Business

Why India needs a well-defined ecommerce export framework

The revised Foreign Trade Policy (FTP) is expected to come into effect from April 1st, 2022. As a policy that continues to remain effective for a period of 5 years, the FTP provides a basic policy framework and strategy for promoting exports and trade. The existing policies on exports have catered largely to traditional, offline, B2B exports and having a differentiated policy framework for e-commerce exports is critical to enabling MSMEs to start exporting with lower entry barriers.

Government has rightly identified exports as a key pillar for India’s economic recovery and subsequent growth in a post COVID 19 landscape. So, it has become more critical that the Foreign Trade Policy, which provides the basic framework of policy and strategy for promoting exports and trade, helps in realising an ambitious vision for exports that will truly help India become ‘Aatmanirbhar’.

The FTP is an important policy instrument for this goal. Through the FTP, it is important to create a conducive policy framework for e-commerce exports that lowers the entry barrier for MSMEs to start exporting and helps promote e-commerce as a channel of exports. Such exports are a potential pathway to a USD 400 billion market, with MSME relevant markets worth USD 300 billion.

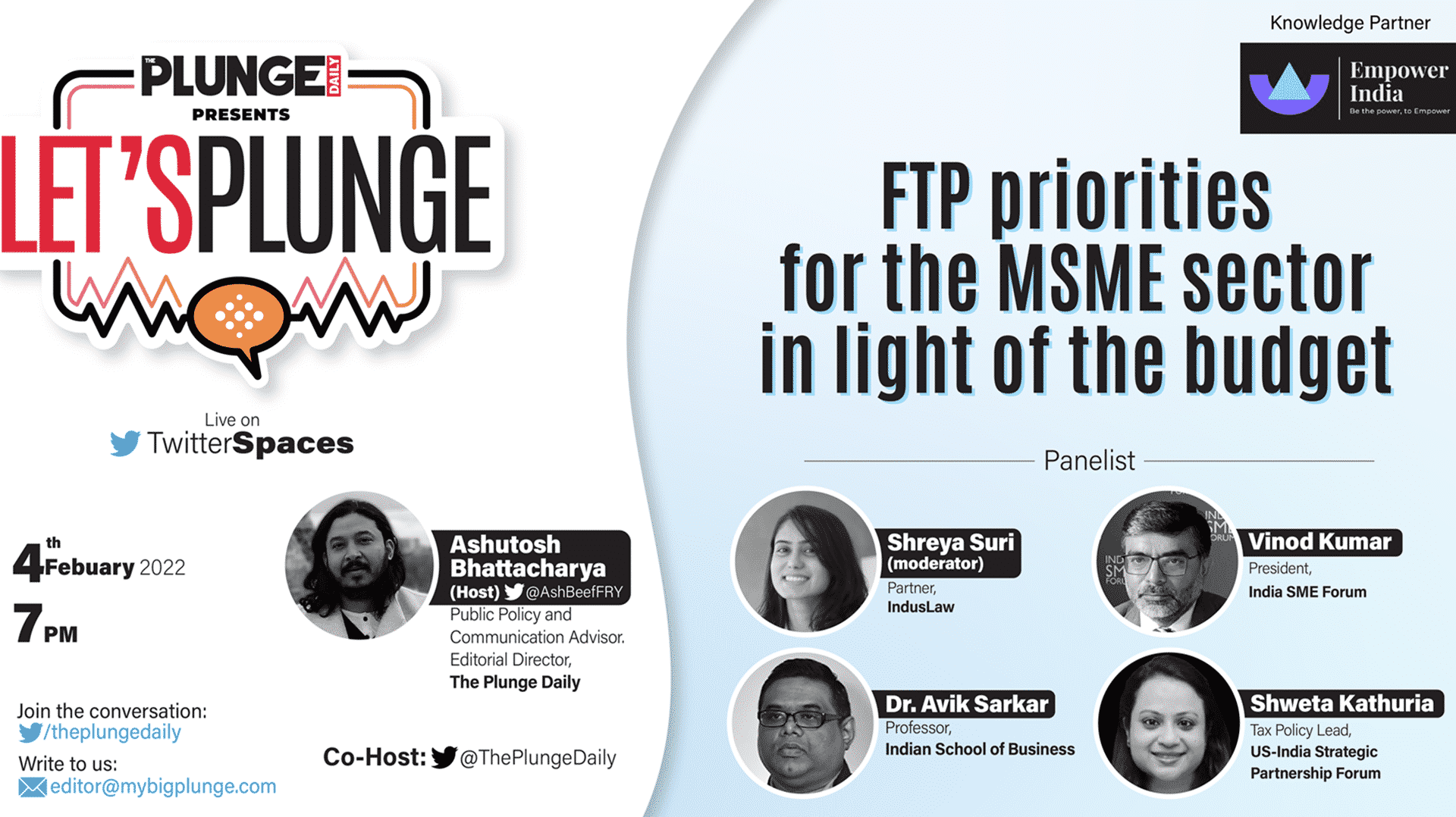

To drive discussion around the same, The Plunge Daily partnered with Empower India for a Twitter Space session on “FTP priorities for the MSME Sector” to underscore the need to prioritise ecommerce export in FTP 2022 for the growth of India’s MSME sector.

During the panel discussion, Vinod Kumar, President, India SME Forum said, “We have a 2600 page Foreign Trade policy. So, if an entrepreneur wants to get into exports, he needs to browse through maybe 3000 odd pages. In the current era, if we are looking at enabling people, we need to have a short and sweet policy that’s easier for an entrepreneur to understand so that he immediately moves on to the next step to expedite the entire process. We should not have a policy that prevents the guy from getting into b2c markets.

Shweta Kathuria, Tax Policy lead, US-India Strategic Partnership Forum underlined the need for GST parity for MSMEs which have onboarded the ecommerce bandwagon

“Every supplier which is selling goods on ecommerce platform is required to obtain mandatory GST registration irrespective of the turnover which is not the case when you are selling it offline or through brick and mortar stores because then if you’re selling if you’re a supplier of goods and your turnover is less than 40 lakhs and if you are a supplier of services, which is less than 20 lakhs, you’re not required to obtain a GST registration, she said.

Dr Avik Sarkar, Professor, Indian School of Business highlighted that, “Ecommerce can boost the international export for the MSME segment. As we all know, the traditional export route is quite difficult and complicated. You have to go through associations, you have to go through trade bodies, you have to send samples of products to the foreign countries and often people might like it. Ecommerce has made it simple for a lot of the players to take advantage of. Several MSMEs are exporting through the E commerce route but their percentage is still quite low. So, there has to be a push for MSME ecommerce export in the upcoming foreign trade policy.”

The panelists made following recommendation vis-à-vis e-commerce exports to be integrated with the upcoming Foreign Trade Policy 2022. These include:

- Increase e-commerce exports awareness

- Implement end-to-end digitisation for exports related processes

- Develop specialised logistics capabilities for e-commerce exports

- Simplify compliances and regulatory requirements for e-commerce export

- Create long term capabilities and schemes to support the growth of e-commerce exports