Business

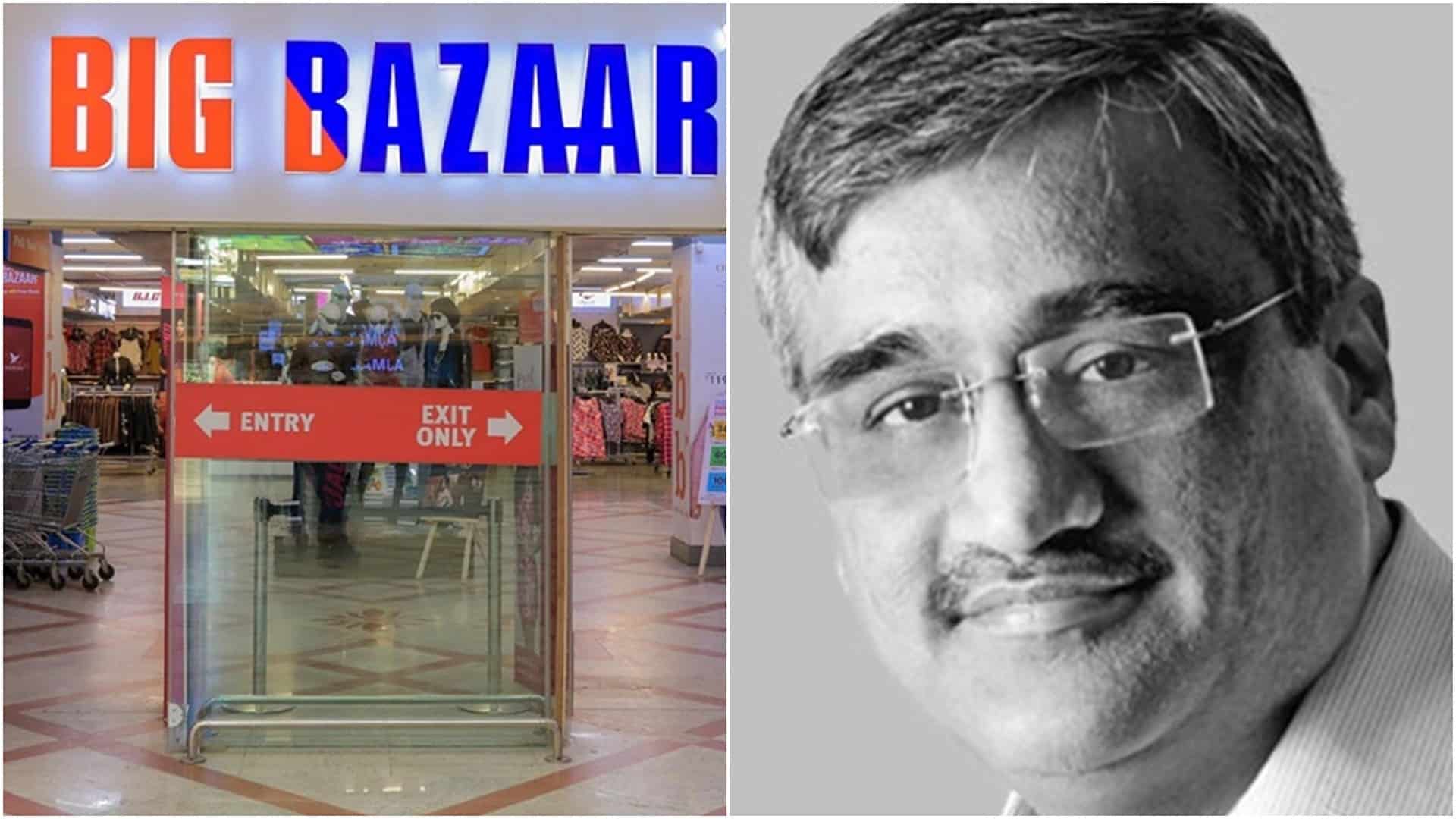

Future Group’s Big Bazaar suspends operations amid Reliance takeover

Billionaire Mukesh Ambani’s Reliance Industries Ltd has taken over the operations of at least 200 stores of Future Retail which is now being rebranded as Reliance Retail, the retail arm of the oil-to-telecom conglomerate. The company is also in the process is in the process of absorbing as many as 30,000 workers of the smaller retail giant after brokering deals with landlords. The development comes after the Kishore Biyani-led group failed to make lease payments to landlords, PTI quoted sources a s saying. Meanwhile, Future Retail Limited suspended most of its online and offline operations as stores remained shut on Sunday

Reliance Retail, the retail arm of the oil-to-telecom conglomerate, had in August 2020 agreed to take over the retail and logistics business of the Future Group for ₹24,713 crore but the deal couldn’t be closed as Future’s warring partner Amazon went to courts citing violation of some contracts. Future denies any wrongdoing.

Sources said several landlords had approached Reliance as Future Retail Ltd (FRL), which is neck deep in losses, was unable to pay rent.

Future has more than 1,700 outlets, including the popular Big Bazaar stories, and has not made lease payments for some of its outlets. Facing closure, Reliance transferred the leases of some stores to its step-down subsidiary, RRVL and sublet them to Future to operate the stores, the sources said.

It has since started rebranding the stores and offered to take all employees employed there on its payroll, they added.

In addition, a majority of inventory at these stores was being supplied by Reliance Jiomart as a cash-strapped FRL could not clear dues to existing suppliers. Reliance will likely replace Big Bazaar signages and branding from these stores with its own brand.

Amazon has argued that Future violated the terms of a 2019 deal the companies signed when the US e-commerce giant invested USD 200 million in a Future Group unit. Amazon’s position has been backed by a Singapore arbitrator.

Without confirming or denying the takeover of its stores, Future Retail Ltd in a stock exchange filing said, “The shareholders are aware that FRL is going through an acute financial crisis. The company has defaulted on its loan servicing and as already informed, the account of the company has been classified as NPA by the banks.”

Also Read:_Amazon’s partner Samara Capital plans USD 500 mn India-focused fund: Report

FRL said it is finding it difficult to finance the working capital needs and “termination notices have been received for a significant number of stores due to huge outstanding, and we would no longer have access to such store premises.”

“The ongoing litigation initiated by Amazon in October 2020, and which is continuing for the last one and a half years, has created serious impediments in the implementation of the Scheme (Reliance takeover), resulting in severe adverse impact on the working of the company,” it said, adding the firm is scaling down its operations to reduce losses.