Electric Vehicle

Apple shares at record high after reports of a self-driving car

Apple shares closed on a high note following reports that iPhone maker is accelerating plans to build a self-driving car. Apple stock rose 3.04% to a new intraday record of $158.32 in early afternoon trading. Its stock closed up 1.7% and traded at $160.55 a share. The tech giant is aiming for a fully autonomous vehicle with a 2025 deadline.

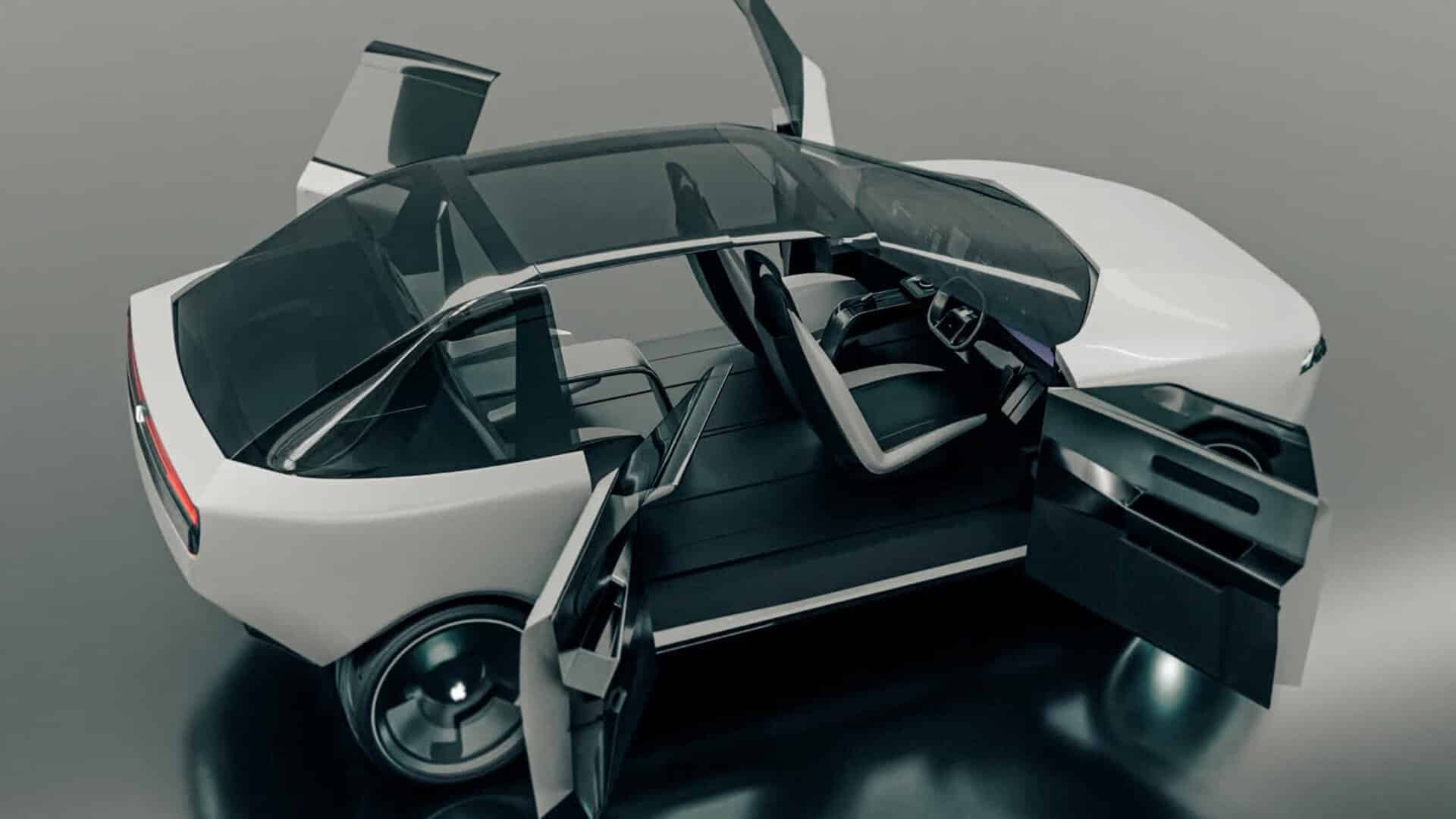

According to Bloomberg reports, the Apple self-driving car will be fully electric and will feature “no steering wheel and pedals” and seamless integration into the company’s many devices, including an iPad-like touchscreen.

Reports say Apple has completed much of the core work on the processing chips needed to make the self-driving vehicles function, which represents another key win for Apple as it expands its internal chip-making capabilities. However, earlier this year in April, Apple CEO Tim Cook had declined to confirm Apple’s car plans. “We’ll see what Apple does.”

Katy Huberty, an analyst at Morgan Stanley, said the first press report to include a broad number of data points sourced to Apple insiders and provides enough reported detail to potentially lend credibility to the idea that Apple’s Car launch could both accelerate adoption of new technology (EV+AV) and expand the addressable market similar to past Apple product launches.

“While autos represent a brand new endeavor for Apple, the company’s track record in new markets and its vertical integration capabilities could foreshadow success,” Huberty said. “She has the equivalent of a buy rating on the stock and cars present the clearest path for Apple to double its revenue and market cap.”

The analyst further said that they can provide a number of examples from the last 20 years that show while Apple may not always be first to market its innovation engine, differentiation via vertical integration, and manufacturing, operational excellence have allowed it to leapfrog first movers.

Also Read: Agriculture Insurance Company launches Parametric Insurance to protect farmers

Adam Jonas, an analyst at Morgan Stanley, referred to Apple’s car as the ultimate EV bear case. He called the tech giant’s entry into the space a clear negative for much of the automobile coverage. “Fully-autonomous vehicles will be slow to gain adoption in the US because of a myriad of moral, legal and technological barriers,” Jonas explained. “To be clear, we do not believe consumers will own title to a fully autonomous car, but will engage in the services as a subscription or transport utility.”