News

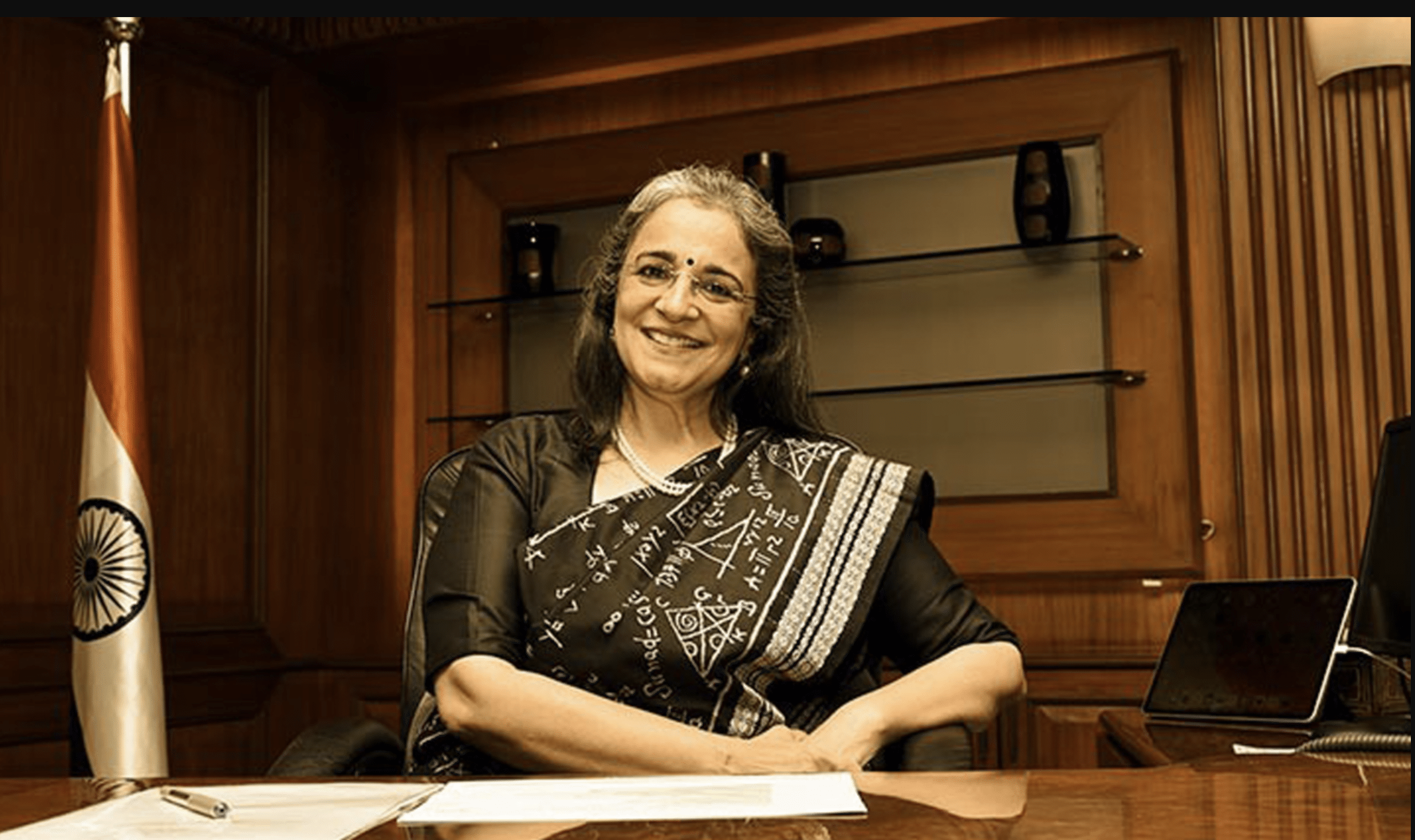

SEBI Backs Madhabi Puri Buch over Investigating Hindenburg Adani allegations

In an expected turn of events, the Securities and Exchange Board of India (SEBI) has decided to back its Chairperson, Madhabi Puri Buch, publicly, following serious allegations of conflict of interest with Adani against her by U.S.-based short-seller Hindenburg Research, instead of distancing itself from Buch in light of the controversy and announcing an investigation, which would have been logical. SEBI has issued a statement defending her, which will spark a debate over the regulator’s independence and commitment to transparency. To jump to defence is not the job of a regulator, and to lock their social media profiles doesn’t inspire any confidence.

