Economy

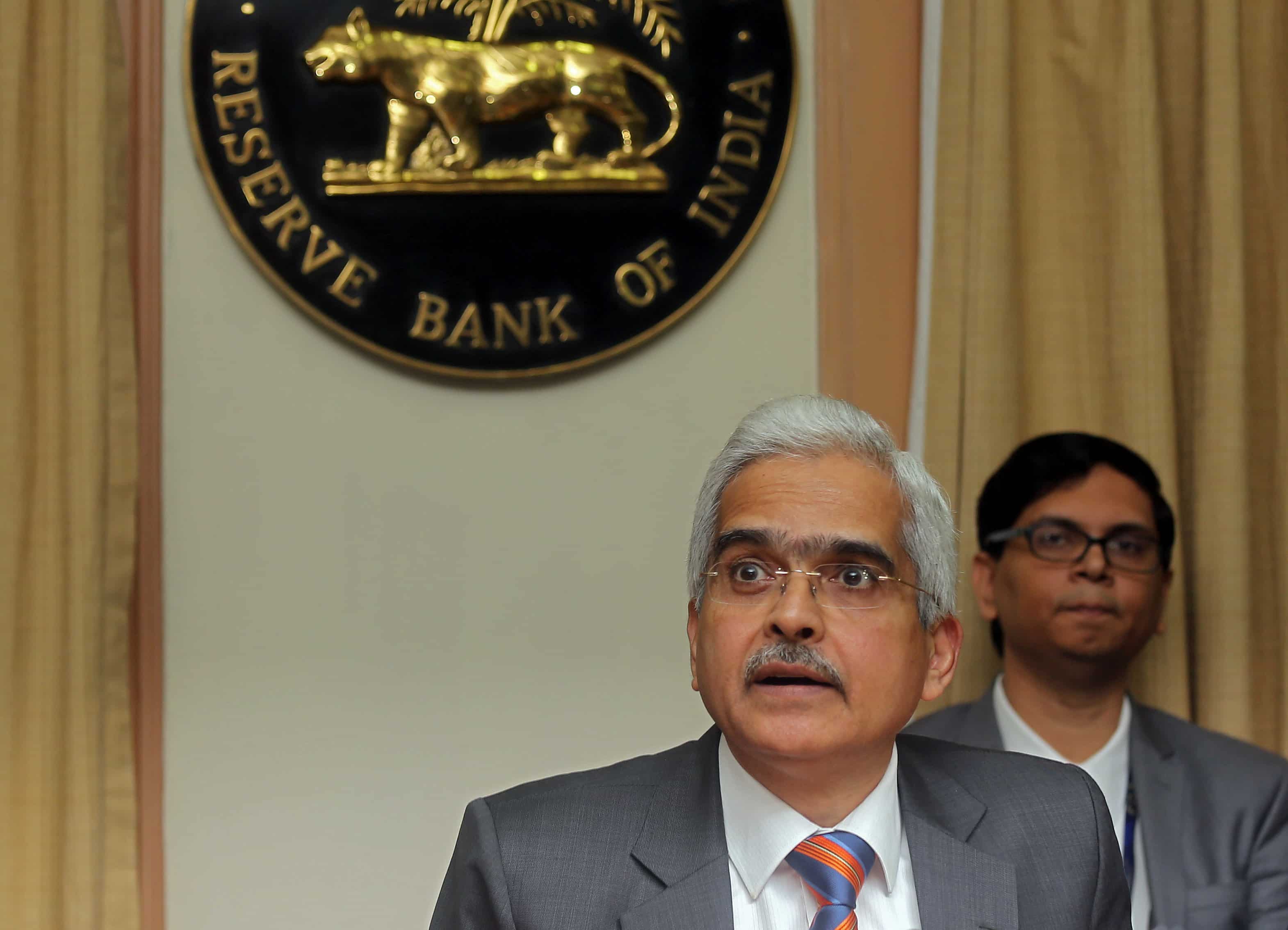

Downside risks to growth continue due to recent spike in COVID-19 infections: RBI Governor

Even as the growth outlook has improved, downside risks to growth continue due to recent surge in COVID-19 infections in advanced economies and parts of India, says Reserve Bank of India (RBI) Governor Shaktikanta Das. He said the country needs to be watchful about the sustainability of demand after festivals and a possible reassessment of market expectations surrounding the vaccine.

Speaking at the 4th Foreign Exchange Dealer’s Association Annual Day, Das assured the financial markets that the regulator will continue to work in a nimble-footed manner to ensure orderly functioning of the markets. “The Reserve Bank remains committed to fostering orderly functioning of financial markets and will continue to evaluate incoming information having a bearing on the financial markets and act, as needed, to mitigate any downside risks,” he said.

The governor said regulatory reforms have moved the financial markets to the next trajectory amid the pandemic. He pointed out that India’s economy has recovered stronger than expected from the initial impact of the novel coronavirus, but there is a need to be watchful of demand sustainability after festivals and a possible reassessment of market expectations surrounding the virus. “After witnessing a sharp contraction in the economy by 23.9 per cent in Q1 and a multi-speed normalization of activity in Q2, the Indian economy has exhibited stronger than expected pick-up in momentum of recover,” Das said.

Also Read: Plum raises US$4.1 mn to expand into new markets and build new distribution channels

The governor highlighted that, today, the capital account is convertible to a great extent. “Inward FDI is allowed in most sectors and outbound FDI by Indian incorporated entities is allowed as a multiple of their net worth. The external commercial borrowing framework has also been liberalized to include more eligible borrowers, even as maturity requirements have been reduced and end-use restrictions have been relaxed.”

Das also said that banks in India have been permitted to deal in offshore rupee derivative markets. He said banks have also been permitted to undertake foreign exchange transactions beyond the usual onshore market hours.

Pingback: ‘Men of Platinum’, PGI India celebrates new collection with men who stood their ground | The Plunge Daily

Pingback: Virus, vaccines and volatility: Stock market takes a wild ride in 2020 | The Plunge Daily