News

Gold and Silver Plunge as Trump’s Fed Pick Shakes Global Markets

The yearlong rally in precious metals came to a dramatic halt on Friday as gold and silver suffered their steepest single-day losses in decades, following President Donald Trump’s announcement of Kevin Warsh as his pick for the next chair of the US Federal Reserve.

Gold prices fell roughly 12% to around $4,786 per ounce, marking their worst daily decline in more than ten years. Silver plunged even harder, tumbling nearly 30% to about $80 an ounce in what traders described as a historic reversal. The sharp sell-off rippled across global markets, with US stocks also retreating from recent record highs.

Why Trump’s Fed Nominee Spooked Markets

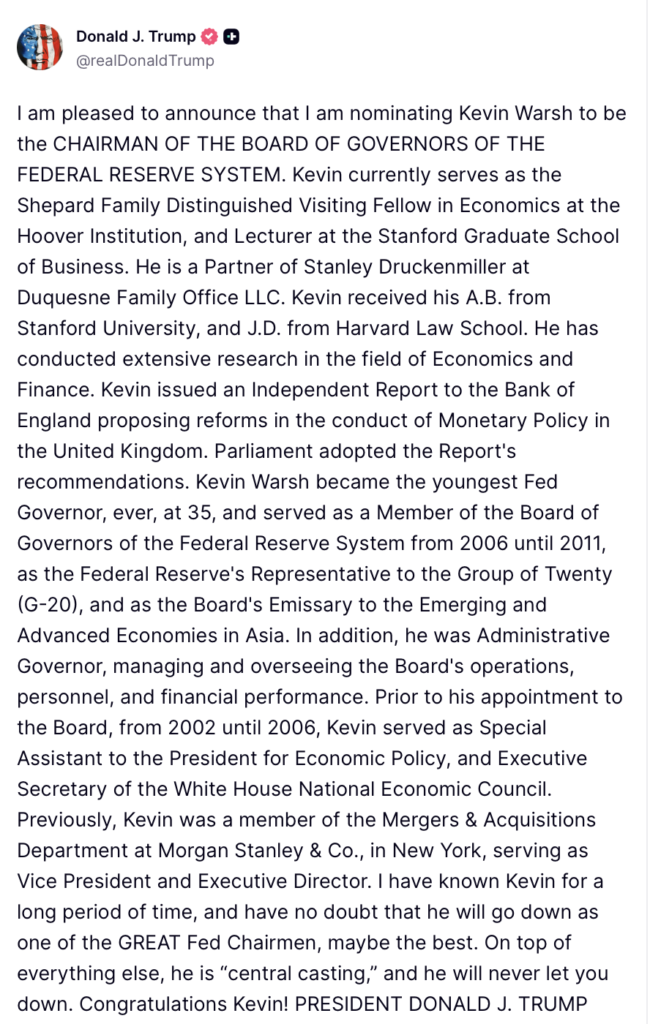

The sudden downturn was sparked by Trump’s selection of Kevin Warsh, a former Federal Reserve governor, as his Fed chair pick to replace Jerome Powell later this year, pending Senate confirmation. Investors had spent months bracing for a more dovish Fed appointment aligned with Trump’s calls for lower interest rates and looser monetary policy.

Instead, Warsh is widely viewed as a policy hawk with a track record of prioritizing inflation control and central bank independence. That perception forced markets to rapidly reprice expectations around interest rates, inflation, and the US dollar—key drivers behind gold and silver’s explosive rise over the past year.

The Dollar’s Comeback Hits Precious Metals

One of the biggest casualties of the shift was the so-called “debasement trade,” a strategy in which investors piled into hard assets like gold and silver to hedge against a weakening dollar and fears of political interference at the Fed.

Following the announcement, the US Dollar Index jumped nearly 1%, reversing part of its 11% decline over the past 12 months. A stronger dollar typically pressures precious metals, which are priced in greenbacks, making them less attractive to global buyers.

Market strategists said the dollar’s sudden rebound acted as a trigger for widespread profit-taking after metals surged to record highs in recent months.

Trump Truth Social Post on the Fed Chair Pick – Kevin Warsh

Profit-Taking After a Parabolic Run

Despite Friday’s collapse, gold remains up roughly 65% over the last year, while silver has dramatically outperformed even that gain. Analysts noted that such parabolic moves often end with violent pullbacks once sentiment shifts.

Some economists described the sell-off as a knee-jerk reaction fueled by confusion over how Warsh would ultimately lead the Fed. While Trump has historically favored looser monetary conditions, Warsh’s past positions suggest a more orthodox approach, complicating investor assumptions.

Broader Market Impact and What Comes Next

US equities also felt the pressure, with major indexes pulling back as traders reassessed the outlook for rates and liquidity. The Nasdaq led declines, reflecting sensitivity to higher-rate expectations.

Whether Friday’s plunge marks the definitive end of the precious metals boom remains uncertain. Some strategists caution that further downside is possible if confidence in Fed independence continues to strengthen. Others argue the long-term case for gold and silver could revive if inflation or geopolitical risks resurface.

For now, markets have delivered a clear message: Trump’s Fed pick has fundamentally altered the narrative—and the gold rush may no longer be a one-way trade.