), which represents companies like Nazara, GamesKraft, Zupee, Winzo etc., said that the decision by the GST Council is “unconstitutional, irrational, and egregious”. “The decision ignores over 60 years of settled legal jurisprudence and lumps online skill gaming with gambling activities. This decision will wipe out the entire Indian gaming industry and lead to lakhs of job losses and the only people benefitting from this will be anti-national illegal offshore platforms,” said Roland Landers, CEO of AIGF.

Pingback: Ahead of IPO, Utkarsh Small Finance Bank collects Rs 223 cr from anchor investors