Business

FRL Insolvency: Creditors invite fresh bids, divide assets into 5 clusters as it fails to attract any bids so far

The creditors of Future Retail Ltd have now invited new expressions of interest where the prospective buyers can bid for the debt-ridden firm “as a going concern or individual cluster or a combination of clusters” of its assets as it failed to attract a resolution plan in over four months.

Despite finalising 11 prospective bidders like Reliance and Adani group’ JV April Moon Retail, FRL against which the corporate insolvency resolution process (CIRP) was initiated on July 20, 2022, failed to receive any bids till February 20, 2023 despite two extensions in deadline for submissions. Following this, lenders have decided to divide the assets into clusters to make them more attractive to buyers. “… the last date of receipt of resolution plans was December 15, 2022, which was subsequently extended to January 16, 2023 and thereafter to February 20, 2023. However, no resolution plans were received for FRL by the due date of submission of resolution plans for the Corporate Debtor.

Also read: Koo rolls out new safety features for proactive content moderation

“Subsequent to the above, the RP, in terms of approval by the CoC, hereby issues this invitation for expression of interest (IEOI) for submission of EOI for Corporate Debtor as a going concern or individual Cluster or a combination of Clusters of the assets of FRL,” it said. The Resolution Professional (RP) has now issued a new invitation for expression of interest (IEOI) for FRL, where the prospective buyers can bid FRL “as a going concern or individual Cluster or a combination of clusters” of its assets. Under the new IEOI, for which the last date for submission for the eligible prospective resolution applicants (PRA) is April 7, 2023, the Committee of Creditors (CoC) has provided two options.

In the first option, PRA could bid for the acquisition of FRL as a whole, including its shareholding interest in its subsidiaries. While under the second option, FRL business has been distributed in five clusters diving business, in which PRAs can bid for “any individual cluster or any combination of clusters”. Giving its reasons, the new IEOI said “having regard to the complexity and scale of operations of FRL, the RP has, in consultation with and prior approval of the CoC of FRL, categorized the business of the Corporate Debtor in 5 clusters”. CIRP was initiated against FRL by its lender Bank of India after it defaulted on loans.

As per the provisions of the Insolvency & Bankruptcy Code expression of interest was invited from prospective bidders on October 04, 2022. Later, it was reissued and the submission date was extended for the Resolution Plan and a final list of 15 PRA was published on November 15, 2022. Under Cluster I, creditors have put large format stores – 10 from North and Central, 3 from South, 6 from East and 11 store from West. It has also put in small format stores from 3 zones, totaling 272 stores. In Cluster II, it has put equity stakes of FRL in TNSI Retail, which collectively owns and manages the WHSmith Business and of Welcome Retail.

While in Cluster III, CoC has put Food Hall business and all business-related assets. In cluster IV, CoC has put the inventory and fixed assets at various locations which are not part of Cluster I and Cluster III. The last Cluster V has residual entities/assets/investments/brands of FRL not covered in any of the clusters. Earlier on March 15, FRL had informed that almost one and a half months after resigning from the suspended board of FRL, Kishore Biyani has withdrawn his resignation. This came after the RP had raised objections to the contents of Biyani’s resignation letter and had requested him to recall it. Earlier this month, the RP of FRL filed an application before the National Company Law Tribunal (NCLT) against the former and present directors of the company for causing a loss of Rs 14,809.44 crore to creditors.

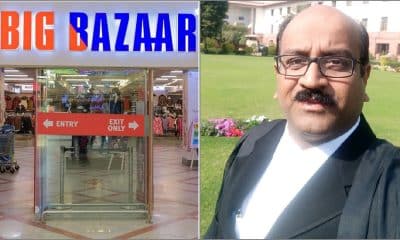

FRL operated multiple retail formats in both the hypermarket supermarket and home segments under brands, such as Big Bazaar, Easyday, and Foodhall. At its peak, FRL was operating over 1,500 outlets in nearly 430 cities. It was part of the 19 Future group companies operating in the retail, wholesale, logistic and warehousing segments, which were supposed to be transferred to Reliance Retail as part of a Rs 24,713-crore deal announced in August 2020. However, lenders had rejected the takeover of the 19 Future group companies, including FRL, by Reliance amid a legal challenge by Amazon.

As many as 13 companies including Reliance Retail, Adani Group’s JV April Moon Retail and 11 other companies have made it to the final list of prospective bidders for acquiring FRL. Last year in August, stock market regulator Sebi ordered a forensic audit of the accounts of FRL for the financial years 2019-20, 2020-21 and 2021-22.

Pingback: Zen Technologies bags Rs 127 crore order from armed forces