Statement from SEBI

Chief Madhabi Puri Buch “In the context of allegations made in the Hindenburg Report dated August 10, 2024 against us, we would like to state that we strongly deny the baseless allegations and insinuations made in the report. The same are devoid of any truth. Our life and finances are an open book. All disclosures as required have already been furnished to SEBI over the years. We have no hesitation in disclosing any and all financial documents, including those that relate to the period when we were strictly private citizens, to any and every authority that may seek them. Further, in the interest of complete transparency, we would be issuing a detailed statement in due course. It is unfortunate that Hindenburg Research against whom SEBI has taken an Enforcement action and issued a show cause notice has chosen to attempt character assassination in response to the same. Madhabi Puri Buch Dhaval Buch

The Allegations and SEBI’s Response

Hindenburg Research released new documents that accuse Madhabi Puri Buch of having a financial stake in offshore entities allegedly used by the Adani Group for stock manipulation and money siphoning. According to Hindenburg, Madhabi Puri Buch’s connections to these entities may have influenced SEBI’s handling—or lack thereof—of the investigation into the Adani Group, raising concerns about a potential conflict of interest.

SEBI issued a kneejerk statement expressing complete confidence in Madhabi Puri Buch’s leadership and dismissing the allegations as baseless. The regulator emphasised that Buch has always acted with the highest integrity and transparency and rejected any suggestion that personal financial interests influenced her actions.

Statement from @SEBI_India Chief Madhabi Puri Buch

“In the context of allegations made in the Hindenburg Report dated August 10,2024 against us, we would like to state that we strongly deny the baseless allegations and insinuations made in the report. The same are devoid of any… https://t.co/c4ICQ4F7M8— Shereen Bhan (@ShereenBhan) August 10, 2024

Defending, Not Distancing

SEBI’s decision to stand by its Chairperson is notable for several reasons. Typically, when a high-ranking official faces serious allegations, a regulatory body might distance itself from the individual to maintain its credibility and impartiality. By backing Buch, SEBI appears to be taking a calculated risk, signalling that it does not believe the allegations merit such a response. However, the fact that they blocked their social media profile is suspicious.

This approach is bound to raise questions about SEBI’s independence. Critics argue that the regulator should focus on conducting a thorough investigation into the claims rather than issuing statements of support that could be perceived as prejudging the outcome of any inquiry. Buch’s public defence also undermines the regulator’s role as an impartial arbiter in matters of financial misconduct.

Risks of Backing the Chairperson

By publicly backing Buch, SEBI risks becoming embroiled in the controversy itself. If further evidence emerges to support Hindenburg’s allegations, SEBI’s credibility could suffer significant damage, potentially leading to calls for reforms within the regulator. The perception that SEBI is more concerned with protecting its leadership than ensuring accountability and transparency could also erode public trust.

Moreover, SEBI’s response may be viewed as a missed opportunity to demonstrate its commitment to rigorous oversight, regardless of the individuals involved. In times of crisis, regulatory bodies often strengthen their positions by showing that no one is above scrutiny, not even their top officials.

Implications for SEBI’s Future

The situation has broader implications for SEBI’s role in India’s financial markets. As the country’s primary securities regulator, SEBI maintains market integrity and protects investors. Domestic and international observers closely watch its actions—or inactions—and any sign of partiality or weakness could have ripple effects on market confidence.

If the allegations against Madhabi Puri Buch are unfounded, the regulator’s decision to stand by her could be vindicated. However, if further investigation reveals any wrongdoing, SEBI’s choice to defend rather than distance itself could have lasting consequences for its reputation

Pingback: Rahul Gandhi Questions SEBI Integrity After Hindenburg Report