Funding News

Funding Alert: Arcatron Mobility raises undisclosed sum from Klub

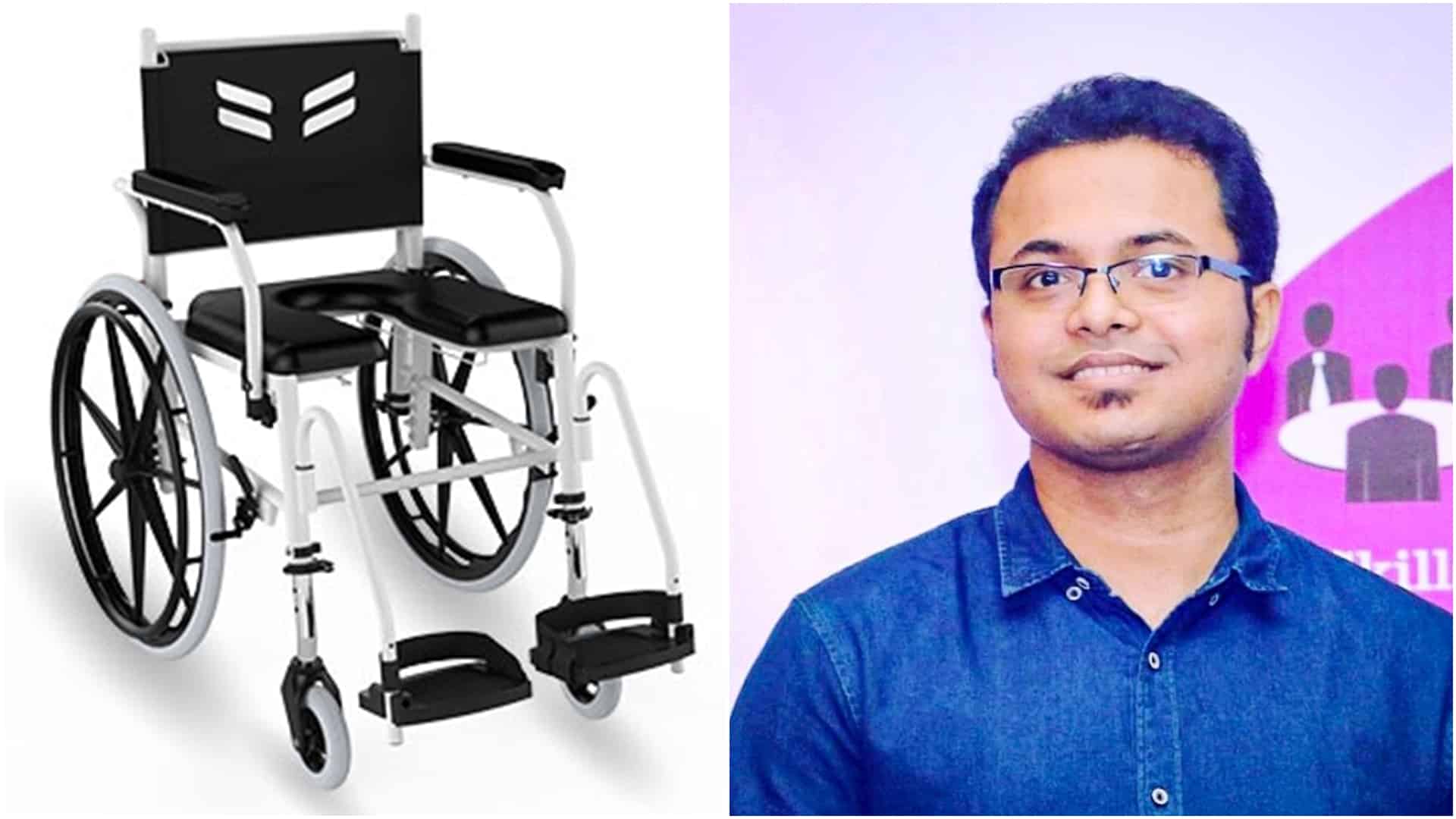

Arcatron Mobility, Pune based assisted living startup that manufactures next-generation mobility devices, has raised an undisclosed amount in growth financing through Revenue Based Financing platform, Klub. The company is using capital raised through Klub to ramp up inventory/production and has grown at a monthly CMGR of 100%.

