Amazon

Amazon Stock Drops 10% After $200 Billion Spending Forecast Spooks Investors

Amazon’s aggressive investment plan comes amid an industry-wide AI spending race. Alphabet recently projected up to $185 billion in capital expenditures for 2026, while Meta has signaled spending as high as $135 billion.

Amazon stock slid more than 10% in extended trading after the e-commerce and cloud giant delivered mixed fourth-quarter earnings and unveiled a massive $200 billion capital expenditure plan for 2026. While revenue beat expectations and Amazon Web Services (AWS) posted its fastest growth in over three years, Wall Street reacted sharply to the scale of Amazon’s spending ambitions.

Mixed Q4 Earnings Results

Amazon reported earnings per share of $1.95 for the fourth quarter, narrowly missing analyst estimates of $1.97. Revenue came in at $213.39 billion, topping expectations of $211.33 billion and marking another strong holiday quarter for the company.

Despite the revenue beat, the slight earnings miss combined with a sharp jump in forecast spending overshadowed the results. Net income rose to $21.19 billion, up from $20 billion a year earlier, reflecting improved efficiency across retail and advertising operations.

AWS and Advertising Deliver Strong Growth

Amazon Web Services remained a standout performer, generating $35.58 billion in revenue, above analyst expectations. AWS revenue grew 24% year over year, its fastest expansion in 13 quarters, signaling renewed momentum after a period of slower enterprise spending.

Advertising revenue also impressed, climbing 23% to $21.3 billion. Amazon’s ad business has quietly become one of its most profitable segments, benefiting from the company’s vast consumer data and growing presence in connected TV and streaming.

$200 Billion Capex Plan Raises Red Flags

The market’s biggest concern centered on Amazon’s forecast that capital expenditures could reach $200 billion in 2026, far above analyst expectations of roughly $147 billion. The spending surge will largely focus on AWS, particularly data centers, custom chips, robotics, and artificial intelligence infrastructure.

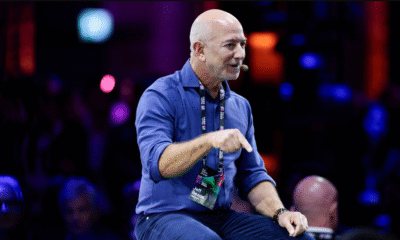

CEO Andy Jassy defended the move, stating that demand for both traditional cloud workloads and AI services is exceeding expectations. He emphasized that Amazon is “monetizing capacity as fast as we can install it,” highlighting strong customer appetite for AI-powered computing.

AI Arms Race Intensifies Across Big Tech

Amazon’s aggressive investment plan comes amid an industry-wide AI spending race. Alphabet recently projected up to $185 billion in capital expenditures for 2026, while Meta has signaled spending as high as $135 billion. Investors, however, are increasingly wary that runaway AI investment could pressure margins before meaningful returns materialize.

Although AWS remains the market leader, competition is intensifying. Microsoft Azure reported 39% growth, while Google Cloud surged nearly 48%, raising concerns that Amazon may need to spend heavily just to maintain its dominant position.

Layoffs Continue Despite Revenue Growth

The earnings report also followed news that Amazon plans to cut roughly 16,000 corporate roles, on top of layoffs announced late last year. While total headcount edged up to 1.57 million employees globally, most of that growth came from warehouse operations rather than corporate teams.

Outlook: Long-Term Bet, Short-Term Pain

For the current quarter, Amazon forecast revenue between $173.5 billion and $178.5 billion, broadly in line with expectations. Still, investors appear focused on whether Amazon’s $200 billion AI-driven bet will deliver sustainable stock returns or weigh on profitability in the near term.