Business

Saudi Aramco in talks to buy 20% stake in RIL’s O2C business

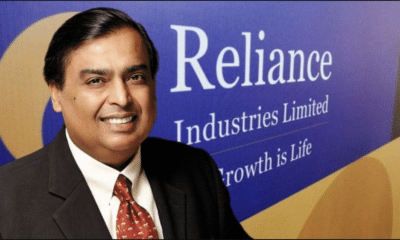

Reliance Industries’ shares zoomed nearly 3 percent to Rs 2,202 amid reports that Saudi Aramco is in advanced stage of negotiations with Mukesh Ambani-led group for around 20% stake in RIL’s oil refining and chemicals (O2C) business.

The Middle Easter energy giant is discussing the purchase of roughly 20 per cent stake in the Reliance unit for about $20 billion to $25 billion in Aramco’s shares, Bloomberg reported quoting the people with knowledge of the matter. A deal with Aramco would ensure steady supply of crude oil for Reliance’s giant refineries and make the Indian company a shareholder in Aramco. The report adds that the transaction, with Aramco which is valued at about $1.9 trillion, would give Reliance a stake of around 1% in the world’s biggest energy company.

Last month, Saudi Aramco chairman and Governor of the Kingdom’s wealth fund Public Investment Fund, Yasir Al-Rumayyan, was inducted on the board of Reliance Industries Ltd, as a precursor to the massive deal.

Speaking at the virtual annual general meeting on July 15 , Ambani said that due to unforeseen circumstances in the energy market, the deal (with Aramco) has not progressed as per original timeline. But he expressed hope that the two sides remain committed to a long term partnership.

“Nevertheless, we at Reliance value our over two-decade long relationship with Saudi Aramco and are committed to a long-term partnership,” he said at the event.

The deal between Reliance and Aramco involves the Indian entity offering at least 20 per cent stake in a special purpose vehicle covering refining, petrochemicals and marketing. RIL board has already approved hiving-off its $75 billion O2C business into a separate entity. This is subject to approval of the National Company Law Tribunal (NCLT).

Also Read: India’s trade deficit with China dips to USD 44 bn in 2020-21

RIL is looking for investment to pare debt and focus on the expansion of its refining business. Besides, the investment will also give RIL assured supply of crude oil to its refineries. Aramco fits the bill as the company itself had indicated its desire to expand beyond Saudi Arabia and in particular invest in oil and gas space in India.