Business

Lending app Myshubhlife gets USD 4mn from Patamar Capital, existing investors

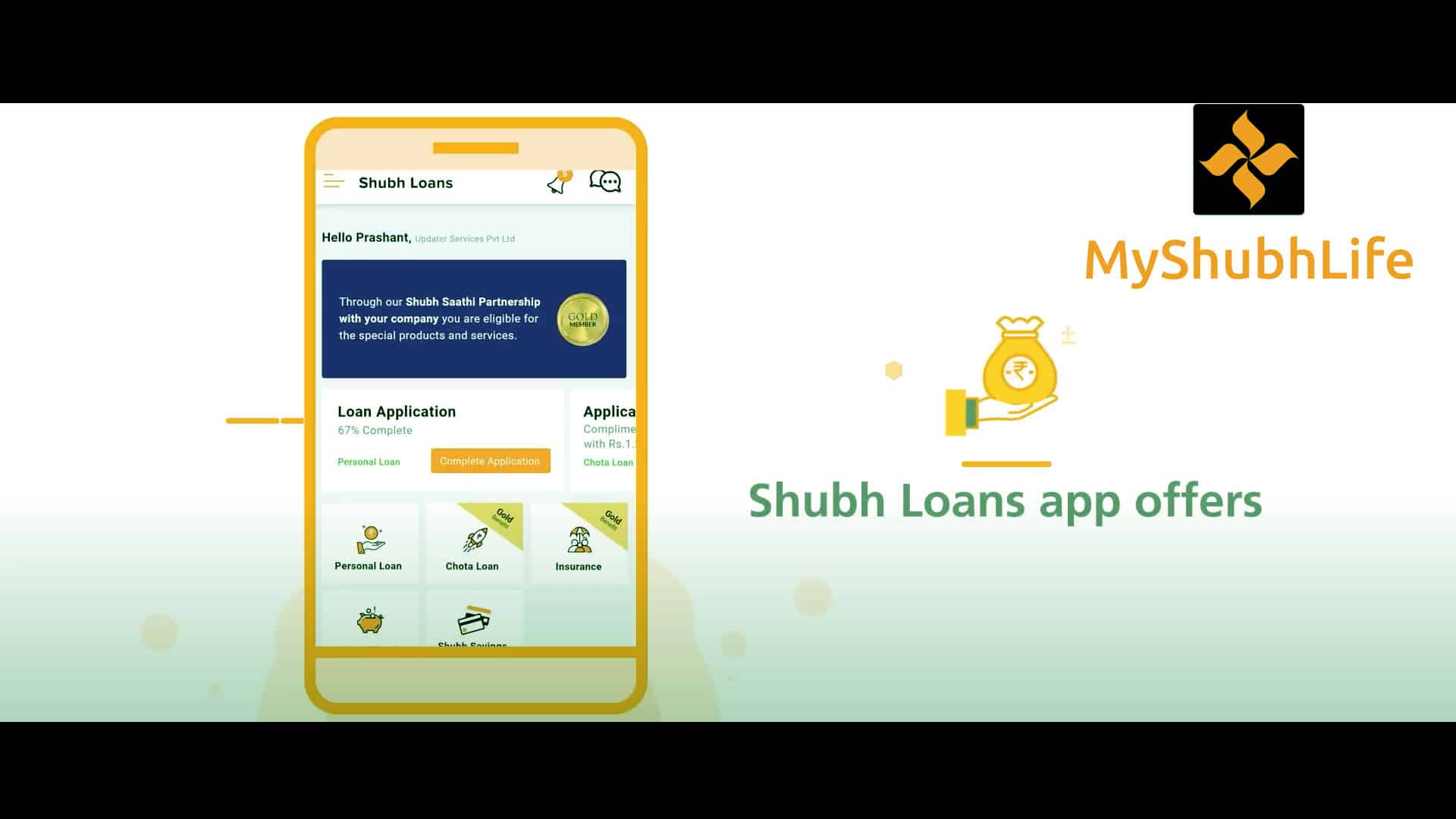

Mobile app-based lender MyShubhLife (earlier Shubh Loans) has raised USD 4 million (about Rs 29 crore) in a funding round led by Singapore-based Patamar Capital and some of its existing investors. Myshubhlife offers loans, savings products like insurance, SIPs, e-gold, and e-filing taxes. Patamar has invested in these types of business models for over a decade. We strongly believe that owing to technology, the time is ripe for reimagining economies where all working-class employees have equal access to capital and financial services.

MyShubhLife has unlocked the potential of providing financial services at scale through acquiring a deep understanding of the behavioral patterns of India’s under-served working-class population. We are excited to back tech entrepreneurs like Monish who have the drive to create sustainable impact in South Asia said Satchith Kurukulasuriya, Principal, Patamar Capital.

Also read: Supreme Court stops NCLT from giving go ahead to Future Retail – Reliance deal

Its parent company Datasigns Technologies has so far raised USD 4.8 million in series A2 funding. It had received NBFC license from RBI in 2019, founder and chief executive Monish Anand said.