Business

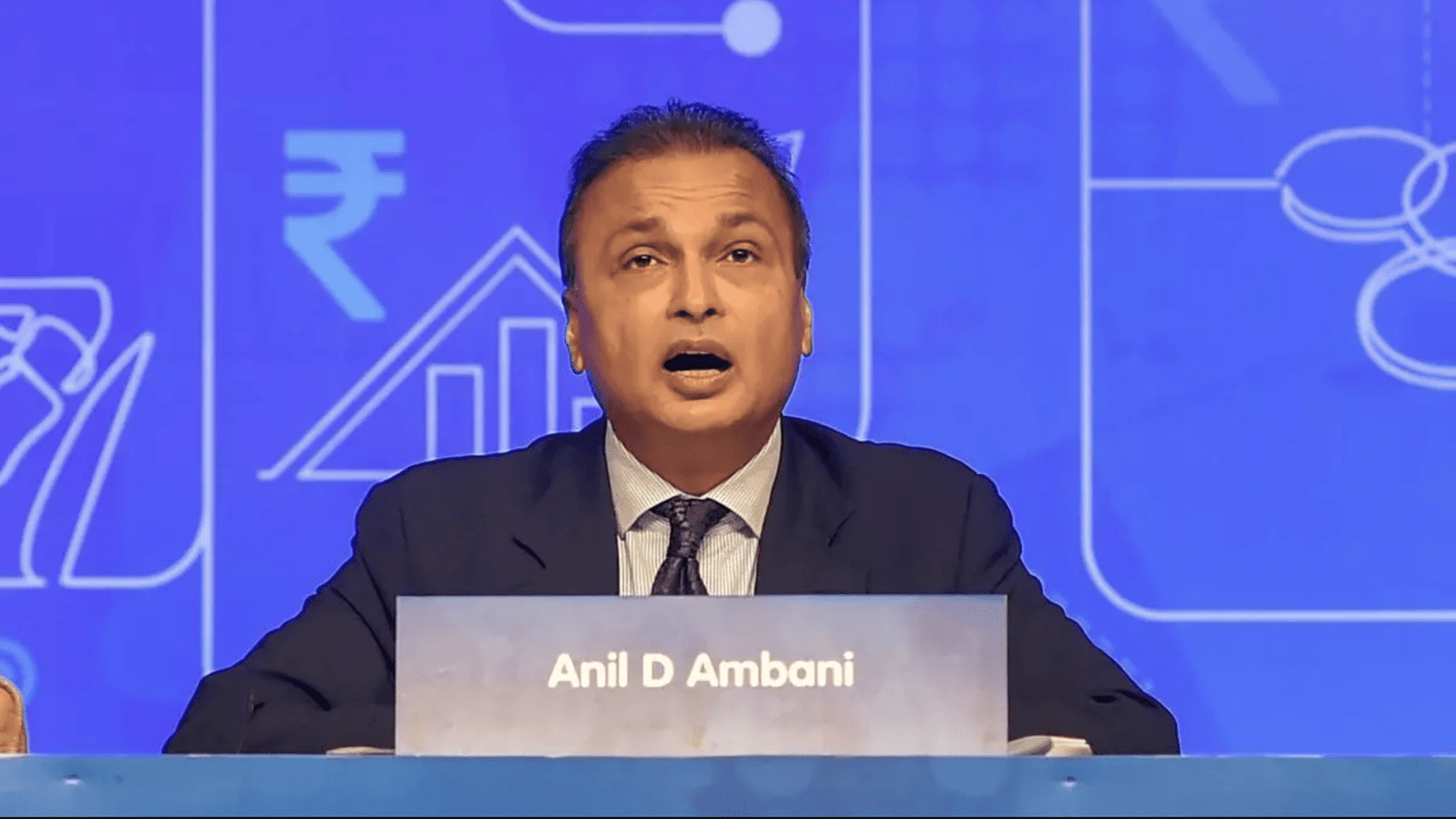

Anil Ambani’s Reliance Group expansion plans with a ₹17,600 crore fundraising strategy

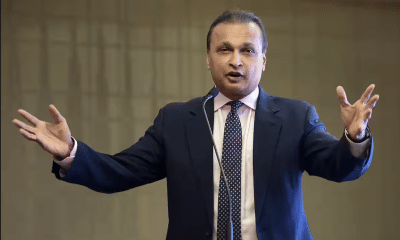

Anil Ambani led Reliance Group is gearing up for an expansion by executing a massive ₹17,600 crore fundraising plan. This financial move is set to bolster the group’s key companies, x, ensuring they remain well-capitalized and debt-free as they move forward with their strategic growth initiatives.

The fundraising effort includes several components. First, Reliance Infrastructure and Reliance Power have announced they will raise ₹4,500 crore through preferential equity issues, of which ₹1,750 crore will be contributed by the company’s promoters. The remaining ₹2,750 crore will come from prominent institutional investors, including Fortune Financial & Equities Services, Florintree Innovations LLP, Authum Investment and Infrastructure, and Sanatan Financial Advisory.

Furthermore, the Anil Ambani group secured an additional ₹7,100 crore from Varde Partners, a global investment firm, through long-term foreign currency convertible bonds (FCCBs). These bonds have a 10-year maturity period with a low interest rate of 5%, providing the companies with a stable, long-term financing option. Another ₹6,000 crore will be raised through qualified institutional placements (QIP), with Reliance Power and Reliance Infrastructure each aiming for ₹3,000 crore.

This combined effort will increase the net worth of both companies to around ₹25,000 crore, significantly strengthening their balance sheets. It also positions the companies to implement expansion plans in various sectors, particularly infrastructure and power.

A senior Reliance Group official mentioned that the capital raised through equity and equity-linked bonds will help the companies execute their growth plans while maintaining a conservative debt-to-equity ratio of 70:30. This strategy, according to the official, will provide the group with a total investment outlay of ₹50,000 crore, ensuring enough resources to pursue new projects over the next few years.

These developments mark a crucial phase in Anil Ambani’s Reliance Group recovery and growth trajectory, signalling strong potential for future success as the group remains committed to its expansion goals across key sectors in India.