Business

Payroll, Benefits, and Taxes which loves Employers & Employees

Employees are essential for any organisation, hence aptly called human resources or people success. For startups and small businesses, providing and managing employee payroll & insurance and benefits can be a huge pain. In the early stages of a startup, this responsibility falls into the hands of founders, who either manage the payroll services and benefits themselves or work with a local accountant and insurance brokers. The entire process and volume of work are tedious and very time-consuming – not necessarily providing the value for the time spent by the founders, despite the fact that this whole process is indispensable in ensuring that the employees are happy, healthy and productive. Then to manage all these requirements Founders needs to interact with multiple apps.

To disrupt and streamline all the HR requirements, we a FinTech startup Workzippy launched our beta version of new Web/ Mobile app in the market this week. The Company is working to change the way people get paid, simple as that. It does that on both sides of the equation, first by making it super-easy for employers to do payroll management and secondly by improving the experience of getting paid for employees, choosing benefits and filing tax returns.

Most Startups and small/medium-sized businesses today don’t have a good system in place for managing payroll, benefits, old school expenses and tax filing. The vast majority of the small firms and startups do it manually through old-school desktop software which involves a lot of mistakes resulting in delays & fines levied against them for accounting disparities. Workzippy has built a solution where the employer only needs to put in employee information once and then on auto pilot mode it will take care of all recurring payrolls. There are features like payment to vendors, one-time bonuses or hourly wages to employees/contractors etc. Workzippy enables employers to seamlessly and painlessly set up group health insurance and ancillary benefits for their employees, whether it be medical, dental, etc. The process traditionally takes weeks, requiring co-founders or (unlucky!!) staffers to contact brokers for quotes and manage the tedious enrollment process themselves, which usually involves dozens of follow ups and sorting through stacks of paper forms for each employee. Workzippy will turn this multi-week, paper-filled process into something that can happen in just a few minutes from the comfort of your local browser or app — even the actual signing of those forms.

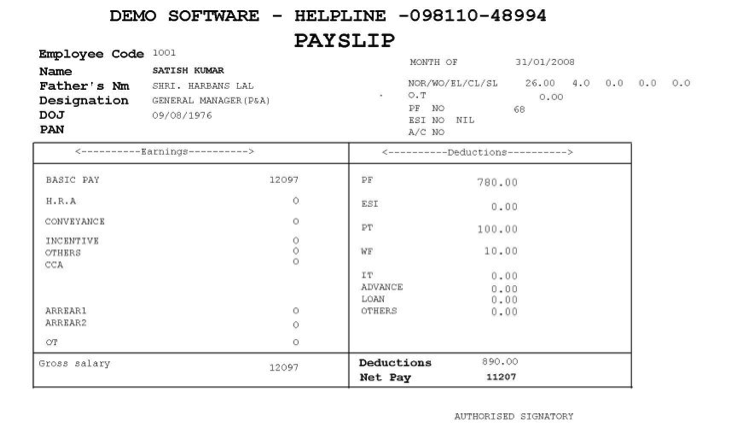

The company’s key focus while designing the whole system was to improve the experience for employees. Usually, employees get their pay direct deposited into their account and don’t even look at their pay slip – typically because they’re greeted with something that looks like this:

Many employees don’t understand anything from the payslip, and neither does this solution provide any analysis to them. Workzippy is set out to change that and ensure an employee gets notifications through their regular pay cycle and also a conscious experience.

The best approach is to provide simply a more visual, intelligent and smart way to show the breakdown of an employee’s salary and where all of a person’s money went as part of its email notifications. This is the hardcore analysis of a person’s finances that a user will appreciate and be interested in knowing. By making the payslips easier to understand and by providing a more meaningful analysis, the employees will look forward to receiving their payslips. To add to these awesome features, Workzippy has also formulated handy tools for employees to evaluate their expected take home pay with the help “In hand Pay Calculator. This tool pre-determines the expected salary of an employee so as to enable him to calculate and advise him to invest into various tax saving schemes so as to lower his taxes and increase the take home pay. With Workzippy analytics employee can make smarter decisions for the tax planning.

Now employees can configure their health benefits and select the plan which fits best for their needs rather than compromising and buying their individual plan. WorkZippy provides an excellent dashboard where an employee can see summary & make changes to benefits.

Workzippy is also integrated with Taxzippy, which helps employees to file their individual tax return seamlessly. The whole process of filing taxes takes less than couple of minutes. It’s a haven for the employees as both solutions work hand in hand and compliment each other.

The Company is also working on an app for its solution which is expected to be launched later this month. The app is designed to help employees to onboard on companies payroll, view their payslips, uploading their receipts to file expenses and much more. In the next phase app will be designed to help employers to run their entire payroll process from their mobile phones, without having to jump on the desktop to do things like view a payroll history, run a new cycle, payslips and receive notifications to remind them of tasks that need completion. Notifications can be set for employees, too, to alert them exactly them a payment has been received.

The Workzippy & Taxzippy teams are working on a much more intuitive feature pack and is expected to release soon.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of the publication