News

Mobikwik raises $40 mn from Net1

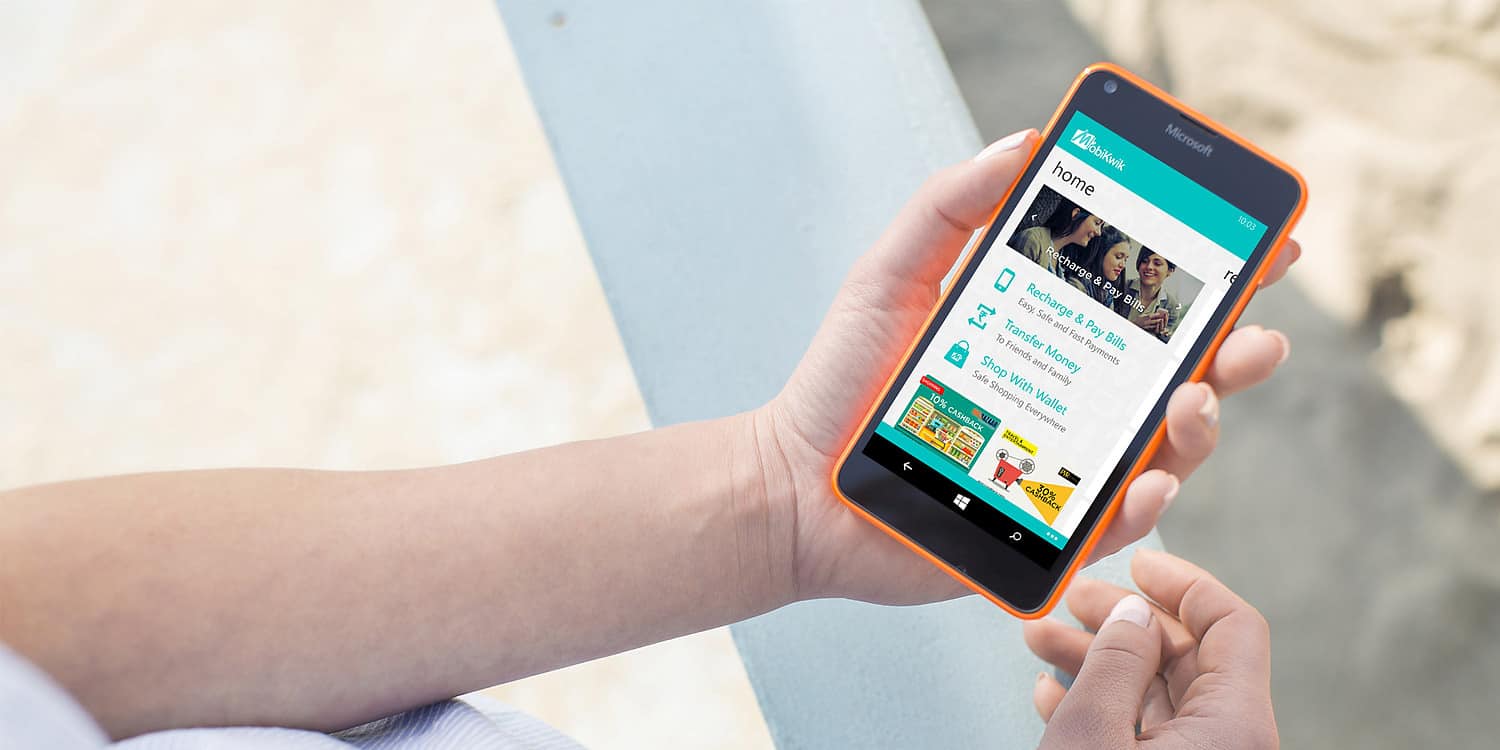

In a move that would further open newer modes of payments for the Indian entity’s 100, 000 merchants, South-African alternative payments system provider Net1 has signed a subscription agreement of $40 million with digital wallet firm MobiKwik.

Serge Belamant, the chairman and chief executive of Net1, said, “Our strategic investment in MobiKwik provides us with meaningful participation in one of the largest and fastest growing digital payment markets globally. This investment will accelerate our ability to build scale in India.”

MobiKwik has plans to reach to 150 million users and half a million merchants over the next years. And the introduction of the new virtual card technology across the wallets will further enhance the value proposition differentiation to users.

“For both online and offline merchants it will increase acceptance, and accelerate growth,” Serge Belamant added.

MobiKwik has last raised $70 million in its Series C round led by Japan’s GMO Payment Gateway and Taiwanese semiconductor company MediaTek, in May this year.

Launched in 2009 by Bipin Preet Singh and Upasana Taku, Mobikwik now has over 32 million mobile wallet users and one lakh retailers onboard. It has among its investors Sequoia Capital, Tree Line Asia, American Express, Cisco Investments, GMO Payment Gateway and MediaTek among its investors.

MobiKwik has partnered with over 50,000 businesses like Café Coffee Day, IRCTC, Uber, Big Bazaar, Meru Cabs, OYO Rooms, PVR, Archies, and much more. It competes with the likes of Paytm, Snapdeal-owned Freecharge, Pay U, Mymobile, Oxigen Wallet and Udio in the mobile wallet segment.