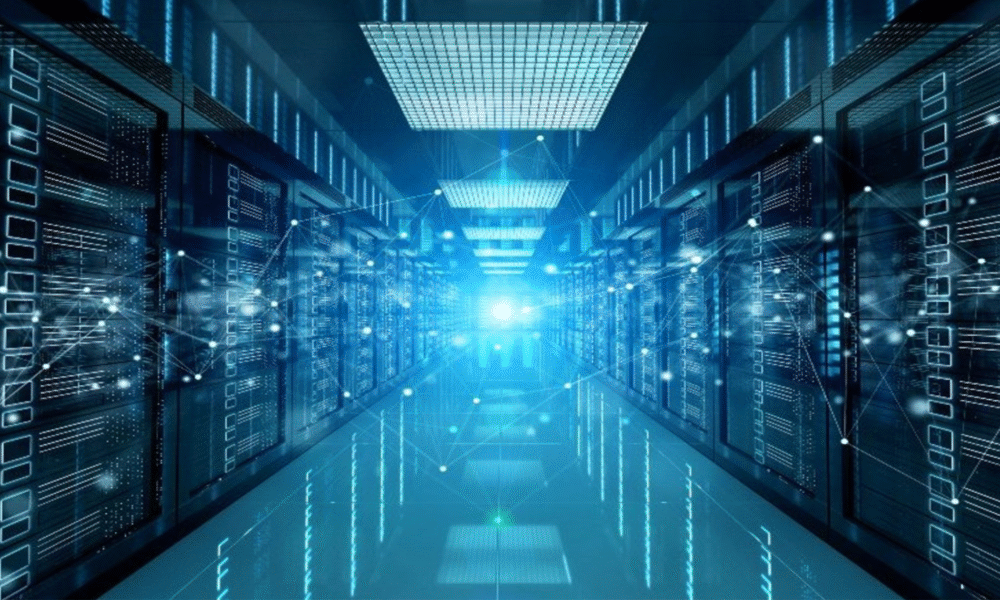

Digital Infrastructure

Sify Infinit Files ₹3,700 Crore IPO, India’s First-Ever Data Center Public Offering

India is set to witness a major milestone in its digital infrastructure journey. Sify Infinit Spaces Limited, one of the country’s leading data center colocation providers, has filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI), marking India’s first-ever data center IPO. The company plans to raise ₹3,700 crore, combining a fresh issue and an offer for sale.

IPO Structure and Proceeds Utilization

According to the DRHP filed with SEBI, the initial public offering (IPO) will comprise a fresh issue of equity shares worth ₹2,500 crore and an offer for sale (OFS) of ₹1,200 crore by selling shareholders Kotak Data Center Fund (₹643 crore) and Kotak Special Situations Fund (₹557 crore).

Sify Infinit may also explore a pre-IPO placement of up to ₹500 crore before filing its Red Herring Prospectus, with proceeds from such a placement deducted from the fresh issue size.

The proceeds from the IPO will be used primarily to fund capital expenditure for ongoing projects — including Tower B at its Chennai 02 Data Center (₹465 crore) and Towers 11 and 12 at its Rabale Data Center in Navi Mumbai (₹860 crore). Additionally, ₹600 crore will be used to repay or prepay borrowings, while the remainder will go towards general corporate purposes.

A Legacy of Innovation and Leadership

A subsidiary of Sify Technologies, Sify Infinit is part of the Sify Group, one of India’s earliest internet pioneers from the 1990s. Led by Vegesna Ananta Koti Raju, the company has become a cornerstone in India’s digital infrastructure ecosystem, offering colocation, interconnection, and build-to-suit data center solutions.

As of March 31, 2025, Sify Infinit held a 15.26% market share in built IT capacity, operating 14 colocation data centers across six major Indian cities — Mumbai, Chennai, Noida, Hyderabad, Bengaluru, and Kolkata — with a combined IT power capacity of 188.04 MW. Between FY2023 and FY2025, it achieved a 95.41 MW capacity expansion, the highest among its peers.

AI-Ready, Sustainable, and Globally Certified

In a move aligning with the surge in AI-driven workloads, Sify Infinit’s latest facilities — including Rabale Tower 5, Chennai 02 Tower B, and Noida 02 Tower B — have received NVIDIA certifications for AI workloads and IGBC Platinum ratings for sustainability. These sites are also TIA-942 Rated 4 certified, capable of hosting up to 130 kW per rack using advanced direct-to-chip cooling technology.

Robust Financial Growth

Sify Infinit’s growth trajectory reflects India’s booming data economy. Revenue from operations rose from ₹10,213.40 million in FY2023 to ₹14,283.65 million in FY2025, while EBITDA increased from ₹4,126.06 million to ₹6,342.46 million, boosting margins from 40.4% to 44.4%. Profit After Tax (PAT) grew to ₹1,263.6 million, signaling strong profitability.

The firm’s diversified 500+ client base includes three of the top four global hyperscalers and seven of India’s top ten banks, spanning sectors like fintech, OTT, manufacturing, and healthcare.

As India’s demand for data centers surges — projected to grow at 30–35% CAGR (FY2025–2030) — Sify Infinit’s IPO signals a new phase in the country’s digital infrastructure investment story.

JM Financial, CLSA India, J.P. Morgan, Kotak Mahindra Capital, and Morgan Stanley are serving as the book-running lead managers for the issue.

With India’s AI revolution gaining speed, Sify Infinit’s IPO could mark the start of a new era — one where data, not oil, drives the nation’s next growth wave.