Industry

Garment industry thrives with factories near full capacity

India’s garment factories are buzzing with activity after coming to a standstill because of the COVID-19 pandemic. The garment industry is India’s biggest employer after the farming sector. The ruling party sees sustained success for the textile and apparel industry as a stepping stone for the general election in 2024.

India has a 4% share in the $840 billion global market and is the world’s fifth-biggest textile and apparel (T&A) exporter. About a decade ago, India was on par with Bangladesh but fell back because of higher labor costs. The high costs make Indian clothes about 20% costlier.

Industry leaders believe that unless India signs free trade agreements (FTAs) with Western countries, it would not be easy to overtake Bangladesh. Experts have highlighted that Dhaka enjoys preferential export terms and conditions from buyers as it ranks among the least developed countries.

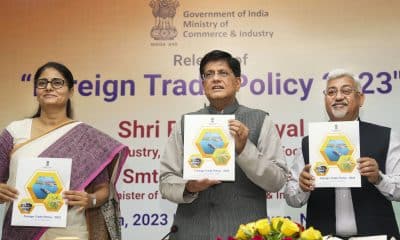

As such, the Indian government is working towards the betterment of the industry. Darshana Jardosh, the junior textiles minister, made some announcements to support the industry. It includes setting up seven huge all-in-one textile parks for about $600 million in an effort to boost employment and make it easier for foreign buyers to place orders and monitor supply chains. Moreover, the government has proposed Production Linked Incentives (PLI) worth $1.4 billion.

The American Apparel and Footwear Association (AAFA) said New Delhi’s ongoing and planned investments prompted more companies to look at India as a potential source of growth over the coming years. Industry sources revealed that Fast Retailing’s Uniqlo and Gap Inc were in talks to expand purchases from India.

The government is aiming for a full fiscal-year target of $44 billion as India’s April-December T&A exports soared 52% to $30.5 billion from the year-ago period. Between 2015 and 2019, global textile exports recorded a compounded annual growth rate (CAGR) of 2%. India noted a decline of 0.8% but Bangladesh and Vietnam grew more than 10%.

The last few quarters have recorded a spike in sales for Indian companies to the United States and Europe. This is attributed to companies boycotting China over alleged rights abuses in the cotton-growing province of Xinjiang. The US President Joe Biden had signed into law legislation, in late December 2021, that bans imports from Xinjiang.

Also Read: Apple’s privacy change to iOS will decrease Facebook’s sales by $10 million: Meta

An Indian exporter told Reuters that the China factor helped it recently sign up new clients that it had long pursued. Narendra Goenka, the chairman of Apparel Export Promotion Council of India and founder of Texport, said they may not be able to pick up at current capacity as the orders coming their way, as much as buyers want to ship away from China. He said the company was spending about $25 million to raise its capacity by more than a quarter over the next two years, with the addition of 8,000 jobs on top of its current workforce of more than 10,000.

Pingback: The SC has declined to hear a Special Leave Petition against hijab case.

Pingback: Businessmen should be respected as bulk employment comes from them.