Industry

Governments and nations race for semiconductors to prevent industries from coming to standstill

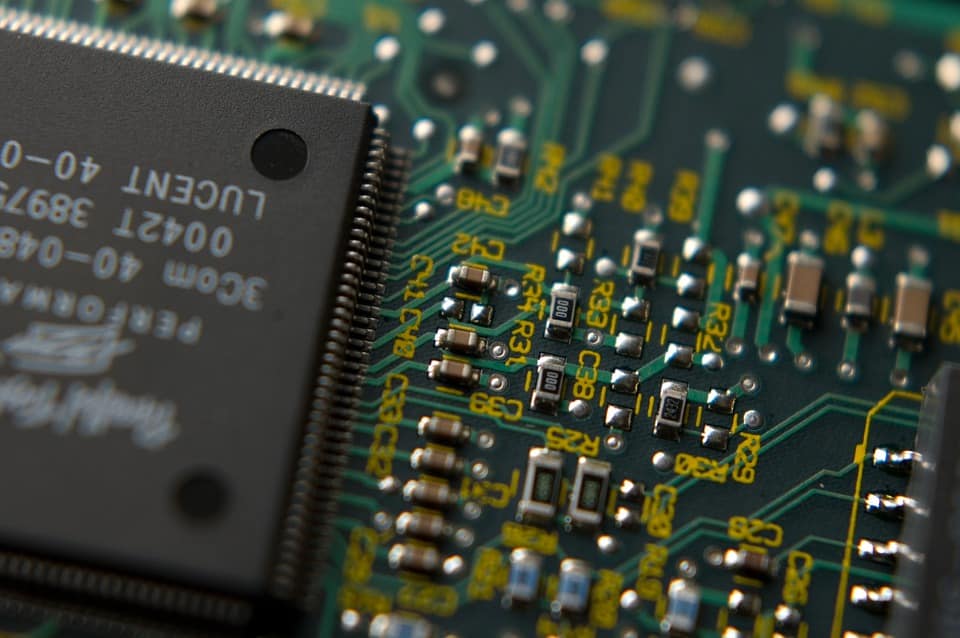

Governments across the world are racing to pump billions of dollars into semiconductors over the coming years as part of an effort to sustain supply chains and become more self-reliant. Semiconductors, the tiny chips of silicon, which is being highly sought by smartphone manufacturers and EV makers, are the lifeblood of today’s economy.

Presently, the industries are facing a crisis of shortage of this essential component which is set to last into 2022 and possibly 2023. It has created ripple effects across the board, with several companies revisiting their plans and profits. KPMG, in its latest insight, highlighted that US-based electronics manufacturers may face production issues due to an impact on production of Organic Light Emitting Diode (OLED) displays. And a US-based automaker giant has also cancelled shifts at two car plants, taking more than a billion-dollar profit hit this year.

As such, countries and businesses are trying their luck with the chips. The semiconductor consumption in India is growing at the rate of 15% at the back of the country’s burgeoning electronics manufacturing industry. Electronics production, which stood at around USD70 billion in 2018-19, is expected to grow at the rate of 30% annually until 2025. This projected growth further amplifies the domestic semiconductor market’s potential, both from a sourcing and global, its manufacturing footprint has long been negligible.

South Korea is the latest country to announce a colossal investment in the industry. It will be investing $452 billion will be invested in chips by 2030, with the bulk of that coming from private companies in the country. Abishur Prakash, a geogolitical specialist at the Centre for Innovating the Future, told CNBC that it’s a wartime-like effort by South Korea to build future security and independence.

“By building massive chip capabilities, South Korea will have the power to decide its own trajectory, instead of being forced in a specific direction,” he said. “This is also about not depending on China or Taiwan. By investing hundreds of billions of dollars, South Korea is ensuring that it is not pegged to other nations for its critical technology needs.”

South Korea’s K-Semiconductor Strategy will support the industry by offering tax breaks, finance and infrastructure. Glenn O’Donnell, VP and research director at analyst firm Forrester, told CNBC that South Korea has a commanding lead in memory chips with a 65% share, largely thanks to Samsung. He pointed out that Asia as a whole dominates in manufacturing, with 79% of all the world’s chips produced on the continent in 2019.

Also Read: Working long hours is a serious health hazard: WHO Study

The US and China have also pledged to boost their respective chip making. US President Joe Biden proposed a $50 billion plan, while China’s Xi Jinping has pledged to spend on high-tech industries. And the EU wants 20% of the world’s semiconductors to be manufactured in Europe by 2030.

“In the ongoing battle for dominance in the technology field, all nations are jockeying for that all-important designation as the key supplier to the world,” O’Donnell said. “South Korea, Japan, the US, Taiwan, the EU and China all covet that gold medal in the Tech Olympics podium.”

Pingback: The United Nations children’s agency UNICEF has requested G7 countries to donate excess supplies of COVID-19 vaccines to the global COVAX sharing scheme.