Industry

Centre can expand Ayushman Bharat coverage to poorest segments: NITI Aayog Report

The government can expand Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) coverage to the poorest segments of the missing middle population, says NITI Aayog. The think tank, in its latest report ‘Health Insurance for India’s Missing Middle’, highlighted that the government can leverage the scheme’s infrastructure to offer a voluntary contributory enrolment.

The AB-PMJAY, a flagship scheme towards Universal Health Coverage, and state government extension schemes, provides comprehensive hospitalization cover to the bottom 50% of the population. Around 20% of the population is covered through social health insurance and private voluntary health insurance primarily designed for high-income groups. The remaining 30% of the population, devoid of health insurance, is termed as the ‘missing middle’. The missing middle contains multiple groups across all expenditure quintiles and is spread across both urban and rural areas.

Highlighting the need for designing a low-cost comprehensive health insurance product for the missing middle, the report also pointed out the gaps in the health insurance coverage across the Indian population. NITI Aayog recognizes the policy issue of low financial protection for health for the missing middle segment. As such it emphasizes health insurance as a potential pathway.

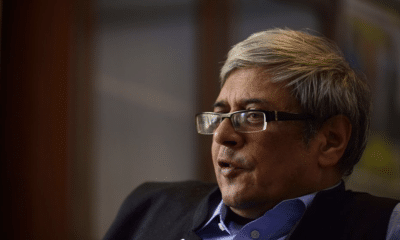

Dr VK Paul, a member of NITI Aayog, in the Foreword of the report says that significant challenges will need to be overcome to increase the penetration of health insurance. “The government and the private sector will need to come together in this endeavor. Private sector ingenuity and efficiency is required to reach the missing middle and offer compelling products. The government has an important role to play in increasing consumer awareness and confidence, modifying regulation for standardized product and consumer protection, and potentially offering a platform to improve operational efficiency.”

Amitabh Kant, NITI Aayog CEO, said the report is an effort to re-invigorate the dialogue on increasing financial protection for health and the broader goal of Universal Health Coverage. It outlines the current landscape, existing gaps and articulates broad recommendations and pathways to increase health insurance coverage.

The report states that India’s population is vulnerable to catastrophic spending and impoverishment from expensive trips to hospitals and other health facilities. It says at least 30% of the population (400 million individuals) called the missing middle are devoid of any financial protection for health.

Also Read: Sony Pictures Networks India extends partnership with UEFA for next 3 years

The report suggests the government can play several different roles, which facilitates and complements the expansion of the private voluntary market, to increase the uptake of health insurance and address some of the challenges.

Launched in September 2018, the AB-PMJAY and state government extension schemes provide

Pingback: Gautam Adani has taken a minority stake of 20% in Cleartrip.