Founded in 2015, Arcatron is building premium mobility products to advance global standards of assisted living and make them dignified and safer. With a wide range of mobility aids that include wheelchairs & wheelchair accessories, toilet & bathroom aids, sleeping aids etc. the brand has proven instrumental in enhancing the lives of people with limited mobility and elderly care needs. Last year, Arcatron launched a premium range of customised Covid-19 products to protect its customers. The success of this new line has wholly revolutionized the trajectory of the company. With Klub’s investment, Arcatron Mobility intends to build up inventory to match the increasing demand for these products.

Klub is the world’s first community-focused Revenue Based Financing platform that provides growth financing to homegrown consumer brands. Revenue Based Financing (RBF) takes a revenue share as returns instead of equity dilution or fixed EMIs. Klub provides capital for high ROI, cyclical spends like marketing, inventory, capex etc. that works well for online first brands across direct-to-consumer and online marketplace sellers. Arcatron Mobility has consistently been a category leader on marketplaces and with Klub financing the brand is scaling on the shoulders of fast-paced innovation and building up inventory.

Speaking on the capital raise, Ganesh Sonawane, Co-founder & CEO, Arcatron Mobility, said, “We started Arcatron to build world-class mobility devices and offer assistive, adaptive, and rehabilitative devices for people with limited mobility. Arcatron has grown year on year at ~250% and in Klub we have found the perfect growth partner. We are seeing a constant uptick in demand and with Klub capital, we aim to build inventory and ramp up production. For niche brands like us, Klub is an ideal investment platform offering flexible, non-dilutive growth capital.”

Commenting on this Anurakt Jain, CEO & Co-founder, Klub said, “Arcatron’s simple design thinking approach and range of mobility products has propelled the demand for its products. Klub’s revenue-based financing will help Aractron scale up operations and build inventory for solving the unmet needs of focus segments. We aim to back challenger brands that have strong fundamentals, great products and the potential to scale rapidly.”

In the last year alone, Klub has deployed capital to more than 80 brands across the country including leading consumer brands and marketplace sellers like Wellbeing Nutrition Tjori, The Man Company, Magic Crate, Stage3, Pipa Bella and many more. With the season sales approaching, Klub aims to support over 350 brands by providing capital for ramping up inventory and marketing.

Founded in 2015, Arcatron Mobility, is a medical device startup focused on designing and selling innovative products to enhance the lives of people with limited mobility. As the demand for mobility assistance increases due to the rapid rate of ageing, spinal cord injuries and obesity, Arcatron aims to fill this gap with world-class mobility devices at affordable prices. Arcatron Mobility has raised total funding of $646K from Angel and Seed investors. The company has the vision to become the domestic market leader in most competing categories and one of the world’s most trusted medical device brands by 2024.

Also Read: Telecom industry under tremendous stress; tariffs need to go up: Sunil Mittal

Klub is India’s leading Revenue Based Financing marketplace providing growth financing to loved consumer brands. Revenue Based Financing takes a revenue share as returns instead of equity dilution or fixed EMIs, making it ideal for a post-Covid financing ecosystem. Klub provides skin-in-the-game capital to loved brands across sectors including wellness, FMCG, direct-to-consumer, food services, fashion, beauty & personal care, subscription, and online-first retailers for recurring marketing, inventory, and capex spends.

Klub’s hybrid investment platform combines financial product innovation, deep data-driven analytics, high-frequency repayments, and community engagement. The company raised capital for its pre-seed funding round by Sequoia Capital’s accelerator program, Surge, and multiple angel investors including Naveen Tewari (InMobi) and Kunal Shah (Cred) among others.